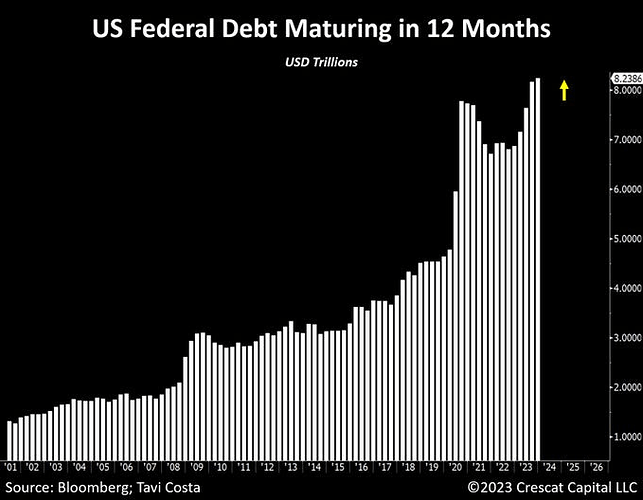

$8.24 Trillion of U.S. Treasuries will mature in the next year, 1/3 of outstanding debt. This while deficits are expected to continue growing, demand is weak, and some big players are reducing holdings. So, the pressure on rates will probably continue while this is the case.

I also, sometimes don’t understand why the treasury did not issue more long-term bonds while rates were low and liquidity ample. The way households did with mortgages and companies with some of their debt, is like they have zero planning, and never expected rates to be high ever again.

https://twitter.com/Barchart/status/1724596138840297760/photo/1

Will share if I find the whole maturity schedule later.