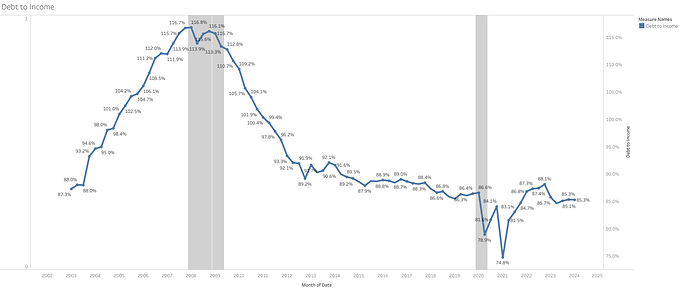

Consumer debt to Income levels in the US, while still high have come down significantly since the 2008 financial crisis. Showing at least a significantly better standing than during that period.

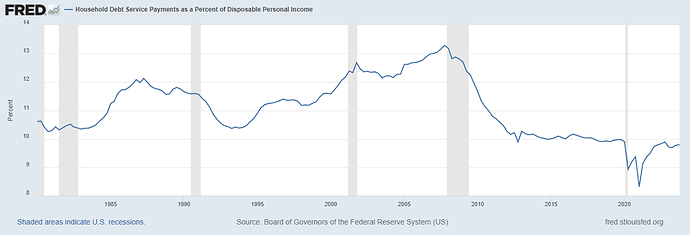

Debt service payments to income show a similar pattern.

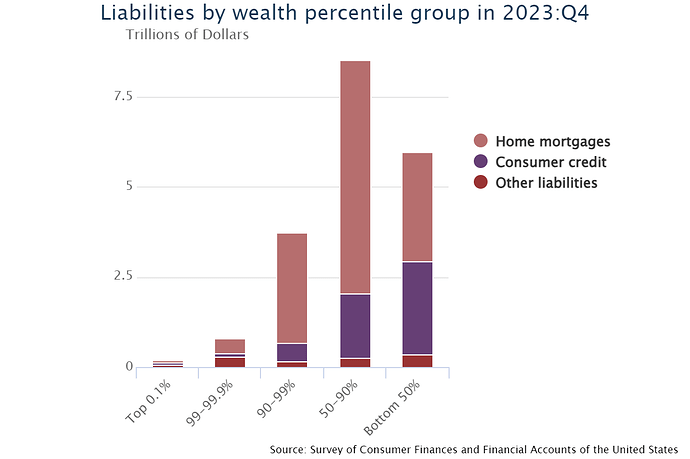

However, it is important to mention this is aggregate data, and that it is most likely skewed for the richest cohorts.

Most of the debt is concentrated on the less wealthy, who would struggle the most in a decline in income.

A better consumer balance sheet however does not mean that short-term or temporary difficulties could be encountered, as can be seen in delinquencies for some consumer debt reaching levels not seen since 2008/2009.

But at least important sectors such as mortgaged debt remain in a healthier place.