The challenge with the labor market is that when it begins to weaken, the decline can accelerate very rapidly

I wonder if the FED regrets not cutting rates in July., because if for some reason they have to cut more than expected in September or any point in the rest of the year (more than 25 bps), it will not send a great signal to the market, suggesting there were late once again to react.

The market seems is no longer taking bad news as good news, either.

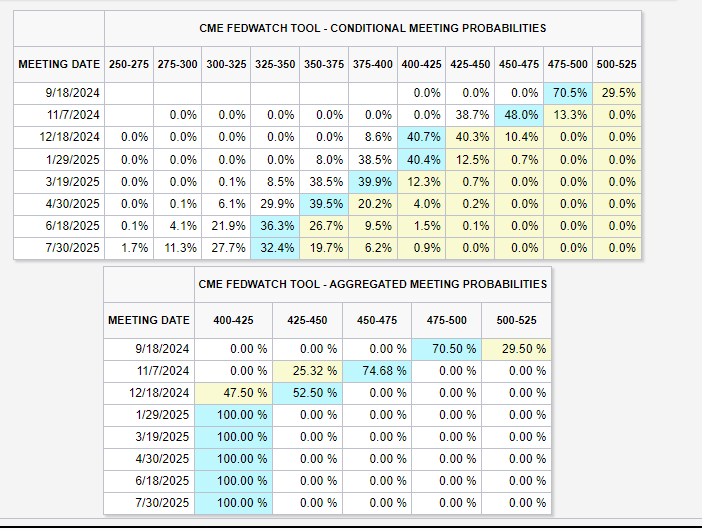

50bps is being priced in already for September with a high probability.

The Jackson Hole Symposium this year will have special attention again.

Mohamed A. El-Erian opinion:

I am stunned by how quickly the market narrative has changed about what the Federal Reserve should do.

The widespread comfort of just a few days ago about the Fed having time to wait until September to cut rates by 25 bps is being replaced by more analysts and economists calling for 50 bps. I’ve even heard someone mention a cut between meetings!

Notwithstanding both my view of a faster and broader US economic slowing than many expected and the aggressive market reaction, it is unlikely that this already mistake-prone Fed will start its cutting cycle with 50 bps.

25 bps is more likely, and I say this even though I have consistently argued that they should have cut last Wednesday.

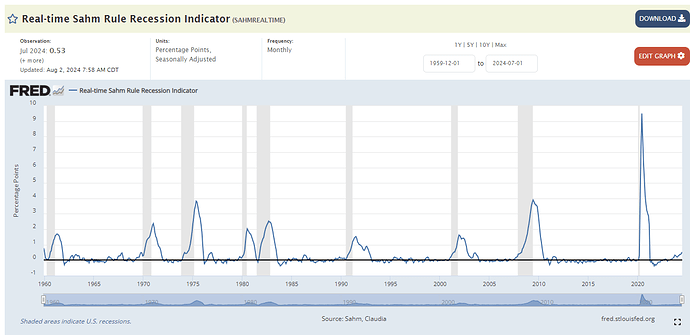

The Sahm Rule has been fully triggered at 0.53, indicating that the economy is already in a recession or on the verge of entering one.

As I mentioned previously, I am more skeptical this cycle that this rule will function exactly as it has in the past due to all the anomalies in this cycle. (maybe this time will require a higher threshold). However, I do not dismiss it entirely, given its 100% track record since 1960.

Hence, I wouldn’t be surprised if the deterioration trend in the unemployment rate continues that it will lead the NBER to declare in the future that we are already in a recession by now or about to enter one.

As I mentioned in the GDP post (some might question how we could be in or on the verge of a recession when GDP remains positive), GDP is not a reliable indicator of the economy’s future developments because the economy can continue to grow at the beginning of recessions.

Thus, it’s better imo, to keep an open mind and consider all data in conjunction.