Meta Likely to Beat Q2 2025 Earnings on Resilient Ad Market

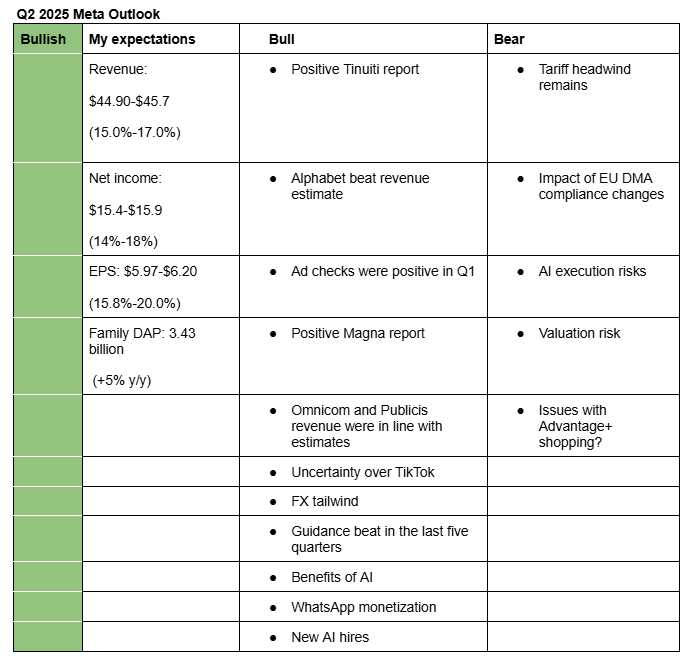

I am bullish on Meta’s Q2 2025 earnings. My estimates reflect resilient ad spending during the quarter, insights from Tinuiti report, FX tailwind, uncertainty around TikTok, revenue beat by competitors, and guidance beat in the last five quarters.

Here is a description of by bullish and bearish sentiments:

Bullish sentiments

- Positive Tinuiti report: Tinuiti’s Q2 2025 Digital Advertising Benchmark report shows that ad spend on Meta Platforms grew 12% y/y. Historically, Tinuiti has been a reliable indicator of Meta’s ad revenue. Based on the report, Meta’s Q2 revenue could grow in the 15%–17% range.

- Alphabet beat revenue estimate: Alphabet’s advertising revenue rose 10.4% year-over-year to $71.3 billion, beating analysts’ estimate of $69.6 billion. This strong performance sends a positive signal that Meta may also exceed its revenue estimates.

- Ad checks were positive in Q1: Several research firms such as Deutsche Bank, TD Cowen, Bofa, JPMorgan, Piper Sandler, Wells Fargo, etc. have indicated that their ad checks were positive during the quarter, implying that Meta is likely to report solid ad revenue in Q2.

- Positive Magna report: Magna recently hiked its 2025 US digital ad outlook by 0.5% to 10.1% due to resilience in Q1. In my opinion, if Magna saw weakness in ad spend in Q2, they couldn’t have raised their projections.

- Omnicom and Publicis revenue were in line with estimates: Omnicom and Publicis reported revenue in line with estimates, with Publicis slightly raising its full-year guidance. Advertising spend typically flows first through media and advertising agencies. In a macroeconomic slowdown, advertisers often bypass agencies. Therefore, continued strength in agency spend suggests positive momentum for Meta Platforms.

- Uncertainty over TikTok: Uncertainty over TikTok’s existence in the US continues to favor ad spend on other platforms such as Meta. According to Tinuiti, ad spend by Tinuiti advertisers on TikTok fell 20% y/y in Q2. An April 2025 report by Sensor Tower indicates that Meta is the primary beneficiary of ad spend shifting away from TikTok.

- FX Tailwind: Meta’s Q2 2025 revenue will benefit from the weaker U.S. dollar against major global currencies. Management, which has a strong track record in forecasting FX impacts, expects a 1% tailwind from foreign exchange this quarter. My rough estimate is a tailwind of around 1.4%.

- Guidance beat in the last five quarters: Meta Platforms has beaten management’s mid-point revenue guidance by an average of 3.2% in the most recent five quarters.

- AI benefits: I expect Meta’s AI tools such as GEM and Andromeda to continue driving ad performance, leading to market share gain. Meta also plans to automate ad creation using AI by 2026. New Street Research estimates that AI ad creation tools could boost Meta’s ad revenue by $28 billion by 2030.

- WhatsApp monetization: Meta Platforms announced in June 2025 that it’s introducing ads in WhatsApp. The venture could start being revenue accretive from Q4 2025. Analysts estimate that WhatsApp ads could bring in additional $6 billion to $10 billion in the coming years.

- New AI hires: Meta has brought in industry heavyweights, including Shengjia Zhao (co‑creator of ChatGPT, now Chief Scientist of Superintelligence Labs), Alexandr Wang (former Scale AI CEO, serving as Chief AI Officer), and prominent AI researchers from OpenAI, DeepMind, Anthropic, and Apple (such as Ruoming Pang, Mark Lee, and Tom Gunter). I expect these new AI hires to address Meta’s underperformance in large language models (LLMs).

Bearish sentiments

- Tariff headwind: The tariff overhang persists as the U.S. has yet to finalize trade agreements with several countries. The 55% tariff deal signed with China is both temporary and unusually high, which could prompt advertisers to remain cautious or delay spending decisions.

- Impact of EU DMA compliance changes: In its Q1 2025 earnings, Meta announced that it expects to modify its ad model in Europe to comply with the Digital Markets Act (DMA), which will significantly impact revenue starting in Q3 2025. I estimate a revenue headwind of $3.7 billion in 2025 and $8.3 billion in 2026. EU Commission said at the beginning of this month that Meta’s pay or consent model needs further reworking, signaling that Meta may not avoid the headwind. However, similar to Apple’s ATT rollout, I expect this headwind to be temporary. Meta’s core AI team will likely develop solutions to mitigate the impact over time. Additionally, growing monetization of WhatsApp and revenue from AI-powered ad creation tools should help offset the decline.

- AI execution risks: Zuckerberg’s strategy now appears focused on “superintelligence”, an ambitious but unproven technology. This introduces execution risk, which could put pressure on the share price, especially amid rising CapEx. Based on recent comments from both Zuckerberg and Alphabet, I expect Meta’s 2026 CapEx to exceed $80 billion (2025 guidance: $64–$72 billion).

- Valuation risk: Trading at a trailing twelve-month (TTM) P/E of around 25, Meta’s share price could face a significant pullback if the company slightly misses expectations or if management delivers negative commentary on AI.

- Issues with Advantage+ shopping Campaigns (ASCs): According to Tinuiti, the share of Advantage+ Shopping Campaigns (ASCs) fell to 35% in Q1 2025, down from 38% in the previous quarter. This decline may signal that advertisers are starting to pull back from ASCs, following a series of complaints since last year that the product has been underdelivering on performance.

Here are management’s and analysts’ expectations for Q2 2025;

Management Guidance for Q2 (Revenue): $42.5-$45.5 billion (+8.9% to +16.5%)

Analysts’ Estimate for Q2 (Revenue): $44.8 billion (+14.7%)

Analysts’ Estimate for Q2 (EPS): $5.89 (+14.1%)

Recommendation

Overall, given the resilience of the advertising market, upcoming monetization from WhatsApp and AI-powered ad creation tools, continued market share gains, and offsetting risks from regulatory headwinds and AI execution challenges, combined with a valuation that appears fair at current levels, I reiterate a Hold rating on Meta shares.