Q3 2024 New Car Pricing Update

As of Q3 2024, I continue to expect further downward pressure on new car prices. While I don’t expect a huge drop, I thin we could see a gradual decline in the range of 4-8% in the next two years.

This will probably be different by region and will work on differentiation when I work more in depth on the model.

Automakers are increasingly focusing on strategies like improving their sales mix and introducing new models to combat price pressures. Although these initiatives may provide some relief, I am not convinced they will be sufficient to prevent further price declines.

These are my arguments for my expectations currently:

- Unlike the used car market, the supply of new vehicles is increasing and is expected to continue growing or at least remain at current levels. However, this trend will vary across different brands, making effective supply management an important focus for automakers.

- Consumer auto affordability and financing conditions have yet to improve significantly, which will continue to soften demand and limit sales growth in the near term.

- Additionally, the negative equity a significant portion of customers have in their vehicle (owing more on their car loans than the vehicle is worth) will constrain their ability to trade in for some, posing another headwind to demand.

- Consumers are shifting toward more affordable vehicles, and this shift in the sales mix will likely also reduce the average transaction price across the industry.

- Combination of supply increasing, days’ supply (inventory levels) rising, dealerships continuing to face higher holding costs due to elevated interest rates on floorplan financing, and soft consumer demand. All of this will likely lead to an uptick in incentives. Currently, incentives are still about 7% in the US, below the pre-pandemic level of 10%, so it would not be surprising to see them return to 10% over the coming years. This will also put downward pressure on net vehicle pricing.

- Competition in the EV segment is only beginning to intensify in my opinion, and it will likely exert continued pressure on prices, particularly in China, a historically critical market for automakers.

The main risks to my expectations are:

- A much sharper-than-expected economic downturn could impair consumers’ ability to purchase new cars even more than currently.

- Geopolitical issues significantly impacting supply chains again.

- Tax tariffs are more significant than expected, alleviating the Chinese competition even more in the US and Europe

Q3 2024 Developments

US Developments

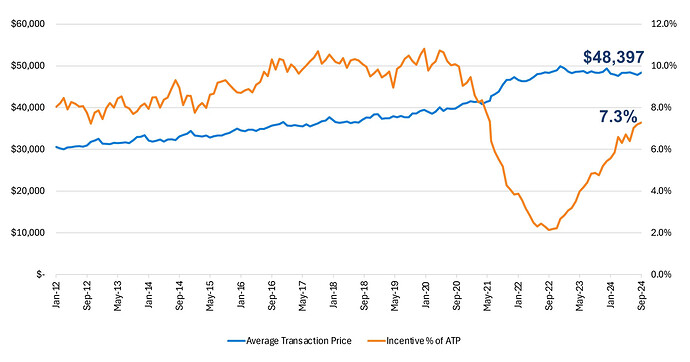

- Average transaction price of new car in September 2024 was 48,397, is basically flat for the quarter, and only lower year over year by 0.4.

- Incentives continue to rise to 7.3% of ATP, however, remain below pre-pandemic levels of 10-11%

- In September, new vehicle prices remained nearly unchanged from January’s $48,369, increasing by less than $30.

- EV prices in September were down 0.9% year-over-year, with an average of $56,351—about 16% higher than the overall market average.

- Smaller, more affordable vehicles are gaining market share in 2024, helping to hold down average transaction prices across the industry.