Yes, but the risk always when these news gets a lot of attention is that a run on the bank could happen at some point, or any other type of liquidity need is not met because no one would want to lend them even overnight because of the risks.

BFTP is still in place but will be ending in March, and is only for treasuries or CMBS backed by the government.

Moody’s also just put it on negative watch, and it could fall to junk. This could add to the fear around them.

Equity is about 10B. And their Common equity tier 1 ratio is only 9.10%.

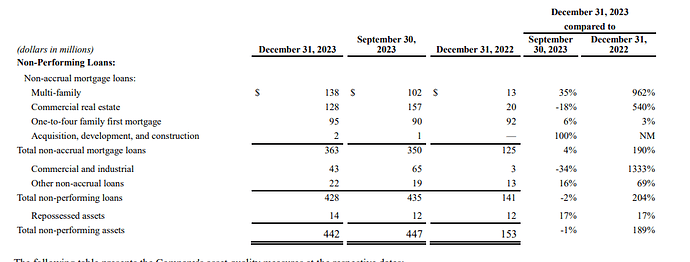

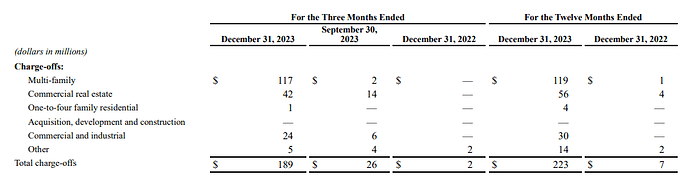

Nonperforming loans and charge-offs are Multifamily and CRE mostly.

But as I mentioned if it fails, they probably just find a buyer. The question is if it can cause a bigger panic, currently, regional banks are experiencing a sell-off.

But at think something imminent is probably low probability.