Q3 2024 Auto Market Insights

New Car Market

Developments:

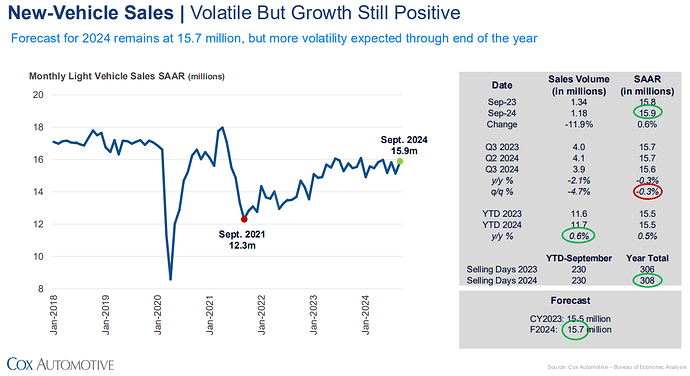

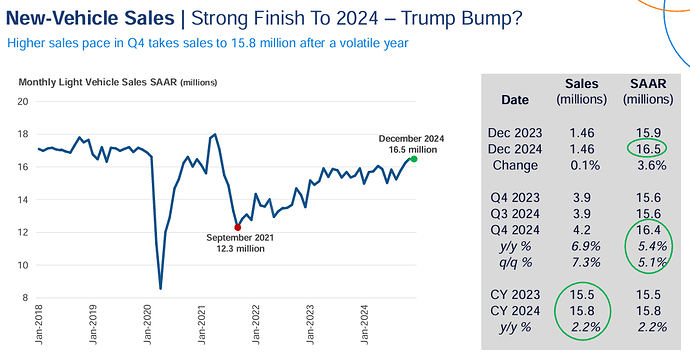

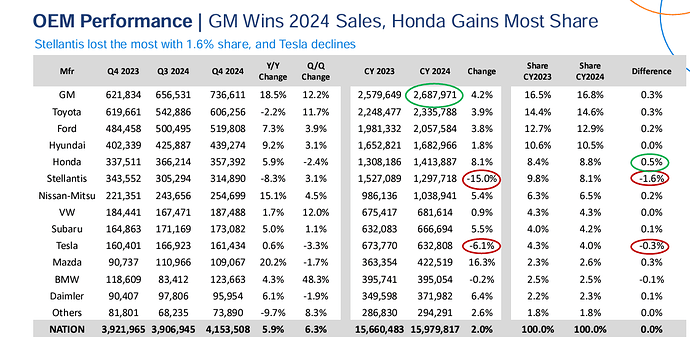

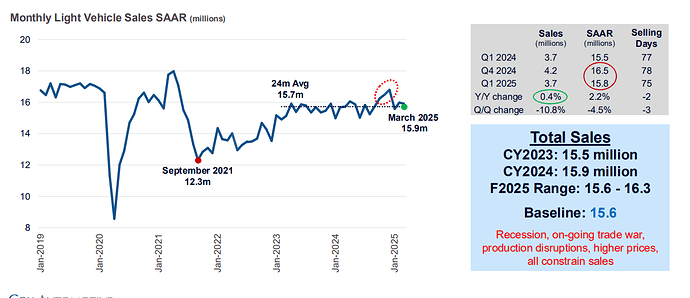

- New car sales declined by 4.7% quarter-over-quarter (Q/Q) and 2.1% year-over-year (Y/Y). Year-to-date (YTD) sales are up slightly by 0.6% Y/Y.

- Sales, measured in seasonally adjusted annual rate (SAAR), dipped 0.3% both Q/Q and Y/Y, but YTD they show a modest increase of 0.6% Y/Y.

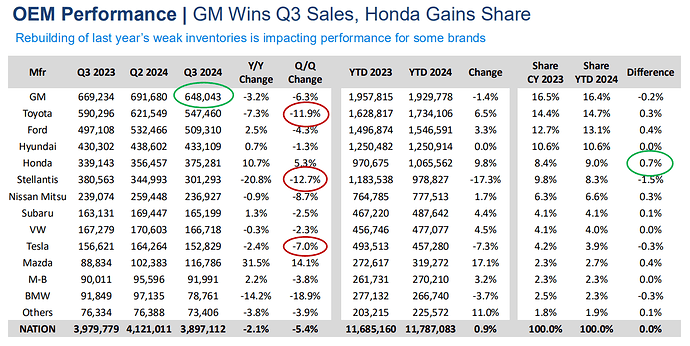

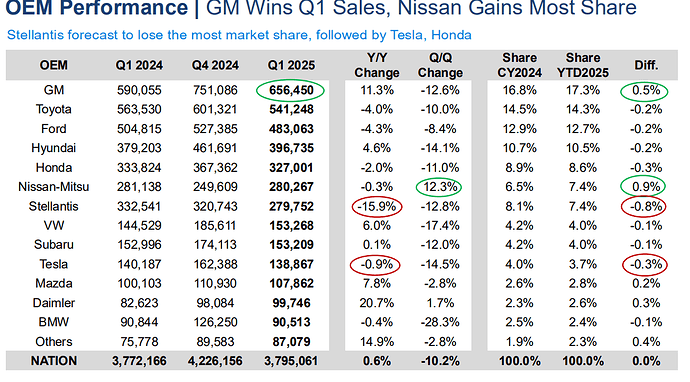

- Volkswagen (VW) sales fell 2.3% Q/Q and 0.3% Y/Y, though YTD sales have risen by 4.5% Y/Y.

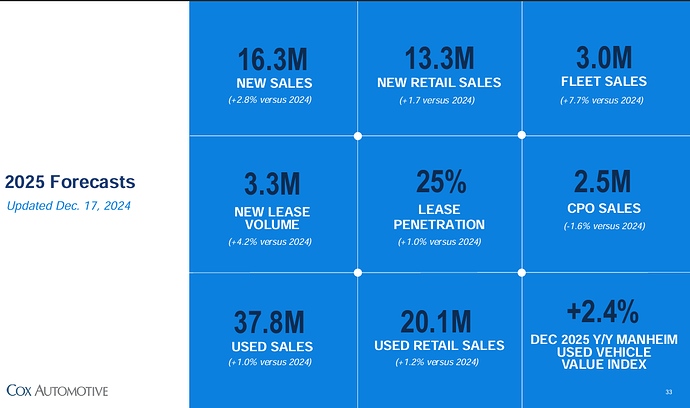

- Cox Automotive is forecasting that new-vehicle sales will reach 15.7 million units in 2024. The forecast has not changed from earlier in the year.

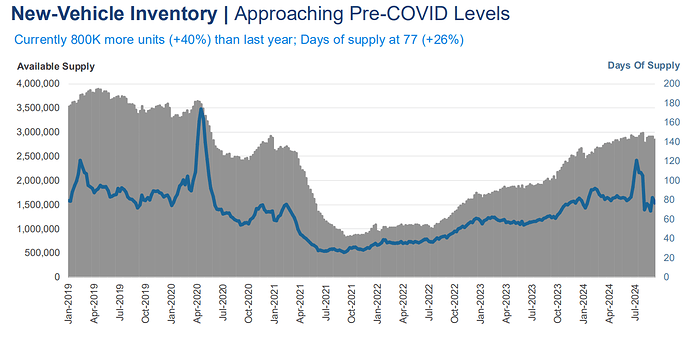

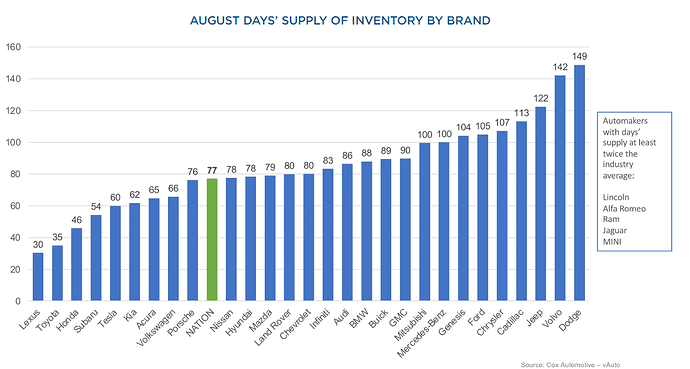

- Currently, supply is 2.9 million, up 40% from last year’s levels, but still below 2019 levels.

- 77 days of supply. up 26% from last year, in line already with 70-80 days supply in 2019.

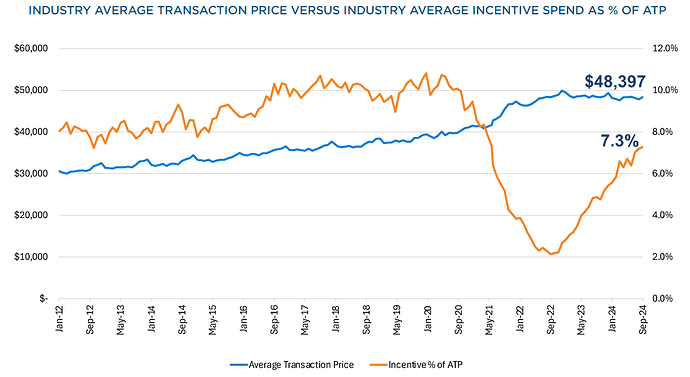

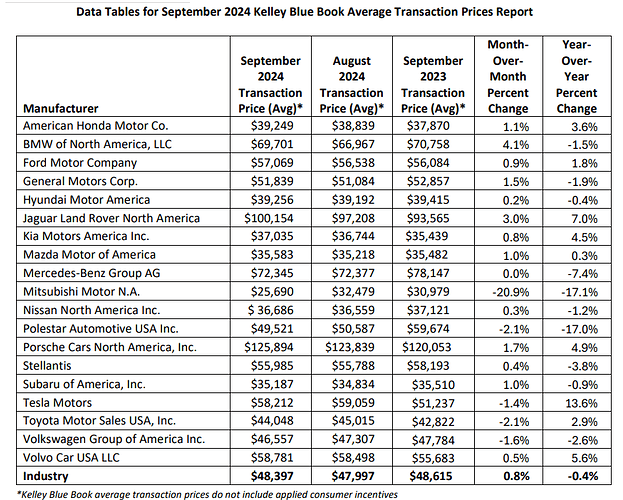

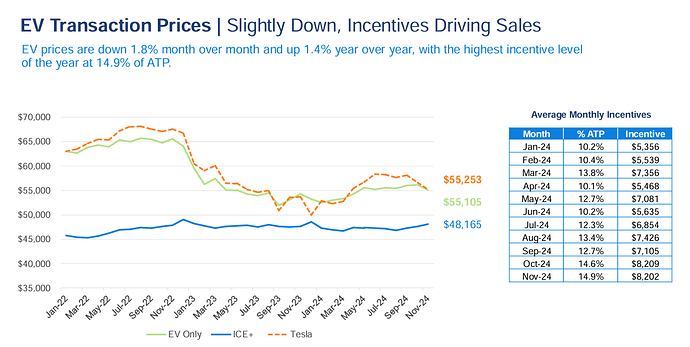

- Average transaction price of new car in September 2024 was 48,397, is basically flat for the quarter, and only lower year over year by 0.4.

- Incentives continue to rise to 7.3% of ATP, however, remain below pre-pandemic levels of 10-11%

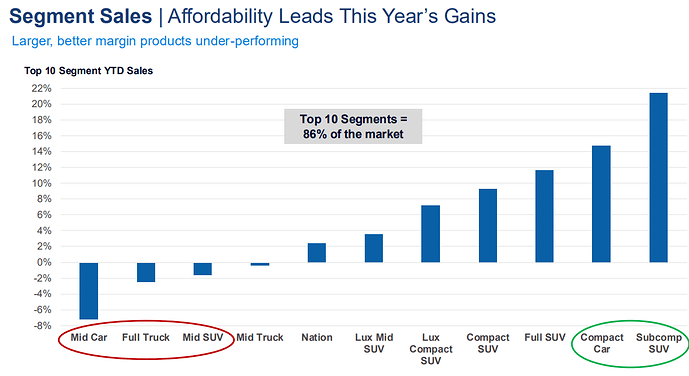

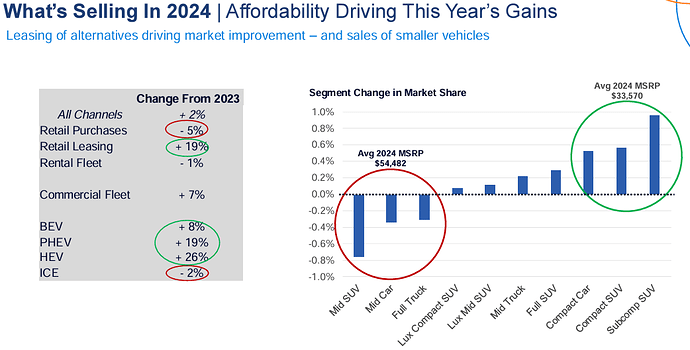

- A shift in consumer preferences is noticeable, with some of the more affordable vehicles driving sales growth YTD. So sales mix is also impacting transaction prices and profitability.

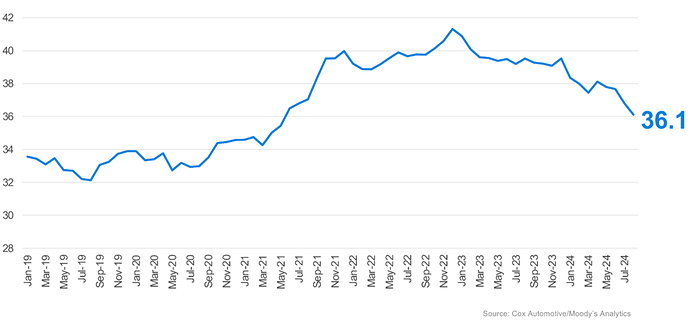

- Affordability continues to increase, the number of median weeks of income needed to purchase the average new vehicle declined to 36.1 weeks from a downwardly revised 36.8 weeks in July, reaching the lowest level since May 2021.

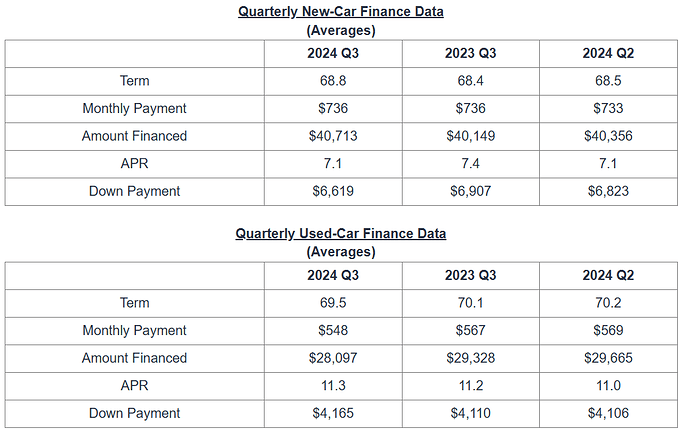

- The typical payment in August declined 1.6% to $737, the lowest in two years.