I sometimes wonder if we and markets are being complacent with CRE, and not putting enough attention to it. Much as they were doing in 2008 with the very obvious crisis in housing.

If not a systemic event, maybe it could trigger a hard stop in lending, making any economic slowdown worse.

Interesting article by WSJ, is a good read if it can be done

Banks’ exposure is even bigger than commonly reported. The banks are in danger of setting off a doom-loop scenario where losses on the loans trigger banks to cut lending, which leads to further drops in property prices and yet more losses.

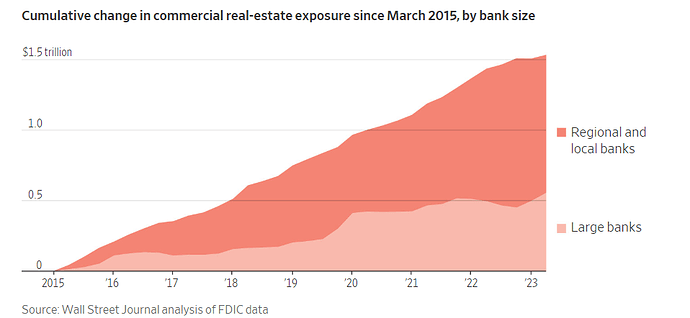

- Banks roughly doubled their lending to landlords from 2015 to 2022, to $2.2 trillion.

- Banks with less than $250 billion in assets held about three-quarters of all commercial real-estate loans as of the second quarter of 2023. They accounted for nearly $758 billion of commercial real-estate lending since 2015, or about 74% of the total increase during that period.

- The volume of commercial property sales in July was down 74% from a year earlier, and sales of downtown office buildings hit the lowest level in at least two decades. When deals begin again, they will be at far lower prices

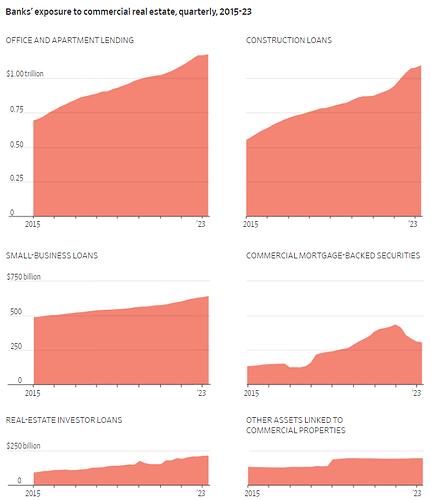

Over the past decade, banks also increased their exposure to commercial real estate in ways that aren’t usually counted in their tallies. Indirect lending brings banks’ total exposure to commercial real estate to $3.6 trillion. That’s equivalent to about 20% of their deposits.

- Between 2015 and 2022, banks more than doubled their indirect real-estate exposure. That included loans to nonbank mortgage companies and to real-estate investment trusts that own and operate buildings and lend to landlords. It also included investments in bonds known as CMBS. Banks boosted lending to small businesses that used property as collateral as well. Holdings of CMBS and loans to mortgage REITs and other nonbank lenders accounted for about 18% of the nearly $3.6 trillion in commercial real-estate exposure in 2022

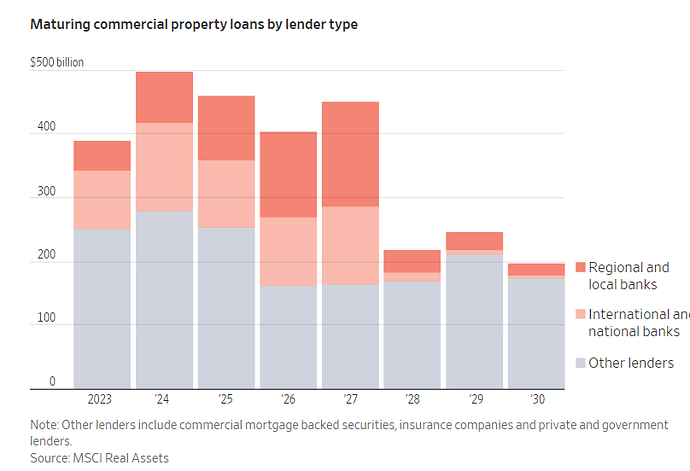

Roughly $900 billion worth of real-estate loans and securities, most with rates far lower than today’s, need to be paid off or refinanced by the end of 2024.

Example of type of discounts happening:

In early 2021, an affiliate of Brookfield Asset Management borrowed $465 million in CMBS and other debt against the Gas Company Tower, a 52-story office building in downtown Los Angeles.

At the time, appraisers valued the property at $632 million, according to Trepp, up from a valuation of $517 million when Brookfield bought the building in 2013. When the loans came due this February, the owner defaulted. An appraiser earlier this year cut the building’s estimated value to $270 million.