SF FED: Consumer pandemic excess savings have been depleted

This analysis could change based on the pre-pandemic trend line used, I would like to recreate at some point the same analysis using the trendline since 2009, but I don’t think will be that much different.

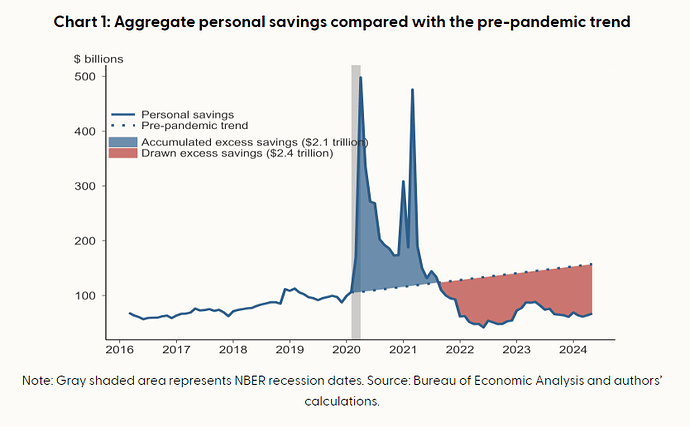

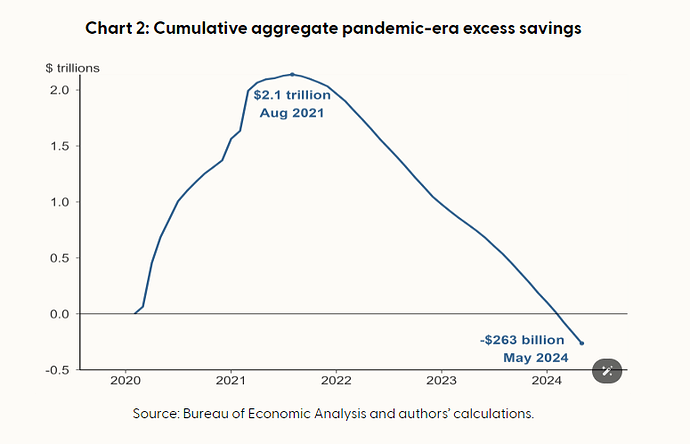

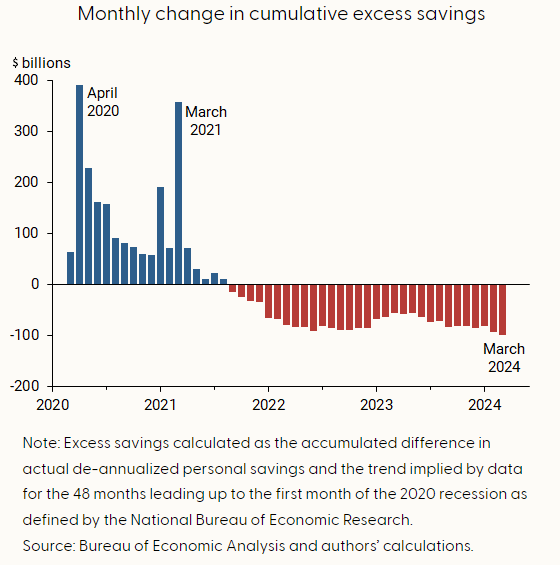

Excess savings defined as the difference between actual savings and the pre-pandemic trend, have been fully depleted.

Households drew down their excess savings at an average pace of $70 billion per month since September 2021, although this drawdown accelerated to about $85 billion per month since last fall relative to the average pace for the entire period

What are the consumer’s options now to maintain spending patterns:

- A strong labor market can help consumers maintain their current spending patterns, even without the savings accumulated during the pandemic.

- Consumers might tap into their non-pandemic-related savings for household consumption, supported by notable gains in equity and other asset holdings over the past year.

- Households now own significantly more nonfinancial assets, such as real estate and vehicles, compared to pre-pandemic levels. This increase, as reported by the Federal Reserve Board, suggests that if households can access funds from these less liquid assets, consumer spending could remain robust.

- Consumers might also rely on debt, such as credit cards and personal loans, to support their spending. However, the current elevated interest rates make the cost of borrowing higher than it was in the decade before the pandemic recession.