Q2 2024 Cox Automotive Insights into Used Car Market and Prices in the US

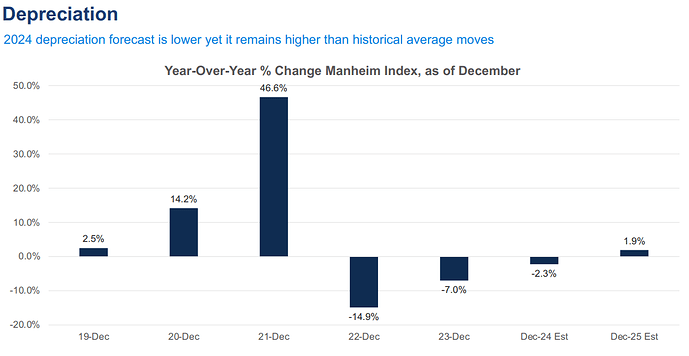

@Aron Cox now expects a 2.3% decline in used car price index in 2024, vs their forecast of -0.7% at the end of Q1.

They started the year forecasting a 0.5% increase, so deterioration has continued to worsen in Q2 2024.

Used car price index declined by -3.44% in Q2 2024 vs -0.45% in Q1 2024.

They expect however about a 1% increase in the second half of 2024 and a 1.9% increase on 2025.

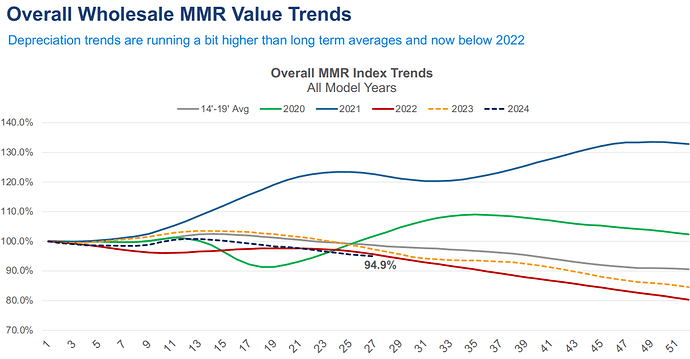

Overall wholesale values (1 to 10 years olds) have fallen 5.1% during 2023, 2.3 points lower than last year, and 3.8 below 2014-2019 averages. Value depreciation has flattened at the end of June according to Cox.

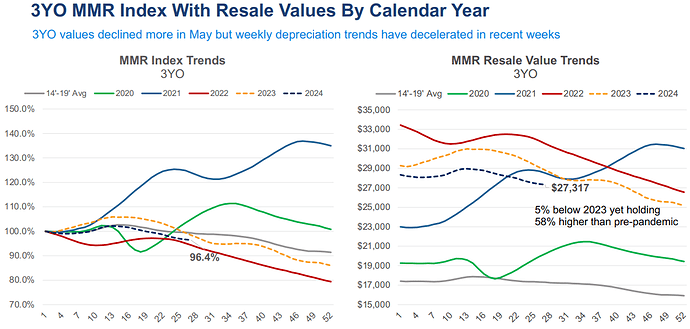

- Values for 1-year-olds have fallen the most by 5.9% during 2024, due to new vehicle supply increases. Values are at $36.4K, 11% lower than 2023, but still way higher than 2019.

- 3 years old values declined only by 3.6% during 2024, at $27.3K there are 5% below 2023 values.

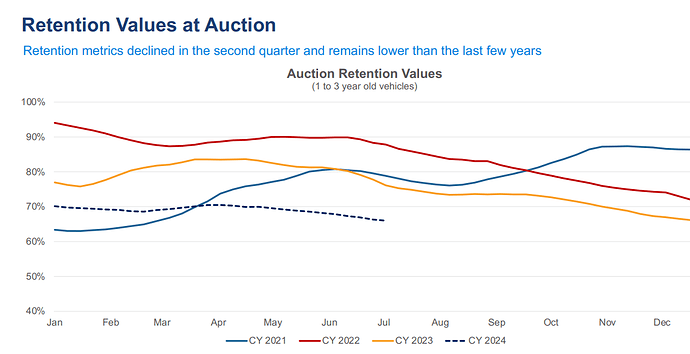

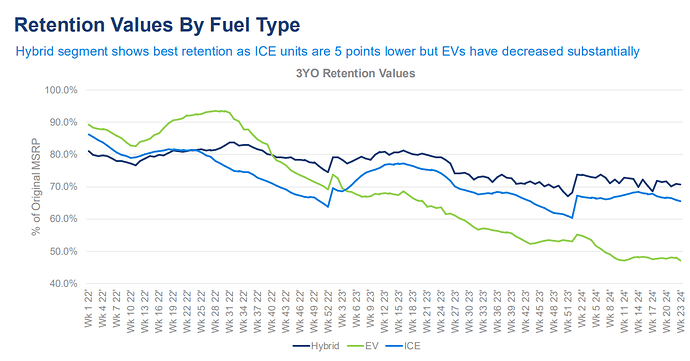

Retention values (% remaining of original MRSP) for 1-3 years old haven to 66% in the 1H2024.

- Q2 declined by 4% vs a flat Q1, a bit higher than normal for this part of the year.

- Hybrids hold value better than ICE units, and EVs underperform both types.

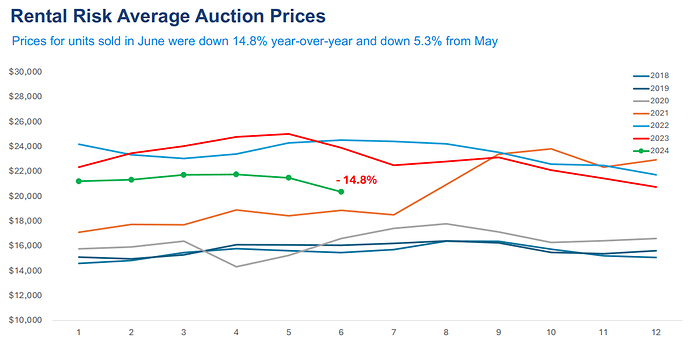

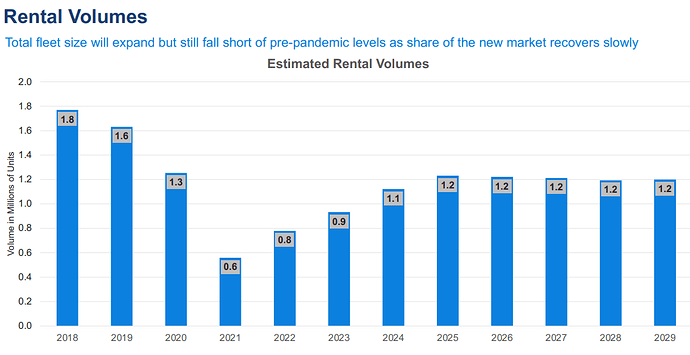

Auction prices for rental units have been trending down during the year, and accelerate during June, with al most 15% Y/Y as of June

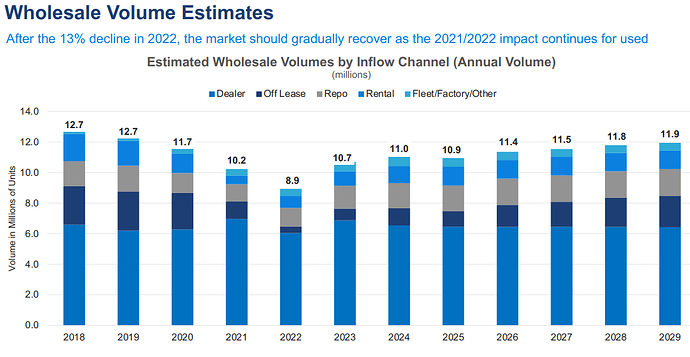

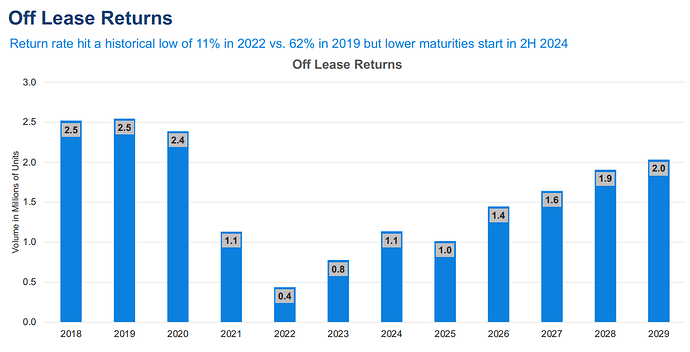

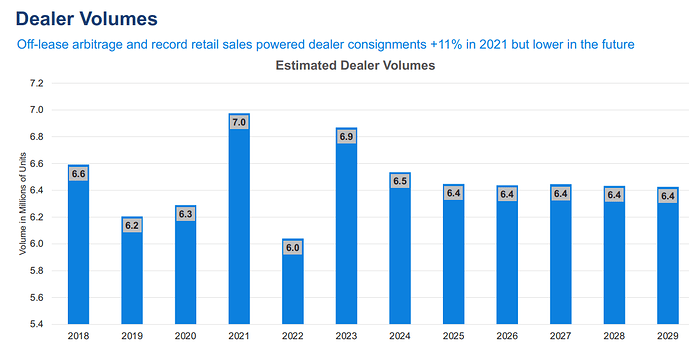

Supply for the used vehicle market is expected to remain tight for the next few years, not returning to the 2019 levels.

Lower leased maturities will play a key role in this.