You can find a full summary of Q4 2023 bank earnings in the wiki:

-

Earnings from the four big banks (JP Morgan, Bank of America, Wells Fargo, and Citi Group) appear mixed.

-

What stood out to me is the net loan charg-off recorded by the four banks which doubled to $6.7 billion from a year ago with Wells Fargo reporting an increase in CRE loan charge-off by $284 million quarter-over-quarter.

“We are closely monitoring credit and while we see modest deterioration, it remains consistent with our expectations,” said Wells Fargo CEO Charlie Scharf.

"The U.S. economy continues to be resilient, with consumers still spending, and markets currently expect a soft landing, " JP Morgan CEO Jamie Dimon said.

You are right, these results actually dont look that great, and there was a significant deterioration in just 1 quarter, especially for CRE.

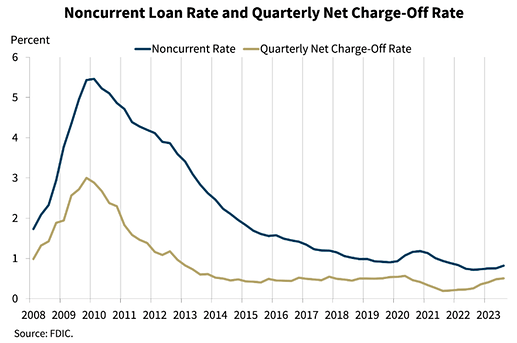

However net charge-off rates remain low even with this increase, and we would probably need additional deterioration to create big issues, but it is a noticeable trend nonetheless if it continues at this rate.

I agree it’s the first noticeable deterioration that we are seeing and those are only the very strong banks we are looking at. How are smaller banks doing esp. in the context of a potentially looming CRE problem?

Looking at the absolute values, they appear stable. The trend doesn’t look good though. CRE Loan Charge-Off for five regional banks (PNC Financials, U.S Bancorp, Citizens Financial Group, Truist Financial Corp and KeyCorp Bank) that are among those that had the biggest exposure to CRE at the end of June 2023 is up 24% q/q to $245 million (y/y: +150%). Their Nonperforming CRE Loans is up 5% Q/Q to $2.4 billion (Y/Y: +223%).

The thing that stood out to me most is how sharply net-income is declining compared to a year ago. What’s the main reason esp. banks with large declines are giving?

Mostly due to the charge paid to FDIC following the failure of Silicon Valley Bank and Signature Bank eg KeyCorp and Citizens Financial paid $190 million and $225 million, respectively.

This is me just guessing, but loan loss provisions are a negative on net income, since these quarter provisions had a significant increase too and all 2023 for some, it could have been a part of the decline in income.

Provisions are volatile too, banks change them every quarter.

If provisions are not used they will boast income later on, but it could also be much worse if they don’t provision enough.

Net Interest Margin is also dropping, and it could be another part of the decline as interest income is too.

And as Aron just mentioned the FDIC charged a fee for the crisis in march 2023 to recoup the losses incurred.

But mostly is going to be specific from bank to bank. As I am guessing others have had to sell securities at a loss and other reasons.

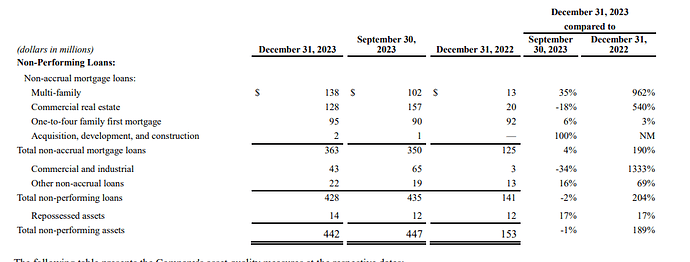

New York Community Banks, the bank that acquired Signature Bank when it failed, reported horrible results today. Stock down more than -30%.

The bank has 115B assets so is a decent-sized bank.

- For the fourth quarter, the company recorded a $552 million provision for loan losses, up from $62 million in the third quarter.

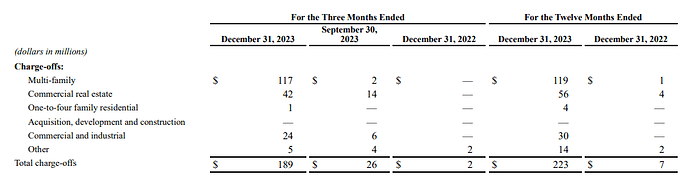

- Net charge-offs were $185 million during the fourth quarter 2023 compared to $24 million in the third quarter 2023.

- The company swung to a fourth-quarter loss of $252 million, or 36 cents a share, from a profit of $172 million, or 30 cents a share, in the same period a year earlier.

- Company cut the quarterly dividend to 5 cents a share of common stock, from 17 cents a share.

https://www.wsj.com/livecoverage/fed-meeting-fomc-interest-rate-january-2024/card/new-york-community-bancorp-stock-drops-after-cutting-dividend-posting-loss-8iuEeHCKspvZmc92r8Bd

https://s22.q4cdn.com/437978920/files/doc_earnings/2023/q4/earnings-result/NYCB-4Q2023-Earnings-Release.pdf

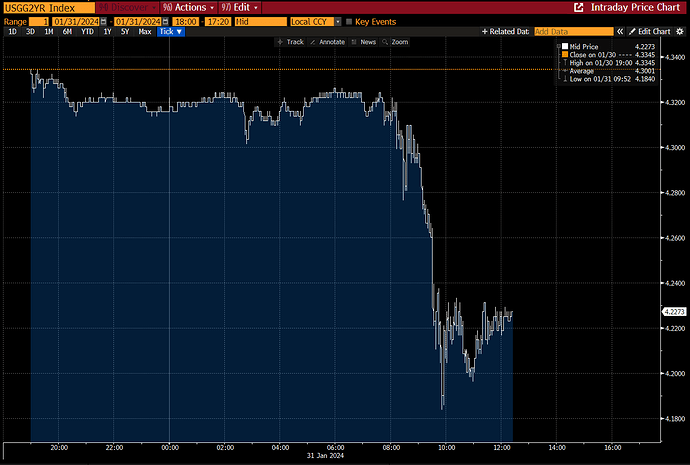

Yields had a significant reaction after this bank earnings release, and also rate cuts expectations.

I think that if for some reason also fails, they will find a buyer too.

An earlier decline in Treasury yields accelerated after New York Community Bancorp results were announced. The interest-sensitive two-year Treasury was down as much as 15 basis points in the immediate aftermath with 10-year yields also down over 8 basis points at one point.

(NYCB) NY Community Bancorp Plunges a Record 45% After Dividend Cut - Bloomberg

Compared to 115b in assets 550m in provisions for loan losses and 185m charge offs looks manageable if there is not a looming much larger problem.

How much equity does the bank has? Which type of loans have been affected?

Yes, but the risk always when these news gets a lot of attention is that a run on the bank could happen at some point, or any other type of liquidity need is not met because no one would want to lend them even overnight because of the risks.

BFTP is still in place but will be ending in March, and is only for treasuries or CMBS backed by the government.

Moody’s also just put it on negative watch, and it could fall to junk. This could add to the fear around them.

Equity is about 10B. And their Common equity tier 1 ratio is only 9.10%.

Nonperforming loans and charge-offs are Multifamily and CRE mostly.

But as I mentioned if it fails, they probably just find a buyer. The question is if it can cause a bigger panic, currently, regional banks are experiencing a sell-off.

But at think something imminent is probably low probability.

Very good point. The possibility of a bank run makes it almost impossible to invest in any of those smaller banks without very specific focus on that field of Investment in my opinion. In addition it should be good for larger banks which can cheaply consolidate.

Imo this form of instability is quite sad, as good businesses like first republic bank could fail overnight just being destroyed by self fulfilling prophecies.

Maybe regulators even need to think about providing more liquidity security to smaller banks as in the current age large withdrawals can happen online within minutes and rumors are spreading faster than ever via social media.