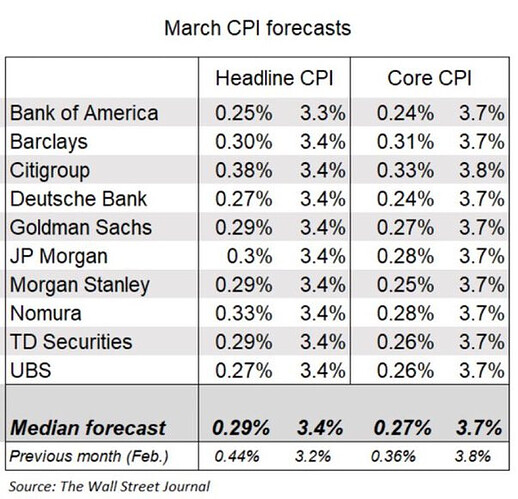

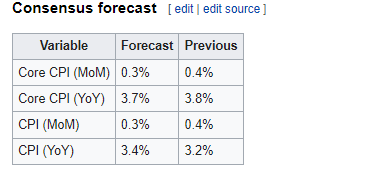

Tomorrows estimates.

Putting all together, most of the more important markets/indicators developments were not great this month, except for car price declines, and wages with more moderate increases.

The increases seen are still not indicative that inflation will be 8-9% again or something, but it is worth monitoring more closely because if these developments continue I would start to become more and more concerned about inflation reaccelerating again (maybe 4-5%)than a recession in the short term. Indicative that the FED could not be restrictive enough yet, or needs to stay this high for longer.

*There are always lags in CPIs, so so these developments are sometimes more important for future CPIs releases, than the current one *

- Energy continued to increase, with both oil and gasoline up more than 5% m/m. Oil is currently 10% Y/Y.

- Food prices also increased in March 1.1% m/m, after 7 months of declines. Still -7% y/y.

- Rents also experienced the second month of increases 0.6% m/m, while at least housing prices have started to moderate again with second month of declines -0.1 m/m

- New and Used car prices both experienced declines during March again, 0.4% m/m and 0.9% m/m respectively.

- PPI came in significantly hotter in February 2024, at 0.6% m/m.

- Import prices has also been on the rise.

- Manufacturing PMI prices jumped during march, while services PMI prices on the contrary moderated but still growing.

- Small businesses also reported higher prices, and higher pricing plans during March 2024.

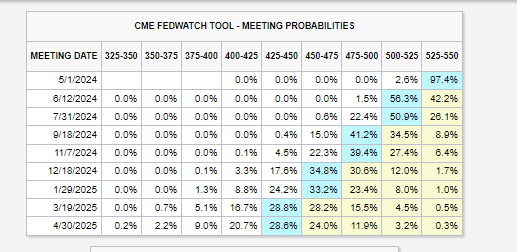

As of today, the markets still are pricing on average ~3 cuts this year starting on June.

I think they are maybe too much still with the state of the economy, and I would also start to question it more if developments continue this way.