New York Community Banks, the bank that acquired Signature Bank when it failed, reported horrible results today. Stock down more than -30%.

The bank has 115B assets so is a decent-sized bank.

- For the fourth quarter, the company recorded a $552 million provision for loan losses, up from $62 million in the third quarter.

- Net charge-offs were $185 million during the fourth quarter 2023 compared to $24 million in the third quarter 2023.

- The company swung to a fourth-quarter loss of $252 million, or 36 cents a share, from a profit of $172 million, or 30 cents a share, in the same period a year earlier.

- Company cut the quarterly dividend to 5 cents a share of common stock, from 17 cents a share.

https://www.wsj.com/livecoverage/fed-meeting-fomc-interest-rate-january-2024/card/new-york-community-bancorp-stock-drops-after-cutting-dividend-posting-loss-8iuEeHCKspvZmc92r8Bd

https://s22.q4cdn.com/437978920/files/doc_earnings/2023/q4/earnings-result/NYCB-4Q2023-Earnings-Release.pdf

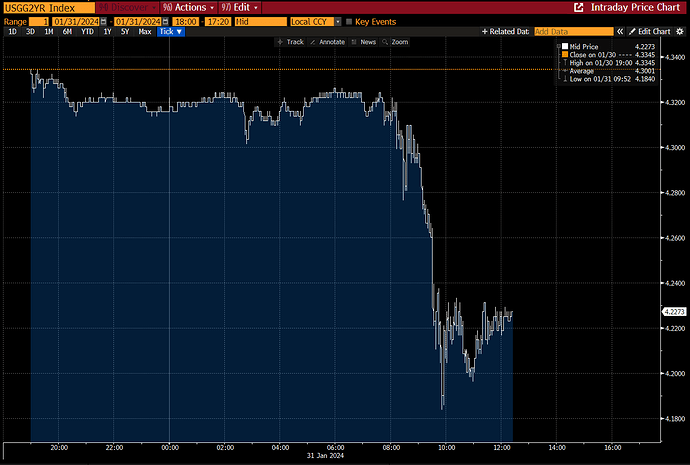

Yields had a significant reaction after this bank earnings release, and also rate cuts expectations.

I think that if for some reason also fails, they will find a buyer too.

An earlier decline in Treasury yields accelerated after New York Community Bancorp results were announced. The interest-sensitive two-year Treasury was down as much as 15 basis points in the immediate aftermath with 10-year yields also down over 8 basis points at one point.

(NYCB) NY Community Bancorp Plunges a Record 45% After Dividend Cut - Bloomberg