Research from NBER (Institution responsible for declaring recessions)

Analysis demonstrates that distress in the commercial real estate sector could lead to the

inclusion of dozens to over three hundred predominantly smaller regional banks within the cohort

of institutions vulnerable to insolvency arising from the uninsured depositor runs.

-

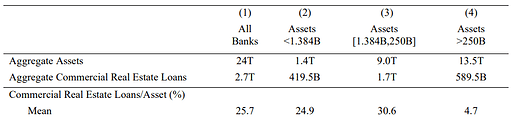

CRE loans represent on average about a quarter of total assets

-

By the end of November 2023, the equity value of real estate holding companies (REITs) specializing in the office sector had plummeted by nearly 55% since the onset of the pandemic. A straightforward calculation suggests that these declines imply a 33% reduction in the value of office buildings held by these companies

-

The commercial property price indices from Green Street Advisors reveal that, across metropolitan

areas, the value of office buildings may have, on average, decreased by approximately half from their pre-2020 values. -

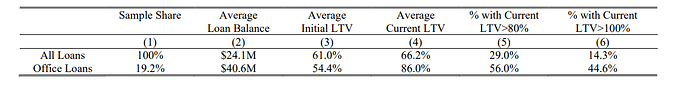

By December 2023, the LTV has risen to 66.2% due to the recent decline in property values. Notably, this increase is much more significant for office loans, which constitute about 19.2% of all loans in our sample. Their LTV experiences a pronounced surge from 54.4% to around 86%

As we observe 14.3% of all loans and 44.6% of office loans are in negative equity.

-

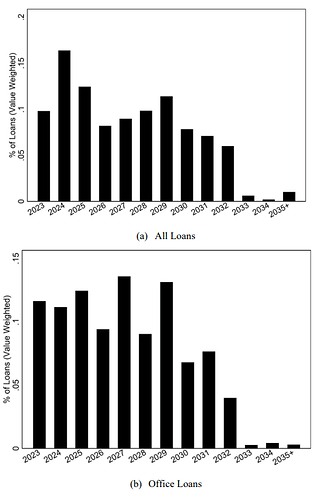

39% of all loans and 35% of office loans come to maturity in 2023-2025 period and hence need to be repaid or refinance by then.

-

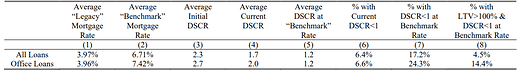

Data reveals that currently, 6.4% of all loans and 6.6% of office loans have a DSCR less than 1, indicating that the net property cash flow is insufficient to cover loan debt service. This would be worse if they need to refinance at the current rates.

-

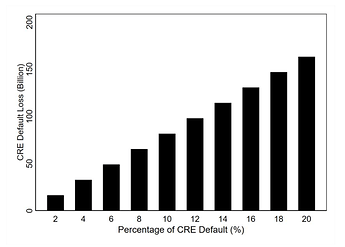

A a 10% (20%) default rate on CRE loans – a range close to what one saw in the Great

Recession on the lower end – would result in about $80 ($160) billion of additional bank losses.

-

Researchers estimated that in a scenario where half of uninsured depositors empty their accounts, losses related to commercial real estate could result in 31 to 67 smaller regional banks becoming insolvent. Another 340 banks could face insolvency due to losses stemming from higher interest rates.