This topic is meant for discussing developments in the banking industry.

SI=-(2-3)%, I=8

-

Moody’s lowered credit rating of 10 small and mid-sized U.S banks by one rung due to rising funding costs, possibility of weakness in regulatory capital and growing commercial real estate risks.

-

The rating agency said some major lenders such as Bank of New York Mellon, U.S Bancorp, State Street, Truist Financial, Northern Trust and Cullen/Frost Bankers are also being reviewed for a downgrade.

“Rising funding costs and declining income metrics will erode profitability, the first buffer against losses,” Moody’s wrote

“Asset risk is rising, in particular for small and midsize banks with large CRE exposures.”

Moody’s Cuts Debt Outlook on US Banks Including Capital One, PNC Amid Strains - Bloomberg

Moody's - credit ratings, research, and data for global capital markets

This will only increase the tightening in credit standards and lending because I don’t think any bank will want its rating lowered next.

The Fed is ending the Bank Term Funding Program (BTFP) on March 11.

This was the program created after the march 2023 crisis.

They also increased the rate in it, because supposedly the program was being used only for arbitrage recently.

BTFP loans has been adjusted such that the rate on new loans extended from now through program expiration will be no lower than the interest rate on reserve balances in effect on the day the loan is made.

Currently, the facility has 161B on borrowings, and the use of it exploded after December 2023, after being stable for months. Is still unclear if it’s really only for the arbitrage happening, or if there are some indeed banks struggling for liquidity, most are convinced it is only the latter.

While I think this is probably mostly true, I also saw this chart which shows that the regional bank cash reserves without the BTFP are not looking great, and maybe some problems could arise after the facility is closed.

But since the amounts used are still not that high, it could just mean more consolidation between big banks.

https://twitter.com/zerohedge/status/1748456248146599959/photo/1

Recently, I also saw the FED is planning to end the stigma of the discount window facility, to can be used without issues if troubles arise. Probably to avoid needing to create a new facility each time liquidity issues happen.

US regulators are preparing to introduce a plan to require that banks tap the [Federal Reserve’s discount window at least once a year to reduce the stigma and ensure lenders are ready for troubled times.

Fed Discount Window: Regulators Prep Plan to Push More Banks to Use Window - Bloomberg

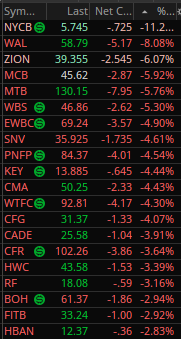

Some Regional Banks Stocks are experiencing a big sell-off today, along with NYCB.

The regional bank index is down almost 10% in two days.

Moodys downgraded NYCB to negative watch

Ratings agency Moody’s said on Wednesday it had placed NYCB on review for a downgrade, which could put the bank into the “junk” territory.

Moody’s said the reflected the bank’s unanticipated loss in its New York office and multi-family properties, weak earnings, material decline in its capitalization, and its growing reliance on wholesale funding.

https://www.reuters.com/business/finance/moodys-puts-new-york-community-bancorp-review-downgrade-2024-02-01/

This has a different feel than March 2023, because this is more of a credit distress.

Not saying something bad is imminent, just that this could be the beginning of more credit stress in the banking industry in the future.

And not just a mismatch in duration creating liquidity issues as before.

I will try to look for commentary to see what analysts are saying.

NYCB could be indeed the next bank to fail.

Is unfortunately that I think this will continue for the smaller banks.

I still don’t expect yet any contagion from this.

“Management identified material weaknesses in the company’s internal controls related to internal loan review, resulting from ineffective oversight, risk assessment and monitoring activities,” the bank said in the filing.

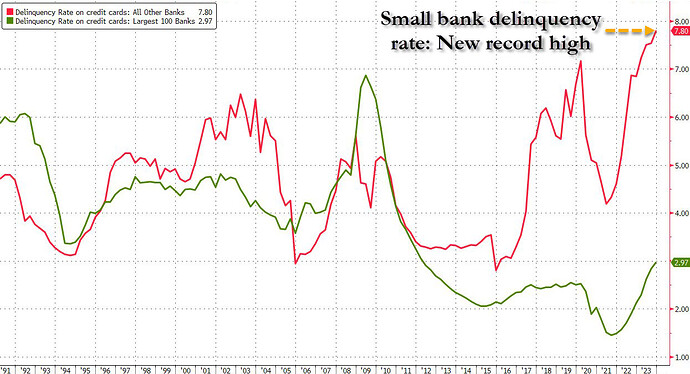

Huge difference in credit card delinquency between large and small banks. However both are already above 2019 levels.

Will try to find if this is the same for all loan types

It seems small banks were extremely lose in their credit standards contrary to the big banks.

Unfortunately small banks don’t have the same regulation requirements than big ones have.

Also Big difference from 2008, 1 of the reasons is difficult to see a 2008 type of crisis as of today data.