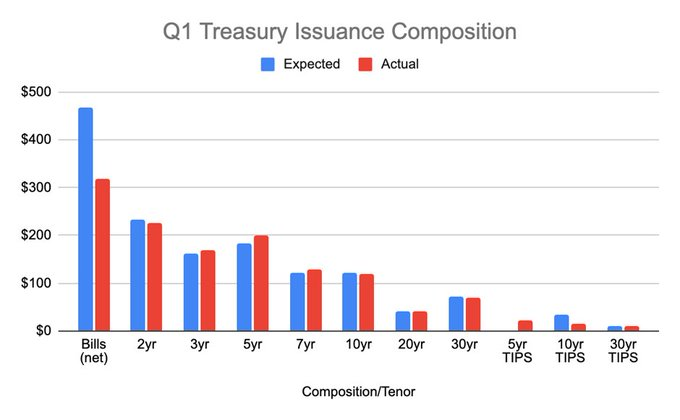

The treasury announced today that it will increase the duration in its debt auctions, and will reduce Tbills issuance. While this is not exactly bullish for risk markets, it came within expectation, and the reaction was minimal. Today NYCB earnings had more impact in yields.

The reductions in bill issuance could also slow the pace of decline of the reverse repo facility and hence delay the slowing of QT too. But at the same time increased in duration could decreased bank reserves, creating the need to slow QT.

Some of their comments are:

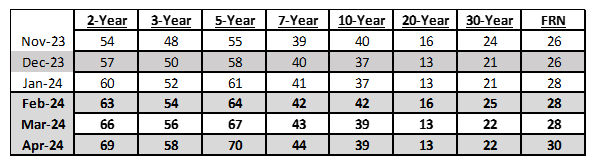

- Based on current projected borrowing needs, Treasury does not anticipate needing to make any further increases in nominal coupon or FRN auction sizes, beyond those being announced today, for at least the next several quarters.

- Given current fiscal forecasts, Treasury expects to maintain bill auction sizes at current levels into late-March. Treasury anticipates that this will likely result in a $300-350 billion net increase to privately-held supply over the next two months.

- By late-March or early-April, Treasury anticipates modestly reducing short-dated bill auction sizes going into the tax filing season. These reductions will likely lead to a $100-150 billion net reduction to privately-held supply during the month of April.

- n preparation for the implementation of a regular buyback program later this year, Treasury anticipates conducting several small-value buyback operations in April with a limited population of securities to test processes and infrastructure.

Quarterly Refunding Statement of Assistant Secretary for Financial Markets Josh Frost