This is actually not a very positive report, even if headline inflation is still coming down y/y.

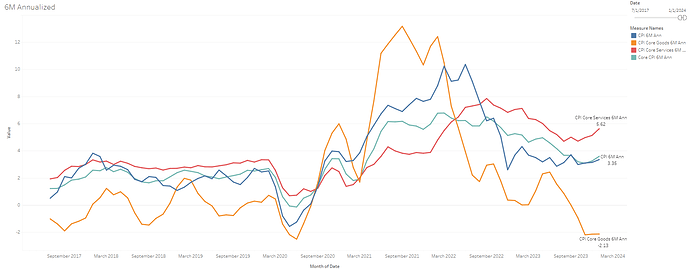

Is just 1 month and seems that seasonal adjustments have been screwed up after covid (have not looked at this myself). But at the same time, the 3/6 months trends are especially concerning.

- Important goods disinflation, especially coming from used cars, but was not enough to offset services.

- 3 month and 6-month annualized rates are accelerating, especially for services. All bottoming around October.

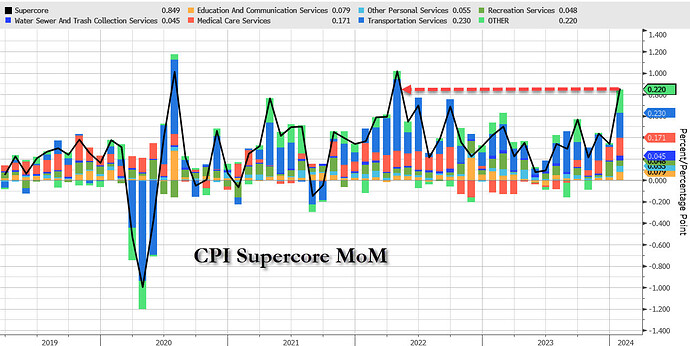

- Supercore services acceleration is particularly high, at 0.85% m/m, from 0.4% in past months. And it was pretty broad too

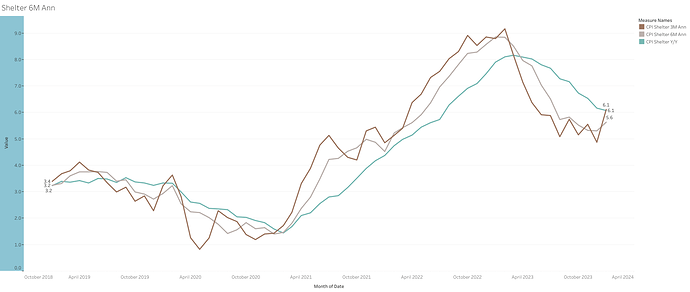

- Shelter is moderating very slowly too, and 3/6 months trends are not the best either. I still expect more moderation from shelter, but it could end up taking longer and maye more modest than anticipated. Especially with home prices at again ATH.

Seems as PMIs pointing to increased inflationary pressures, especially in services, were not wrong.

And appears it will be difficult to control inflation or bring it to target when the economy continues at this pace, and with the huge loosening of financial conditions since October.

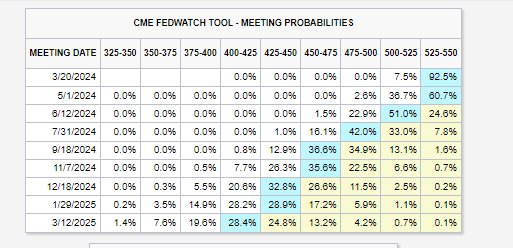

After the report, cuts are not expected until June now, with 4/5 in total. I still think 3 cuts as the FED signaled could be reasonable, but no more than those if numbers continue to cool this slowly and remain sticky.