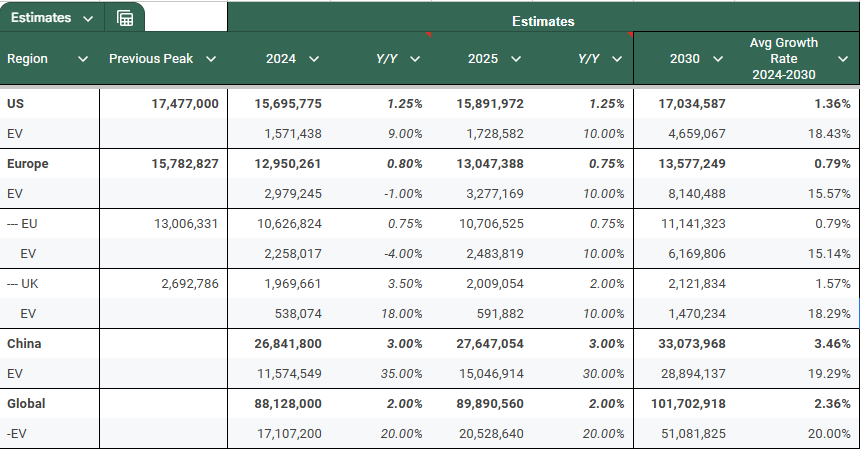

Q4 2024 Model Estimates

Disclaimer: My estimates are very rough guesstimates and based on an initial assessment of the data reviewed, as I haven’t fully analyzed regional fundamentals, impacts, or correlations in depth. Despite my effort to cover as much information as possible during these weeks, key points or arguments may still be missing

It seems the major trends shaping the automotive industry over the next few years include demographic challenges, affordability concerns driven by high vehicle prices, and increasing competitive pressures as the transition to electric vehicles accelerates over the next few years.

Excluding China, I do not anticipate auto sales volumes in most regions returning to their pre-2019 peaks. In the U.S., sales could come close to their previous peak by 2030 but are likely to remain slightly below.

While EV sales are expected to see substantial growth across all regions, they may fall short of ambitious government targets (except in China). Key obstacles include the still higher cost of EVs compared to ICE vehicles, new tariffs on Chinese automobiles, underdeveloped charging infrastructure, low margins on EVs slowing investments, supply chain dependencies heavily tied to China, and consumers still skeptical of EVs, especially as used EV has fallen sharply.

Complete Model

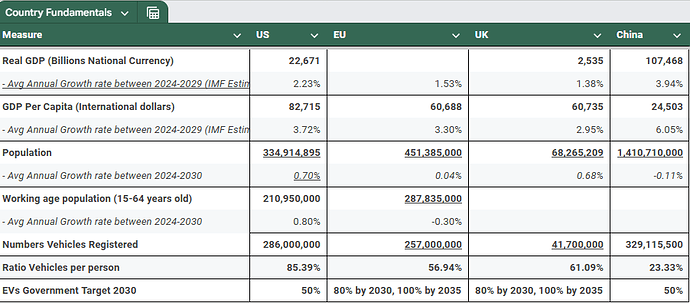

The below table highlights key country-specific fundamentals relevant to the automotive industry, providing a quick overview for my forecast eg. slower growth in the EU compared to other regions while anticipating stronger growth in China.

Table Sheet

I will mention my arguments or assumptions below by region:

USA

I am expecting an average growth rate of ~1.4% per year in vehicle sales for the 2024-2030 period.

- Average real GDP growth at 2.53% per year is projected to be lower than the levels observed in recent years, but still relatively good.

- Population growth, particularly within the working-age demographic, is expected to be very low at 0.7% annually on average. Potential policies during the Trump administration restricting immigration could exacerbate this trend.

- The U.S. has already reached high levels of urbanization (83.3%) and car ownership (85.5%), leaving little room for significant growth in these areas.

- Interest rates are expected to remain elevated for longer, supported by relatively good economic growth.

- Vehicle affordability has worsened compared to 2019 due to rising prices and high interest rates despite improving since 2022, shrinking the pool of consumers who can afford to purchase a car.

- Potential new tariffs on imports could drive or maintain vehicle prices higher, further straining affordability and dampening demand.

- The decline in new car affordability has made used vehicles more appealing. The average vehicle age in the U.S. continues to increase from 12 years in 2019 to 14 in 2024 as consumers hold onto their cars longer.

- The adoption of ridesharing services and increased use of public transportation are expected to grow, reducing demand on private vehicle ownership, especially as cities become very dense. McKinsey estimates ride-sharing revenue to go from $130 billion in 2019 to $450 billion and $860 billion by 2030

- Increasing levels of negative equity and loan delinquencies are damaging consumers’ credit histories, also reducing the number of qualified buyers over the next several years

I anticipate the U.S. will fall significantly short of its EV market share target, reaching approximately 27.5% by 2030 and continuing to lag behind other major regions. Growth is expected to remain subdued in the near term, with a stronger acceleration later in the decade as conditions improve.

- Policies under the Trump administration are likely to eliminate EV-related incentives, which would dampen demand in the short term, especially as prices remain higher than ICEs. Currently there is a $7,500 consumer tax credit for electric-vehicle purchases.

- Several automakers are delaying near-term EV investment plans. However, improved battery costs (a drop of almost 50% from 2023), increased competition are expected to drive faster growth in the latter half of the decade.

- EV prices are projected to reach parity with ICE vehicles after 2026, though they still remain significantly higher in the near future.

- While the current EV charging infrastructure remains insufficient, its eventual improvement and government commitment for investments will catalyze accelerated adoption later in the decade. In the United States, the government has announced nearly USD 50 million to subsidise projects that aim to expand access to convenient charging, in line with its objective of building a national network of 500 000 public EV charging ports by 2030.

Europe

I am expecting an average growth rate of ~0.8% per year in vehicle sales for the 2024-2030 period.

- Economic growth in the EU is expected to be weaker compared to other regions at 1.53% per year on average

- Population growth is expected to be flat, with the working-age population declining

- Productivity levels are significantly lower than in the U.S., which will constrain both economic growth and income levels.

- Although car ownership rates and urbanization (72%) rates are lower than in the U.S., the region’s better public transportation infrastructure and use reduce the demand for private vehicles

- Potential retaliatory tariffs and new tariffs on Chinese cars are likely to drive up or maintain vehicle prices higher, further suppressing demand.

- Other factors such as lower affordability, ride-sharing, and high rates are also present in Europe which will also limit demand to some extent.

EV growth in Europe is projected to achieve significant progress, with market share reaching approximately 60% by 2030. However, this remains well below the region’s ambitious targets, as adoption growth is likely to slow in the near term before accelerating again later in the decade.

- Higher EV and battery costs will constrain some of the anticipated demand for EVs. While battery costs and hence EVs are expected to decline, China continues to dominate supply chains which makes it more challenging

- Strict CO2 emissions regulations in the EU will sustain momentum for EV adoption and investment in the sector. However, a potential relaxation of CO2 emissions standards could slow EV demand further.

- Charging infrastructure remains underdeveloped but is expected to see accelerated investment in the coming years. The EU Alternative Fuels Infrastructure Regulation (AFIR) requires member states to ensure publicly accessible charging stations offer in aggregate at least 1.3 kW of power output per BEV and 0.8 kW per PHEV.

- EVs in Europe also remain significantly more expensive than internal combustion engine vehicles in Europe (25% more expensive), with price parity unlikely until 2026/2027.

- New tariffs on Chinese vehicles will further limit the availability of cheaper options.

- Lack of innovation and investment until now in the industry, and the postponement of new investment, combined with protectionism against other OEMs, will also slow adoption

China

I am expecting an average growth rate of ~3.5% per year in vehicle sales for the 2024-2030 period.

- Despite undergoing deleveraging and an economic slowdown, China is expected to maintain positive real GDP growth, averaging approximately 4% annually.

- Ongoing real estate challenges, coupled with significant household wealth tied to the sector, high savings rates (above 30%) and cautious consumer sentiment (all time low) is likely to reduce demand for expensive vehicles while driving increased interest in affordable EVs.

- Although China is experiencing negative population growth, lower urbanization (66%) and car ownership rates (23%) will continue to support automotive market growth in the coming years, albeit at a slower pace now compared to the rapid expansion seen during the 2010s.

China is expected to maintain its leadership in EV adoption, reaching a market share of 87% by 2030. However, growth is likely to slow later in the decade as market share approaches saturation.

- EV subsidies in China are expected to continue, further supporting demand.

- Price parity between EVs and ICE vehicles has already been achieved, some models are even cheaper, bolstering consumer adoption.

- China’s EV charging infrastructure is significantly more advanced compared to other regions, providing a strong foundation for continued adoption

- The country dominates much of the EV supply chain, ensuring a competitive advantage in production and affordability.

- Chinese consumers show stronger preferences for EVs compared to those in other regions, driving higher adoption rates. AlixPartners’s survey concluded some 97% of 1,000 China-based respondents said their next vehicle purchase is likely to be an EV, compared to 35% in the US and 43% in Europe.