Short description of the topic.

Corresponding Wiki Article. Purchasing Managers Index - InvestmentWiki

Insights from Tim Fiore, the Institute For Supply Management’s Committee Chair for the Manufacturing Report

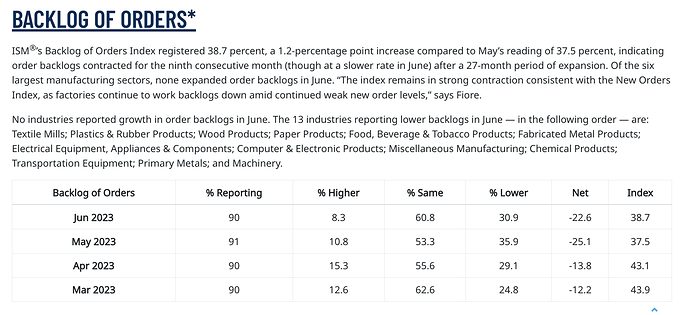

- Companies have burned off their backlogs of orders

- Demand is non-existent, and new orders not coming in

- Companies have started to take action to adjust cost structure, in June companies started to destaff. Dont expect to end throughout the summer, maybe Q4

- China and Europe’s assistance on new exports orders probably not happening for some time, as they are currently pretty weak

- Dont see the bottom yet for manufacturing

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/june/

Welcome to Q3 - Please Prepare For A Very Bumpy Soft Landing - YouTube

How can those statements be quantified? Do we have an article with longer timelines for reference?

What do you mean by that? They are quantified in the report.

We have an article, but still in progress Purchasing Managers Index - InvestmentWiki

In longer timeframes, I don’t think most components have not gotten to levels seen in other recessions. And that’s probably why he thinks the bottom is not in yet. However no one really knows the bottom, but judging by new orders it does not look good yet. United States ISM Manufacturing New Orders - June 2023 Data - 1950-2022 Historical

Sorry, I meant how can his statements be seen in view of the numbers.

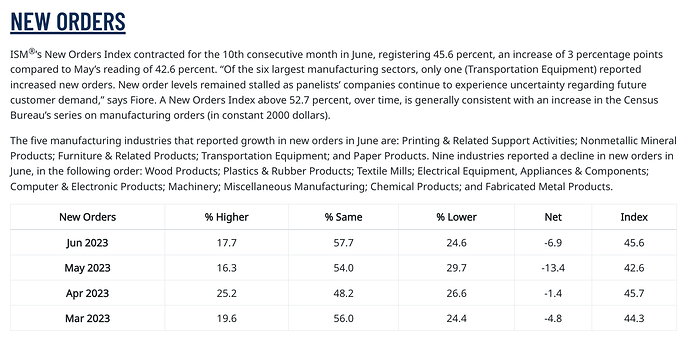

New Order recovered a bit in June and while a contraction is clearly visible most companies describe a stable picture with some describing rising orders.

Therefore I am not sure what he means by “demand is non-existent”.

Which data points from the report are the most important in your opinion? What does

Backlog of Orders Index remaining at a level not seen since early in the coronavirus pandemic

mean in absolute numbers looking at longer timeframes? Do you think he is overdramatizing or describing an accurate picture with his statements? Does he have an incentive to overdramatize?

I dont really see his incentive to overdramatize, to be honest, but this is the first time I have heard his interviews, he does it every month. But I could even see his incentive to be positive instead. He mentioned in the video, that at the start of the year, he was very confident and had a forecast that second half of the year we would start to see the recovery, but unfortunately due to the numbers coming in he had to push it now to at least Q4.

So he is still optimistic we could see a recovery soon, but maybe his overconfidence at the start of the year has made him more cautious now that numbers did not improve as expected.

The data about new orders is very volatile and is not going to decline in a straight line, unless there is a shock, but as long as it does not go above 50, is still contracting per month, just at faster or slower rates.

And backlogs of orders being to low, not sure which type of absolute numbers do you want from this?

This is just an indication of the amount of work companies have at the moment, and could be an indication of future layoffs.

For me new orders and backlogs are the most important, they are the most leading of future production and employment. The sector is not going to recover, without seeing those 2 recovering first. But prices and employment could be an indication of inflation too.

He also does mention that not all sectors inside manufacturing are contracting at the same rate, but the ones accounting for the majority of manufacturing GDP are the ones in a worse position. And since the index is weighted, that’s why it is so depressed at the moment. So is normal in my opinion to see industries still recording stable sentiment.

Also important to mention is that this is manufacturing, and while manufacturing could be in recession, is possible services do not, and we don’t have a broad recession. But services is more lagging too, so we would have to wait and see.

Is interesting that he mentions that a soft landing could even be more damaging than a shock long term, because it would make the uncertainty much more prolonged, which is what is damaging demand at the moment.

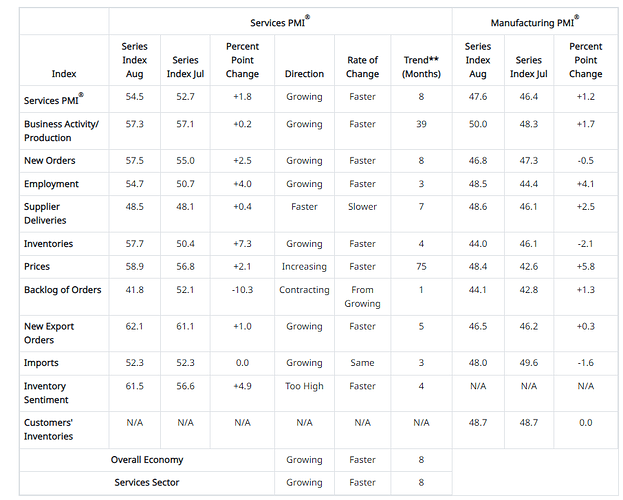

Very different panorama still for services. In June, the Services PMI registered 53.9 percent, 3.6 percentage points higher than May’s reading of 50.3 percent. The composite index indicated growth in June for the sixth consecutive month

Services are about 80% of the GDP

Anthony Nieves, Committee Chair for the Services Report

- 15/18 industries growing. People seem to be showing signs to be spending money on experiences

- Decline in the rate of inflation is very encouraging

- Businesses conditions are very stable, but they still show cautiousness about the long-term economic outlook

- Employment, even though it went above 50, is still a mixed bag between industries. Tech/ information services continued to be the biggest drag

- Historically manufacturing has led services in and out of recession, but the pandemic created so many distortions that is not very certain in this cycle

- Positive outlook forecasted, is going as expected.

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/june/

Episode 779: Services Rebounds with Strong Growth - The Services ISM Report On Business - YouTube

I agree with everything you’ve said here.

With absolute numbers, I mean the backlog of orders index numbers as they have not been linked in the Wiki article but I found the relevant part right now in the report. It could be interesting to eventually create tables for subcategories like those which display longer timelines, but this is not a priority as of now.

The only incentive I could see for someone to overdramatize is to warn the Fed not to overdo it or to gain additional political support. In any case, interviews like those are very interesting and I would like to watch one as well in the future to get an impression as well.

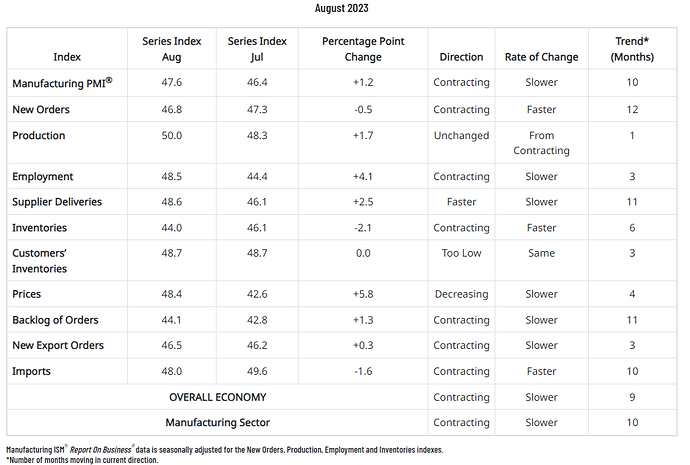

The August Manufacturing PMI registered 47.6 percent, 1.2 percentage points higher than the 46.4 percent recorded in July. The August composite index reading reflects companies managing outputs appropriately as order softness continues, but the month-over-month increase is a sign of improvement

“Demand remains soft, but production execution is consistent with new, reduced output levels based on panelists’ companies order books. Suppliers continue to have capacity. Prices are generally stable. Sixty-two percent of manufacturing gross domestic product (GDP) contracted in August, down from 92 percent in July, a positive trend for the economy. Additionally, the share of manufacturing GDP registering a composite PMI calculation at or below 45 percent — a good barometer of overall manufacturing weakness — was 15 percent in August, compared to 25 percent in July and 44 percent in June, a clear positive,” says Fiore.

Tim Fiore Comments:

- He thinks this is the bottom for manufacturing, don’t see it going much deeper with current conditions.

- The recovery is probably going to be slow from here, we could see a number above 50 (expansion) in the next 6-9 months but is unlikely to be before year-end. This is because of the uncertainty that is still in prices, and the future.

- Demand was relatively stable in August, to be able to maintain production levels, and not allow backlogs to come down more sharply.

- New export orders will not help in the near future. Panelists reporting being concerned about China. Export markets are about 15-18% of manufacturing output.

- Inventories are in the just right zone, which is okay but not great. But only see investments in inventory going up from here.

- Companies are relying on quits to bring headcount down and avoid layoffs, however in August quit rate was the lowest reported in more than 2 years, and could not be enough according to their plans.

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/august/

https://www.youtube.com/watch?v=5iE03EHx8yk

Services PMI

Good news: still growing and resilient.

Bad news: prices are increasing faster, and huge backlog drop.

A risk from an acceleration in the economy is that inflation could most likely increase too, or remain very sticky.

"There has been an increase in the rate of growth for the services sector, reflected by increases in all four subindexes that directly factor into the composite Services PMI® and faster supplier deliveries. Sentiment among Business Survey Committee respondents varies by industry; however, the majority of panelists are positive about business and economic conditions.”

Manufacturing PMI came in better than expected, while still in contracting, the rate of contracting seems to be slowing.

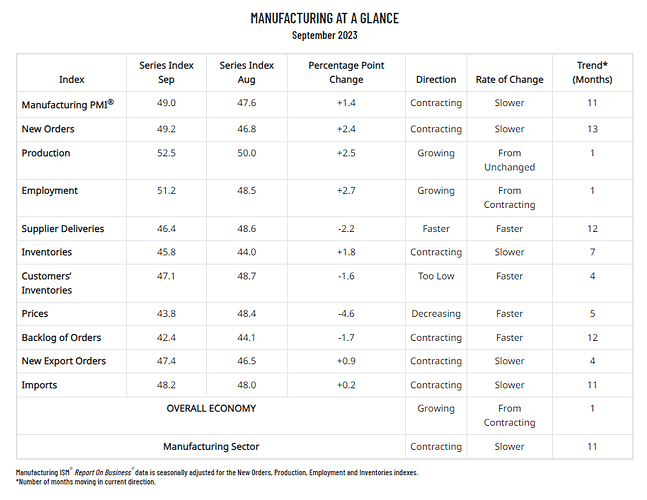

The U.S. manufacturing sector contracted in September, as the Manufacturing PMI® registered 49 percent, 1.4 percentage points higher than the reading of 47.6 percent recorded in August and its highest figure since November 2022 (49 percen. This is the 11th month of contraction, but the third month of positive change. Of the five subindexes that directly factor into the Manufacturing PMI, two (the Production and Employment indexes) are in expansion territory, up from none in August, breaking a three-month streak of no such growth

The past relationship between the Manufacturing PMI® and the overall economy indicates that the September reading (49 percent) corresponds to a change of plus-0.1 percent in real gross domestic product (GDP) on an annualized basis

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/september/

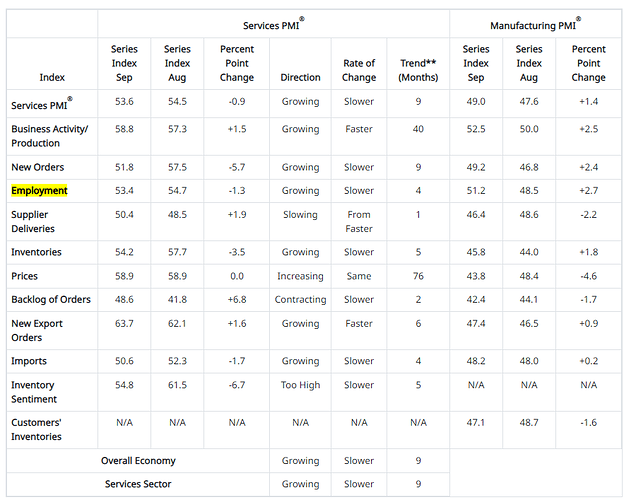

The services sector continues to grow, but its rate of growth is slowing.

In September, the Services PMI registered 53.6 percent, a 0.9-percentage point decrease compared to the August reading of 54.5 percent.

The past relationship between the Services PMI and the overall economy indicates that the Services PMI for September (53.6 percent) corresponds to a 1.3-percent increase in real gross domestic product (GDP) on an annualized basis.

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/september/

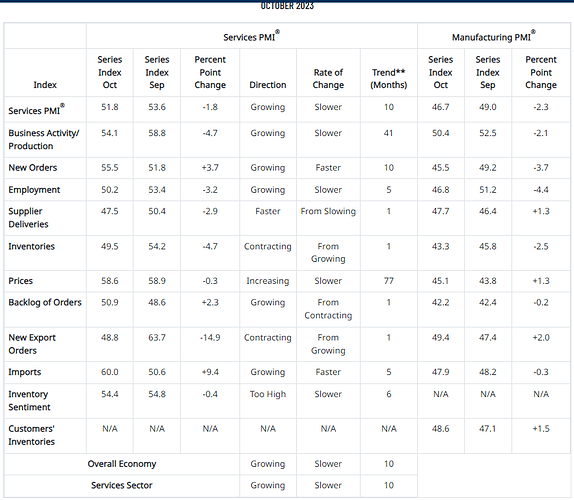

The manufacturing sector registered more weakness than expected in most indexes in October, erasing most of the improvement seen in the prior quarter, but still above the previous low.

“Demand remains soft, but production execution is stable compared to September as panelists’ companies continue to manage outputs, material inputs and — more aggressively — labor costs. Suppliers continue to have capacity. Seventy-five percent of manufacturing gross domestic product (GDP) contracted in October, up from 71 percent in September. More importantly, the share of sector GDP registering a composite PMI® calculation at or below 45 percent — a good barometer of overall manufacturing weakness — was 37 percent in October, compared to 6 percent in September and 15 percent in August.

And while services continue to grow, its growth rate continues to decelerate.

“The services sector continues to slow, with decreases in the Business Activity and Employment indexes. Sentiment among Business Survey Committee respondents’ comments is mixed, with some optimistic about the current steady and stable business conditions and others concerned about such economic factors as inflation, interest rates and geopolitical events. Employment-related challenges are also prevalent, with comments about increasing labor costs, as well as shortages.”

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/october/

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/october/

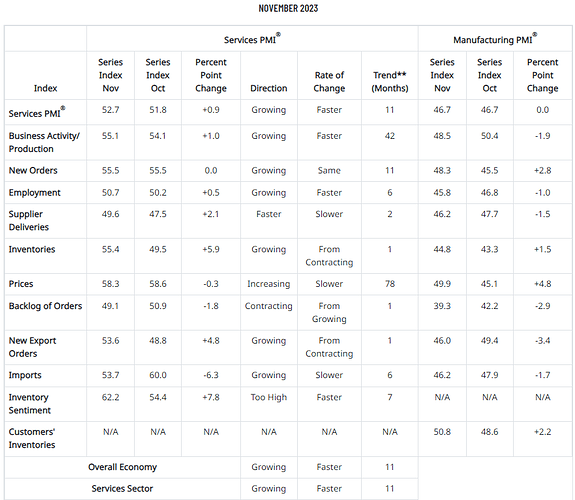

The manufacturing sector remained stable in November, but still below 50 for 13 consecutive months. Employment, Backlogs, Production, and Supplier Deliveries worsened while New Orders and Inventories improved

Demand remains soft, and production execution is slightly down compared to October as panelists’ companies continue to manage outputs, material inputs and — more aggressively — labor costs. Suppliers continue to have capacity. 65 percent of manufacturing GDP contracted in November, down from 75 percent in October. More importantly, the share of sector GDP registering a composite PMI calculation at or below 45 percent — a good barometer of overall manufacturing weakness — was 54 percent in November, compared to 35 percent in October and 6 percent in September. Three of the top six industries by contribution to manufacturing GDP were at or below 45 percent, same as the previous month

ISM services continued in expansion, with overall activity, prices paid, employment and new orders all above 50.

The services sector had a slight uptick in growth in November, attributed to the increase in business activity and slight employment growth. Respondents’ comments vary by both company and industry. There is continuing concern about inflation, interest rates and geopolitical events. Rising labor costs and labor constraints remain employment-related challenges.

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/november/

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/november/

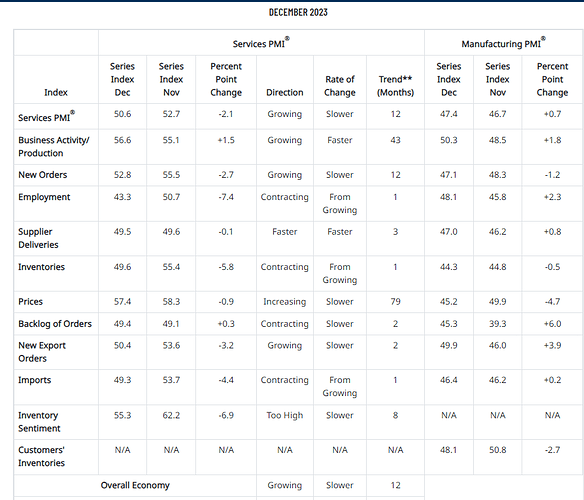

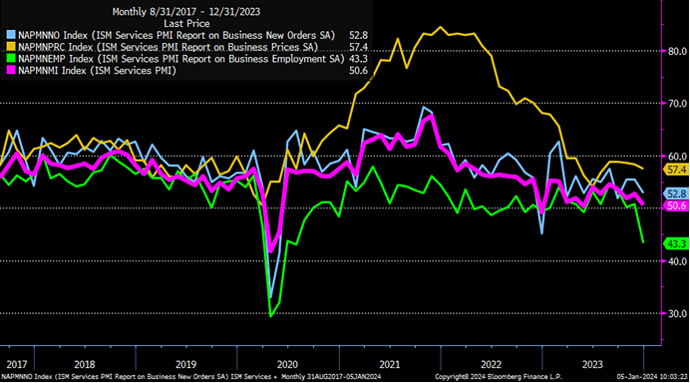

Noticeable miss and slowdown in the services sector, especially employment huge drop and new orders. I was still seeing the economy as strong enough and resilient to sill hold ok, but these numbers if sustained make me question if we could maybe be close to the turn in the economy. Will need more months and other data to have more confidence either way.

Manufacturing is still in contraction territory for 14 months, and not much improvement either in December.

https://twitter.com/carlquintanilla/status/1743299915432841235/photo/1

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/december/

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/december/

What is the significance of the employment sub-index dropping so drastically? How exactly is this data point measured?

Are there additional data points available to us right now that would enable us to create scenarios and attach probabilities to them?

Questions to answer: What is our base scenario? How likely is it? Which data points down the road are we looking for confirmation? What other outcomes do we deem probably and why?

The change is significant, as in just 1 month fell to levels only seen inside recessions. It will need to keep at this level for some months to confirm a trend, but it is a red flag for now, because when the labor market gets weak, it usually does it very drastically, is not a linear trend.

About their methodology:

Survey responses reflect the change, if any, in the current month compared to the previous month. For each of the indicators measured (Business Activity, New Orders, Backlog of Orders, New Export Orders, Inventory Change, Inventory Sentiment, Imports, Prices, Employment and Supplier Deliveries), this report shows the percentage reporting each response and the diffusion index. Responses represent raw data and are never changed. Data is seasonally adjusted for Business Activity, New Orders, Prices and Employment. All seasonal adjustment factors are subject annually to relatively minor changes when conditions warrant them. The remaining indexes have not indicated significant seasonality.

As for your question, currently, you can still find data supporting either thesis that’s what has been very tricky about this cycle. I continue to add the arguments on either side here (I will try to add links to these in the coming days): https://www.mindmeister.com/app/map/2881172333?t=RnRyQObptr

My base case continues to be that we will get a recession, but I am still open to the possibility that it could be much later than anticipated, or that even we could get a soft landing or no landing. I was planning to work on this in the coming days too with what I have until now analyzed, probably after CPI.

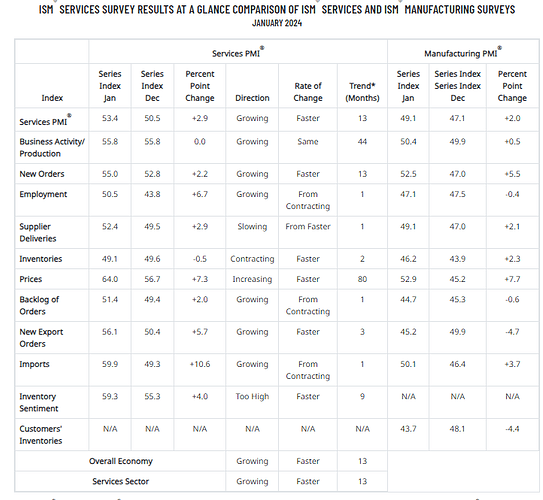

Both the manufacturing and services sector PMI showed some improving dynamics in the economy for January, but the negative that comes with this is that prices in both surveys had a significant jump in both sectors too.

Is early to know, but if this continues, at the very least we could see very little improvement in inflation going forward.

Still not at the level seen in 2022.

Manufacturing

Demand remains soft but shows signs of improvement, and production execution is stable compared to December, as panelists’ companies continue to manage outputs, material inputs and labor costs. Sixty-two percent of manufacturing gross domestic product (GDP) contracted in January, down from 84 percent in December.

Twenty percent of companies reported higher prices, compared to 14 percent in December,” says Fiore. A price index above 52.8 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) Producer Price Index for Intermediate Materials.

Services

The overall growth rate increase in January is attributable to faster growth of the New Orders, Employment, and Supplier Deliveries indexes. The majority of respondents indicate that business is steady. They are optimistic about the economy due to the potential impact of interest rate cuts; however, they are cautious due to inflation, associated cost pressures and ongoing geopolitical conflicts

Prices paid by services organizations for materials and services increased in January for the 80th consecutive month. The Prices Index registered 64 percent, 7.3 percentage points higher than the seasonally adjusted 56.7 percent registered in December. This month-over-month increase is the largest since August 2012 (9.3 percentage points).

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/january/

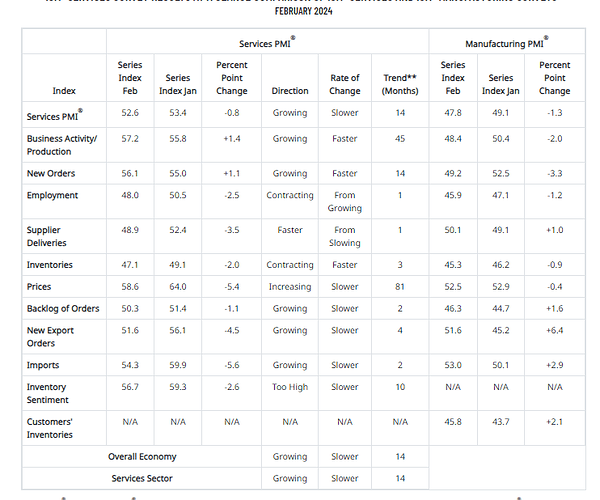

PMIs for February

Not much change from last month, the current feeling is like a stagflation type of environment

- Manufacturing is still in contraction but stable and recovering in some areas, and services are still growing, but at a slower pace

- Employment in both sectors is becoming weaker.

- Prices are still growing in both sectors too.

Services

The slight decrease in the rate of growth in February is a result of faster supplier deliveries and the contraction in the Employment Index. The majority of respondents are mostly positive about business conditions. Respondents remain concerned about inflation, employment, and ongoing geopolitical conflicts.”

Management

“Demand is at the early stages of recovery, and production execution is relatively stable compared to January, as panelists’ companies begin to prepare for expansion. Suppliers continue to have capacity but are showing signs of struggling, due in part to their raw material supply chains. Forty percent of manufacturing gross domestic product (GDP) contracted in February, down from 62 percent in January. More importantly, the share of sector GDP registering a composite PMI® calculation at or below 45 percent — a good barometer of overall manufacturing weakness — was 1 percent in February, compared to 27 percent in January and 48 percent in December

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/february/

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/february/

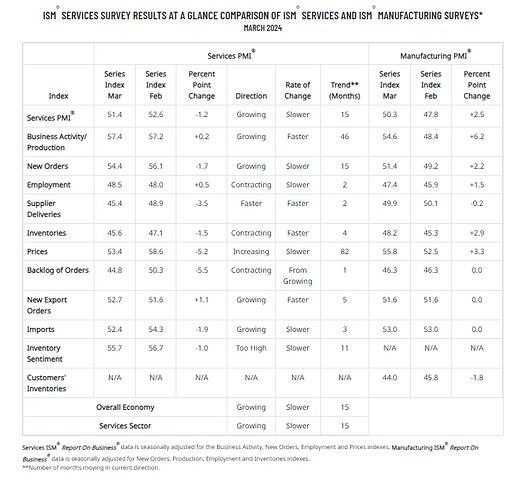

Surprise this month came with manufacturing recorded slight growth again, after being in contraction since November 2022. But this came with higher inflationary pressures for the sector too.

Services had a more soft report. But, still growing.

Employment in both sectors is still in contraction, probably as backlogs remain low.

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/march/