Yes, I agree that it would be beneficial to contrast their opinions with our research.

In this case, I mostly agree with his perspective, and I value that he always discusses topics in terms of probabilities.

I also fear the FED will be too late because of the concern about inflation because I have been noticing a deceleration in consumer spending growth as of late.

So, in terms of data:

Consumer:

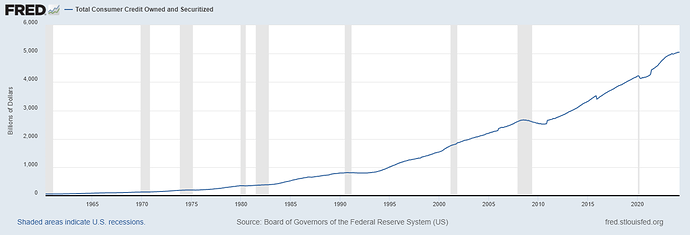

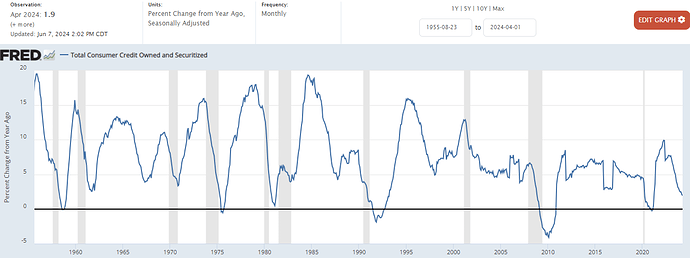

- I previously mentioned, the primary source of consumer spending is currently income. This is because the growth rate of consumer credit is very low and continues to decline.

- I have been reporting the concerning sharp increase in delinquencies for credit cards and auto loans, and they are expected to continue increasing since the share of consumers that are maxed out is expected to rise.

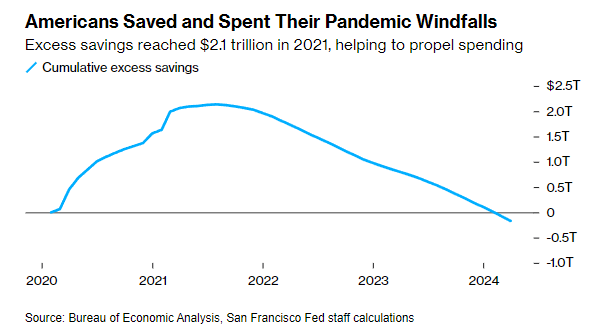

- I have also been noting the very low savings rate in the US consumer, with limited potential for further decrease. And according to the SF Fed, excess savings have already been depleted since March 2024.

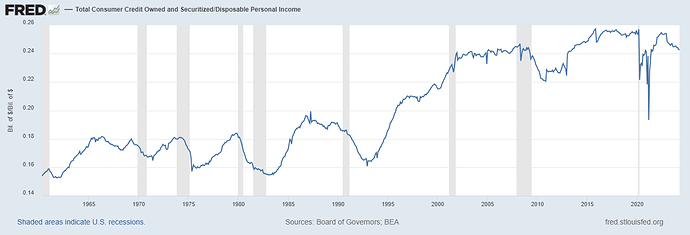

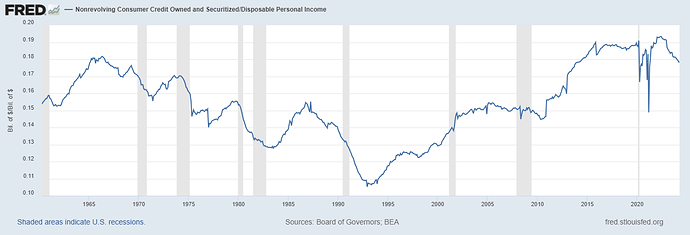

- While debt-to-income levels are better than in 2008, they remain high. And this does not stop short-term issues related to credit accessibility and tough bank standards to effect the economy, especially with delinquency increases.

- Also, what got better after 2008, was mostly mortgage debt (and revolving too), because consumer credit to income remains at similar levels, more especially due to the increase in non revolving debt (auto loans mostly) increases.

Small Business:

- Small businesses have been struggling for a long time and have not shown any significant improvement since then.

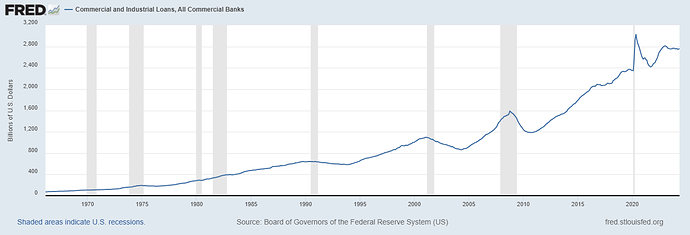

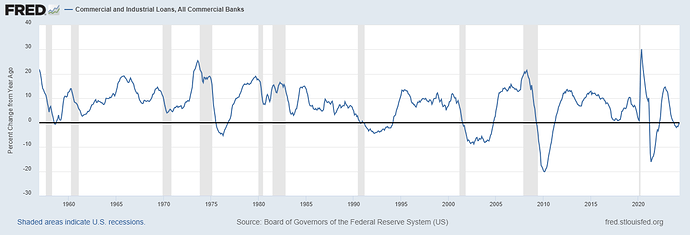

- Business loans are currently experiencing negative growth but stabilizing recenty. There is little incentive and accessibility to borrow and invest at current rates.

- Bankruptcies have been increasing significantly over the past year, recognizing they are starting for a very low level, but growth rate is significant.

- The maturity wall is approaching, especially for small businesses, with interest rates remaining high.

I agree that the current economic tcycle still positive growth is primarily driven by income, but this is the goal of monetary policy to slow the growth of money and credit creation.

Continued weakening in the labor market will likely cause further slowdown, and this deterioration is unlikely to be linear. Because economic problems are never linear, they often intensify rapidly once they begin to be more evident