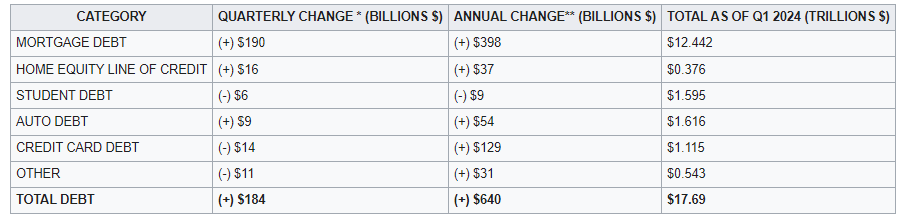

Total household debt increased by $184 billion (1.1%) in the first quarter of 2024, to $17.69 trillion, mostly due to mortgage debt since consumer credit has been slow on Q1 2024.

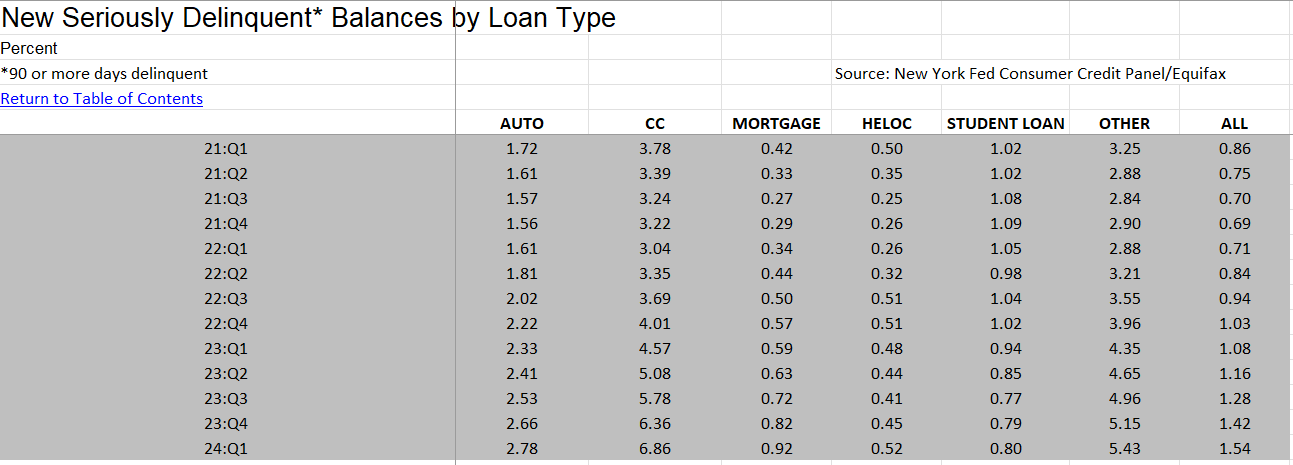

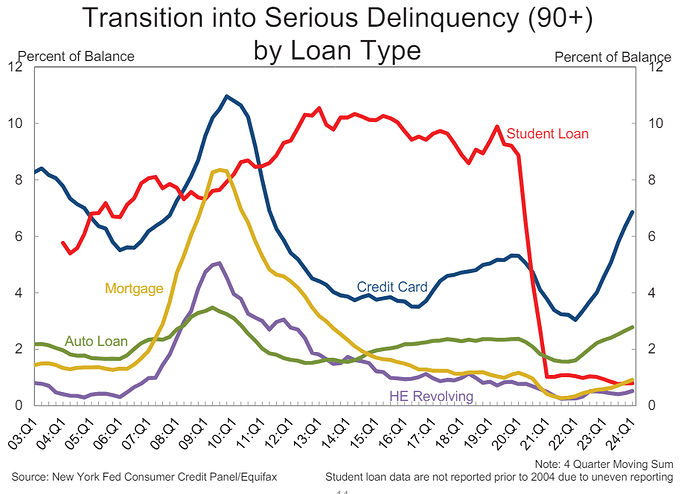

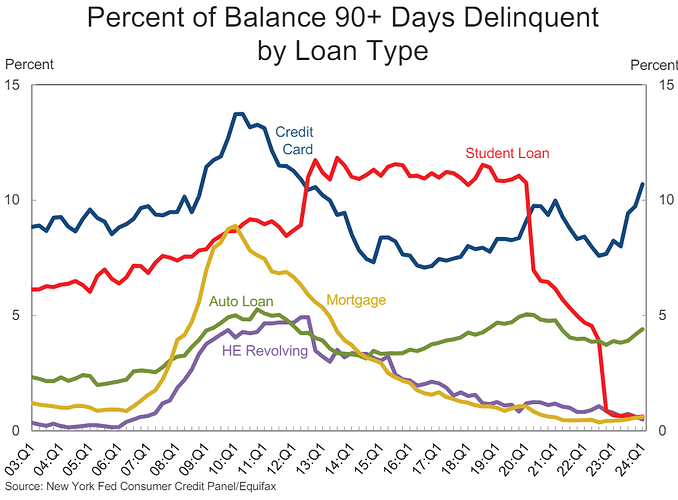

Flow into serious delinquencies continues to increase, particularly on credit card and auto loans and the Other category (sales financing, personal loans, and Retail loans). Other types of debt flow into delinquencies remain low.

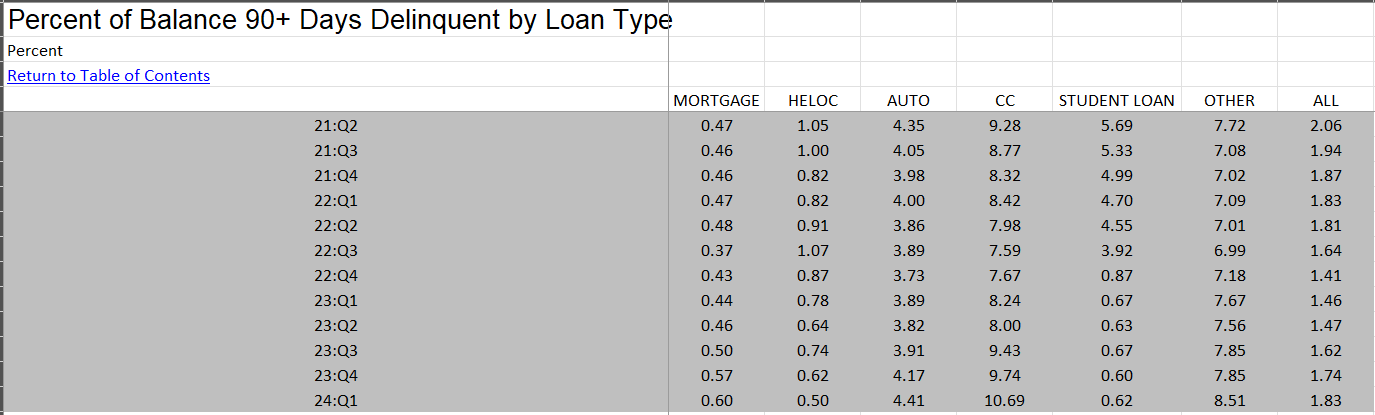

90+ days delinquent balances are particularly high for credit card debt at 10.69%.

The Other category is also high.

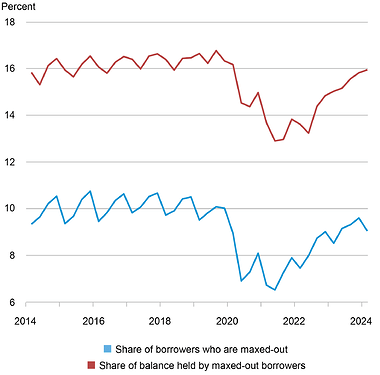

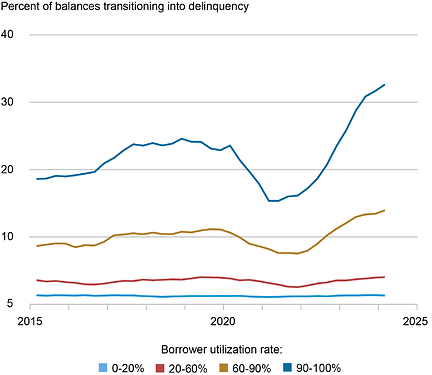

According to their NY FED study, credit card delinquencies are likely to continue to rise, since the share of consumers that are maxed out, and their transition rates are increasing, with no signs of improvement.

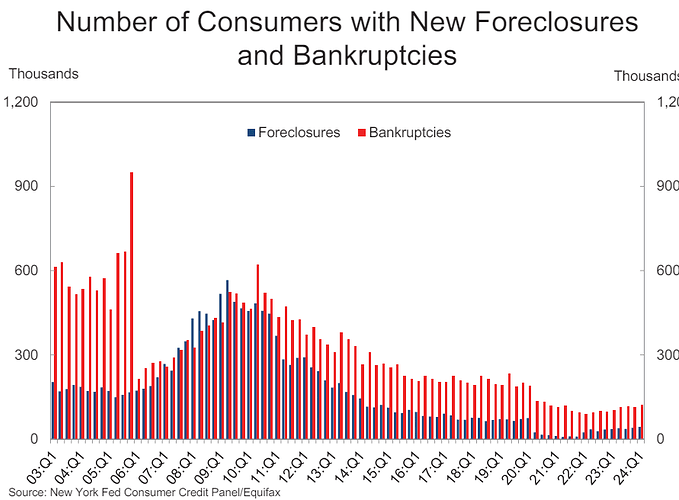

New bankruptcies and foreclosures remain low, but increasing.

https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2024Q1