This topic discusses Volkswagen’s Q2 2024 earnings expectations and results. A summary of our earnings outlook will be posted here. You can find an article on the earnings in the wiki:

Porsche reported strong Q2 probably aided by improvement in pricing

- Porsche Q2 2024 revenue rose by 1% to 10.5 billion euros, beating analysts estimate (calculated) of 10.2 billion euros (-1.6%).

- Its Q2 operating return on sales was 17%, above analysts’ estimate (calculated) of 15.8% and at the upper end (17%) of management’s old outlook for 2024.

Assessment

The strong results are probably due to a 16% y/y (calculated) improvement in pricing, possibly due to new model launches. Unit sales were down 6% y/y (calculated).

Audi financial performance started stabilizing in Q2 helped by easing of supply constrains

- Audi Q2 2024 revenue was flat y/y at 17.2 billion euros (Q1 2024:-18% or €13.7 billion) while operating return on sales rose to 8.8% from 3.4% in Q1 as supply situation affecting V6 and V8 models started easing.

- The brand reiterated its 2024 revenue outlook of between 63 and 68 billion euros but lowered its guidance for operating return on sales to between 6% and 8% (previously: 8-10%) due to restructuring of Brussels plant.

- Audi expects normal production again in Q3.

Traton Group’s revenue fell by 0.7% y/y to 11.6 billion euros in Q2 while operating return on sales rose to 8.7% from 8.3% in Q2 2023 supported by good unit price realization.

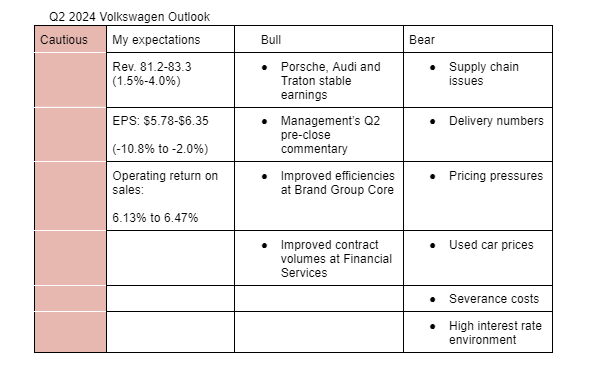

My estimates are based earnings of some of its subsidiaries, delivery numbers and pricing trends. My bullish sentiments include;

- According to analysts, management’s commentary during its Q2 pre-close conference were positive.

- I expect the measures initiated at the Brand Group Core to have further aided its performance in Q2.

- Volkswagen Financial Services will likely see improvement in the number of contract volumes in Q2 as witnessed at Renault and Mercedes-Benz.

Areas of concern include;

-

Porsche lowered its guidance for the full year due to supply chain issues. Volkswagen Group hasn’t adjusted its guidance in that respect yet and could do so while announcing its Q2 results. This could impact its share price. I forecast revenue and operating return on sales of 326.3 billion euros (+1.25%) and 6.54% in 2024 respectively.

-

Delivery numbers were weak during the quarter and there are insights that pricing pressures is growing (Renault and Mercedes-Benz felt pricing pressure during the quarter and Cox data indicates prices declined in U.S). While the subsidiaries that have reported their Q2 earnings were able to compensate for the weak sales volume by increasing prices, the Brand Group Core may not be able to do so given that it’s an economic brand.

- Used car prices continue to trend downwards in Europe and United States. That will likely affect the operating performance of Volkswagen Financial Services.

- Volkswagen Group expects to book a severance cost of 900 million euros in Q2. This will impact its operating result during the quarter.

- We are still at a high interest rate environment. As such, Volkswagen Financial Services could book a high interest rate expense in Q2 as witnessed in Q1.

N/B: Here are the analysts estimates and management guidance for 2024:

Analysts estimates for Q2

Revenue: EUR 82.9 billion (+3.56% y/y)

Operating return on sales: 6.1%

Analysts' estimates for 2024

Revenue: EUR 326.3 billion (+1.23%)

Operating return on sales: 6.6%

Management outlook for 2024

Revenue: EUR 338.4 billion (+5% y/y)

Operating return on sales: 6.5%-7.0%

Volkswagen Group tops estimates, reiterates its 2024 guidance

- Volkswagen’s Q2 2024 revenue rose by 4.1% y/y to €83.3 billion, in-line with my upper-point estimate.

- The group’s operating result fell by 2.4% to €5.4 billion, in-line with my upper-point estimate-mainly due to severance charges at the Brand Group Core.

- Its operating return on sales stood at 6.6% in Q2 (underlying margin:7.6%), above my upper-point estimate of 6.5% while automotive net cash flow in H1 was €-129 million-impacted by increase in working capital associated with model ramp-up and supply constraints (automotive net cash flow in Q2 stood at €2.9 billion).

- Volkswagen reiterated its 2024 revenue guidance growth rate of 5% and operating return on sales outlook in the range of 6.5% to 7.0%.

In the earnings call;

- CFO Arno Antlitz said they expect a range to the lower end of the guided KPIs due to the recently announced supply chain issues at Porsche.

- Antlitz pointed out that Q3 is expected to be a weak quarter due to plant holidays, hence Q4 should be by far the strongest quarter.

- Blume said that the performance programs are to compensate expected headwinds and one-time effects in the restructuring of the group but over time, they will contribute to positive momentum development.

- Antlitz echoed his disappointment over the poor performance of the operating result while Blume kept reiterating that their focus now is costs.

- Antlitz said volume price mix should be stable in H2 (small positive on volume, mix and pricing being challenging but they are in good position there).

Assessment

Though the Q2 results were better-than expected, the call insights indicate that we should expect more restructuring charges which is not good for profitability in the short-term, especially that the Brand Group Core will likely be faced with pricing pressures that are starting to be witnessed by other European automakers. However, I liked that the management seemed more determine in the call to rein in on costs. But the focus on costs in the earnings call could mean that the cost measures is not going according to the plan.

Here are the analysts calls following the earnings;

- Buy, €136-> €125: Analyst Romain Gourvil of Berenberg said the focus must continue to be on costs.

- Buy, €180->€150: Analyst Tim Rokossa of Deutsche Bank said the stock could have a tough time before it is clear whether prices have stabilized or entering a downward spiral.

- Buy, €150->€140: Jefferies analyst, Philippe Houchois pointed out that Q2 results confirmed the improvements at the company.

- Buy, €150: Analyst Fabio Hölscher of Warburg research said Q2 went largely as expected. He expects the firm to post solid H2 results.