Q2 2024 Industry Update

Cox maintains a cautious outlook for the industry, their 2 main concerns currently revolve around:

- Uncertainty among dealers and consumers is high, leading to a wait-and-see behavior among buyers who anticipate lower rates, reduced prices, and potential impacts from the presidential election on the auto industry. Despite higher incentives and lower prices, this uncertainty is why sales have not picked up significantly.

- The Federal Reserve is taking too long to cut interest rates, and another mistake by the Fed could damage the industry more than expected

Sales

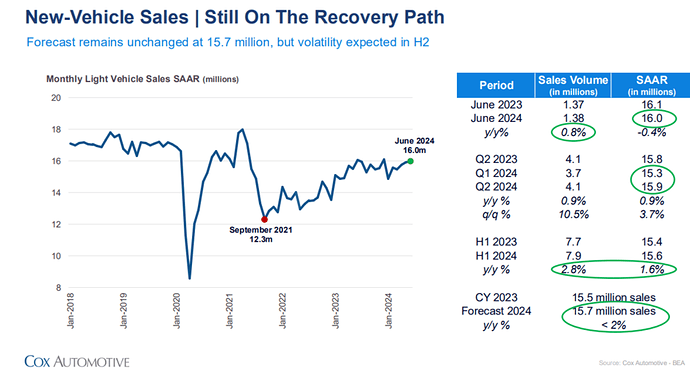

- Sales grew 10.5% q/q in Q2 2024 vs -3.5% in Q1 2024. They grew 0.9% y/y in Q2 vs 5.5% in Q1.

- 1H2024 grew 2.8% Y/Y. Annual forecasts are for a 1.3% growth.

- There are concerns that sales will not maintain the same growth in the second half of 2024 due to ongoing uncertainty.

- Despite this, 2024 is expected to finish slightly better than 2023, bolstered by discounting and better pricing, although uncertainty remains a significant challenge.

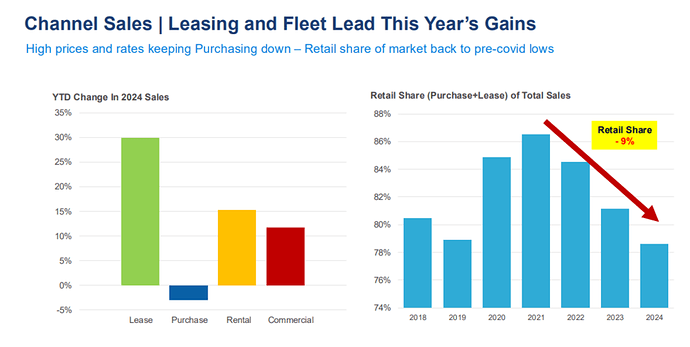

- The year 2024 has seen benefits from lease, commercial, and rental fleet sales. However, individual vehicle buyers have decreased throughout the year. The share of retail sales has been declining, as high prices and interest rates impact consumers’ ability to purchase vehicles. This decline in retail sales could pose a headwind since the pent-up demand for fleet sales is likely exhausted.

Inventory

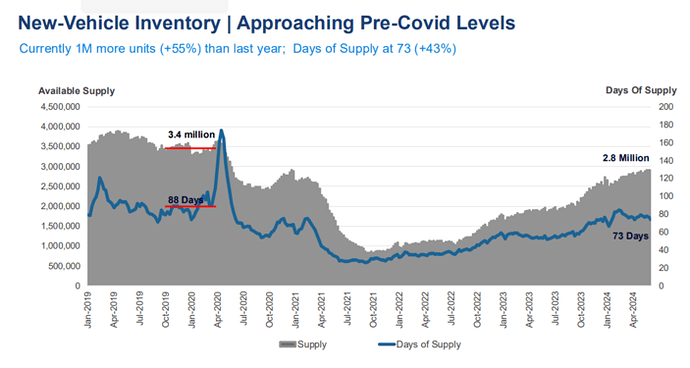

- Inventory is still about 12% lower than pre-levels.

- Days of supply stabilizing in recent months in the 70-80 range, suggesting a new balance, below pre covid levels.

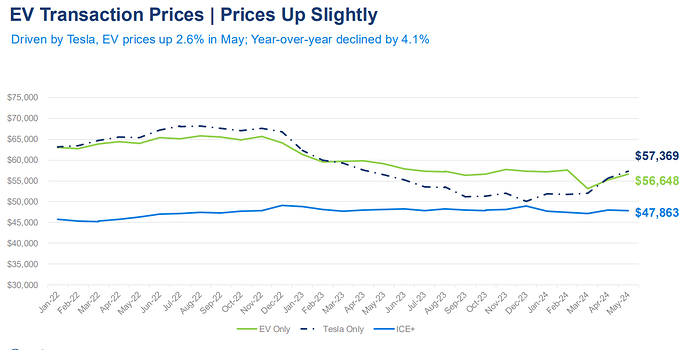

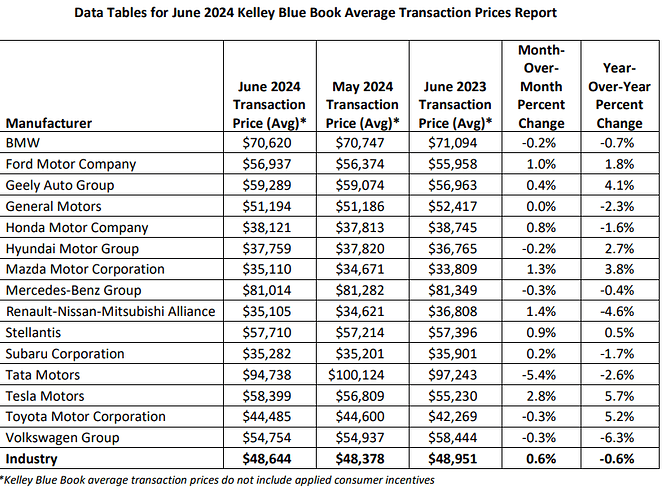

Prices

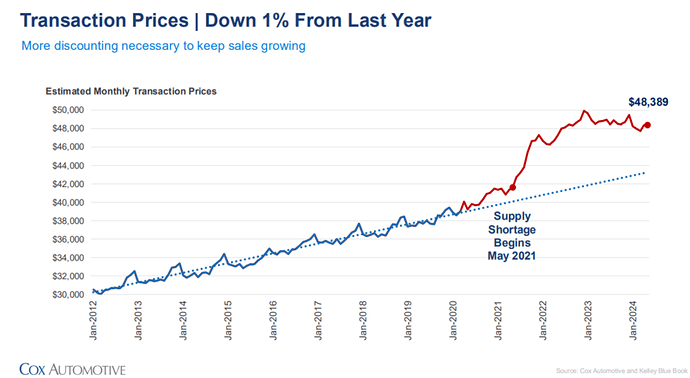

- Vehicle average prices have decreased by 1% year-over-year and 3% from their peak, but they remain 20% higher than in Q1 2020.

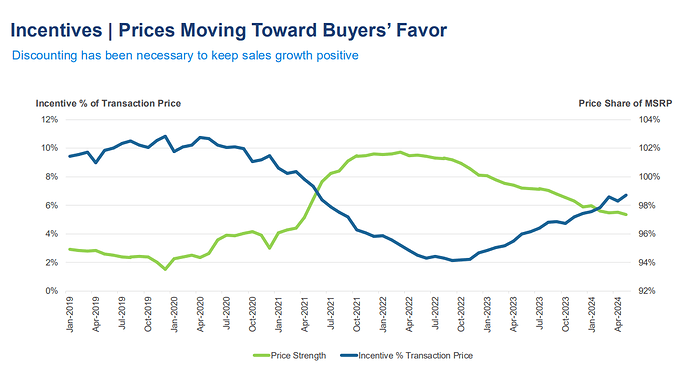

- Increased incentives due to higher inventory levels, although still lower than pre-COVID levels, might create expectations among potential buyers that prices will drop further.

- Consumers may still be unwilling or unable to purchase more unless prices decrease further. The pre-COVID trend could suggest a current price of around $43,000, which is $5,000 lower than today’s levels.

- The forecast for 2024 remains consistent: more inventory and increased discounting.

- While affordability has been improving, consumer price sensitivity for autos has also increased, offsetting this benefit. This is why, despite lower prices and higher incentives, sales have not significantly picked up.

Credit

- In June, 1.81% of auto loans were severely delinquent, an increase from 1.80% in May, but not back to the higher levels we saw in March and February.

- Defaults increased 3.6% in total in June and were up 12.6% year over year.

- The June annualized default rate was 2.92%, 10 basis points (BPs) higher than May and higher than the 2.49% annualized default rate in 2019.

- The year-to-date default rate is 3.07%, which is 17 BPs higher than the default rate in 2019.

- The typical monthly payment increased by 0.6% to $756, and the number of median weeks of income needed to purchase the average new vehicle rose to 37.2 weeks from 37.1 weeks in May. The average monthly payment had previously peaked at $795 in December 2022. The estimated number of weeks of median income needed to purchase the average new vehicle in June was down 6.3% from the same time last year.

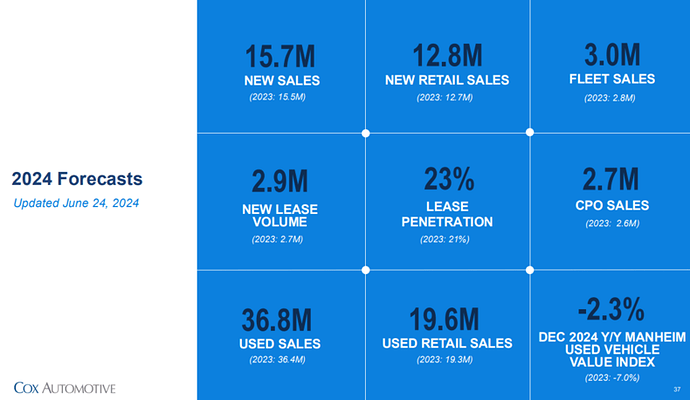

Forecasts

Not much has changed other than the used car price index.

- 1.3% Y/Y growth for new sales, 0.8% for retail.

- The pent-up demand is most likely exhausted.

- Larger economic risk over the next six months is the possibility that the Federal Reserve may wait too long to cut interest rates.

- Some weakness in sales is expected in the second half of 2024 due to consumer uncertainty (waiting for lower rates and prices, and political expectations), but a collapse is not anticipated either.

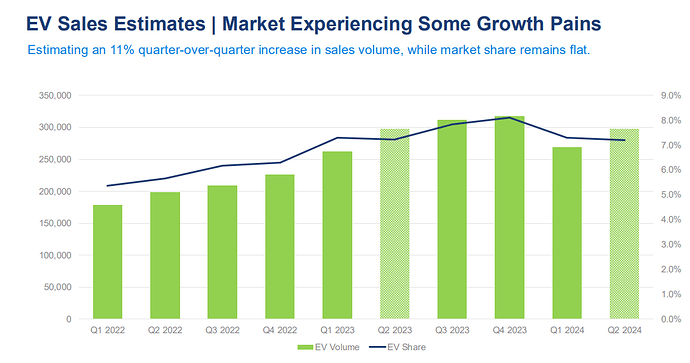

- If Trump wins the election, there could be a pull forward in demand for EVs as tax credits may come under scrutiny.