Labor Report February 2025: Soft but mostly in line payrolls and unemployment numbers

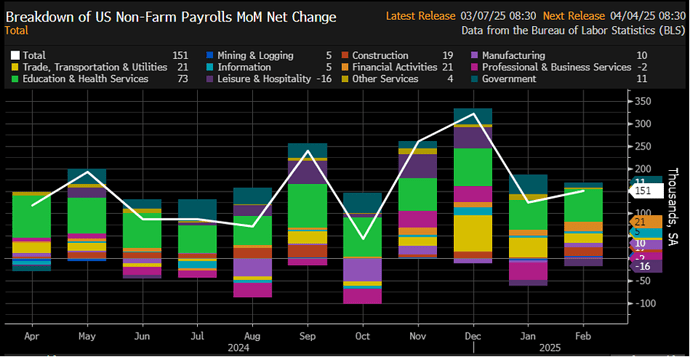

- US Labor Feb Nonfarm Payrolls +151K vs Consensus +160K

- US Feb Unemployment Rate 4.1% vs Consensus 4%

- US Feb Average Hourly Earnings +0.28% (as expected), or +$0.1 to $35.93, year over year at +4.02%.

- US Feb Private Sector Payrolls +140K and Government Payrolls +11K

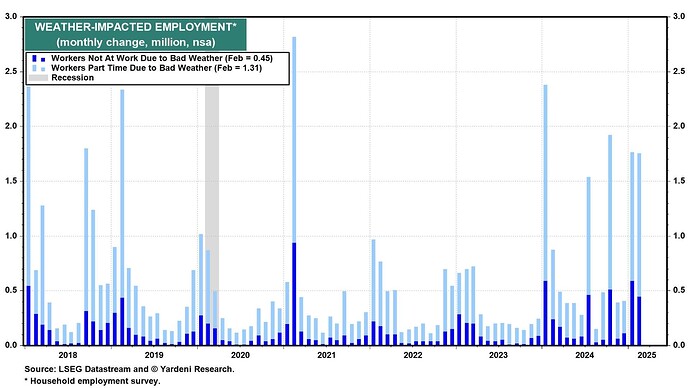

- US Feb Average Workweek Unchanged at 34.1 Hours (expected to increase due to January bad weather)

- The aggregate payrolls index ( total # of jobs * hourly earnings * workweek, a measure of wage income) rose by 0.4% m/m and 4.6% y/y

- US Jan Payrolls Revised to +125K; Dec Revised to +323K

Assessment: A soft or slowing employment report, but still decebt with no sign yet of any imminent recession as some feared. However, there are some concerns in the underlying data that could send some warning signals for the next months:

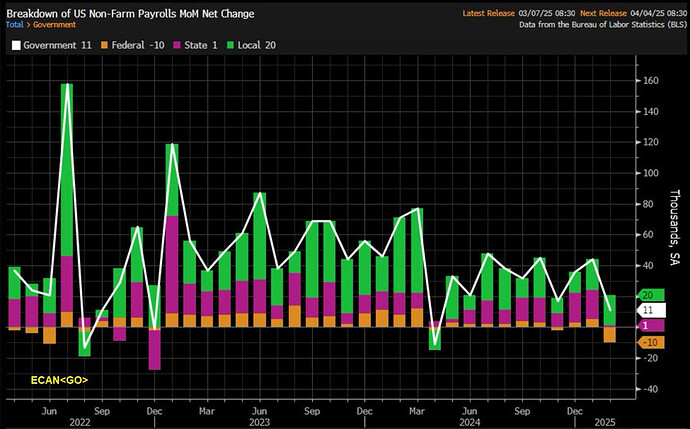

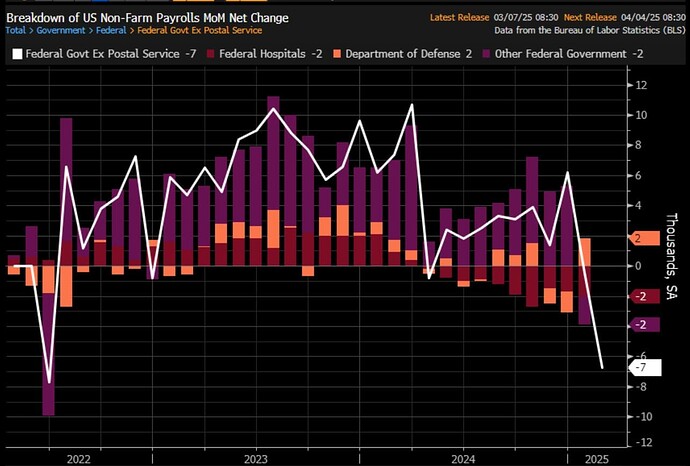

- Doge job cuts are starting to appear modestly in the data, but the biggest impact is expected to come in the coming months.Beyond outright layoffs, a key concern is that government-driven job creation, one of the economy’s primary employment engines in recently, could slow, further dampening labor market momentum.

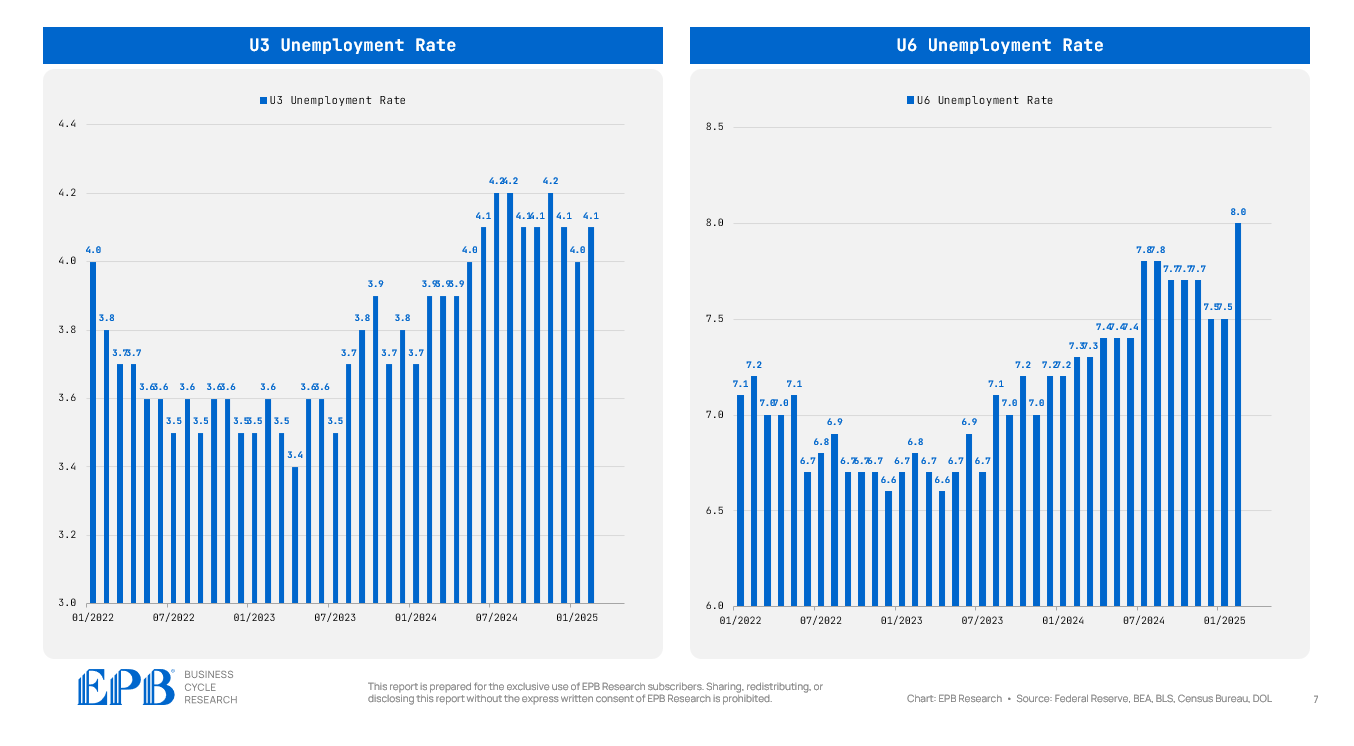

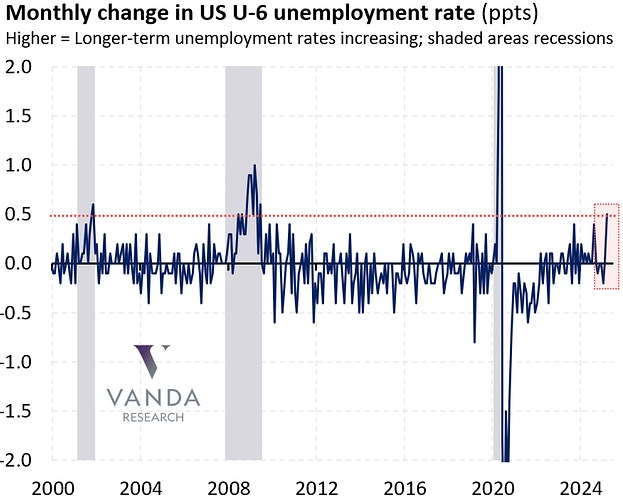

- The underemployment rate climbed 0.5 percentage points in February to 8%, the highest level since October 2021. Such an increase is unusual and may signal that slack is building in the labor market, and upcoming challenges for the broader unemployment rate could come.

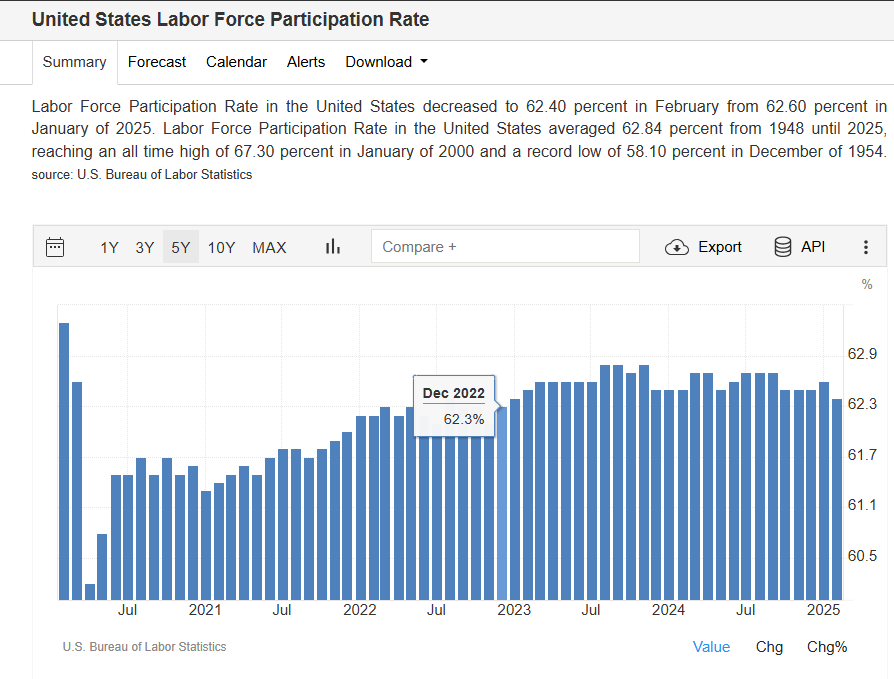

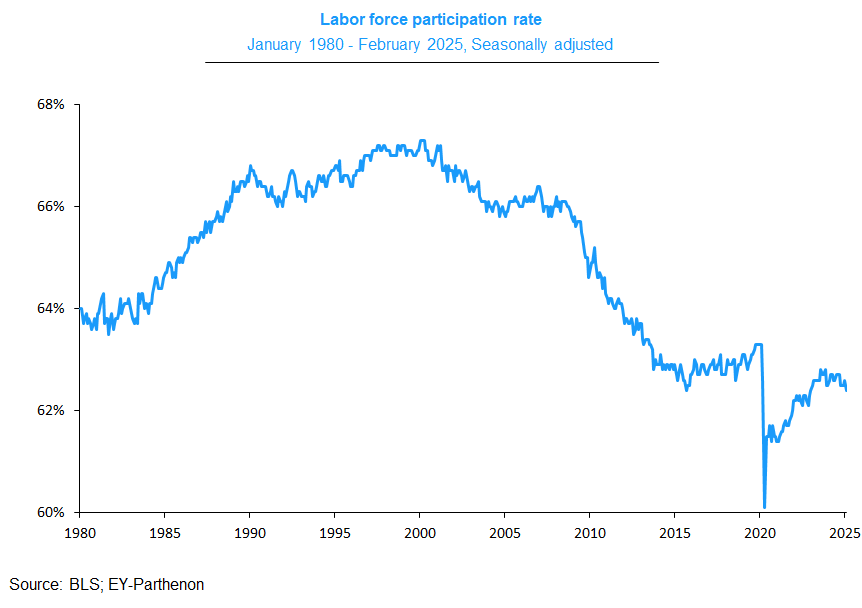

- The participation rate has fallen to its lowest level since Dec 2022. A shrinking workforce reduces economic growth. Immigration policies may continue to play a key role in shaping these trends, potentially further constraining labor supply

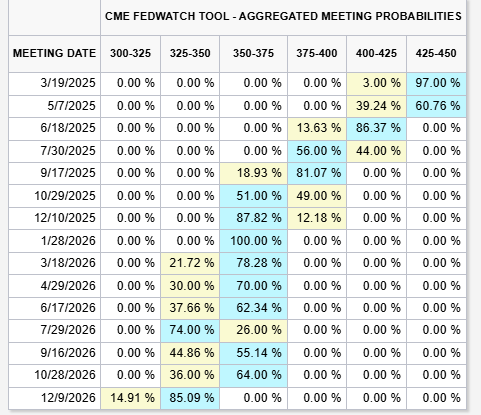

The market pricing now has about 3 rate cuts in 2025, from only 1 at the beginning of the year. The fact there are also risks to inflation, IMO will not allow the FED to cut in aggressively, as I think they would otherwise.

More in-depth details and charts:

-

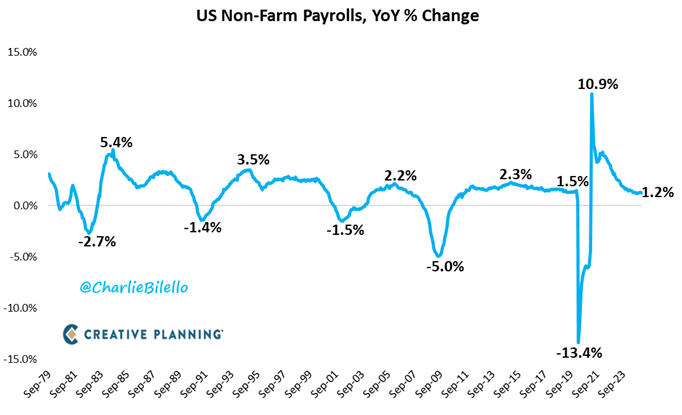

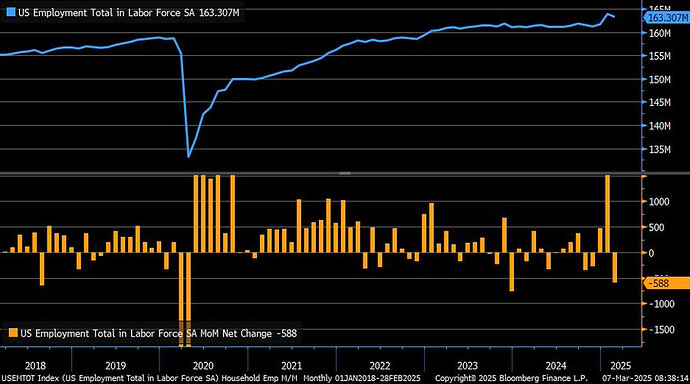

Total jobs in the US increased 1.2% over the last year, the slowest growth rate since March 2021. Household employment fell by 588k in February, the largest drop since December 2023

-

The unemployment rate ticked up modestly to 4.1% in February, but the underemployment rate (which includes persons marginally attached to the labor force and part-time workers for economic reasons) rose to 8%, up 0.5% from January., and the highest since 2021.

-

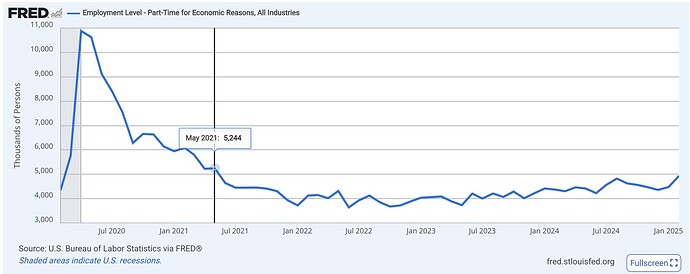

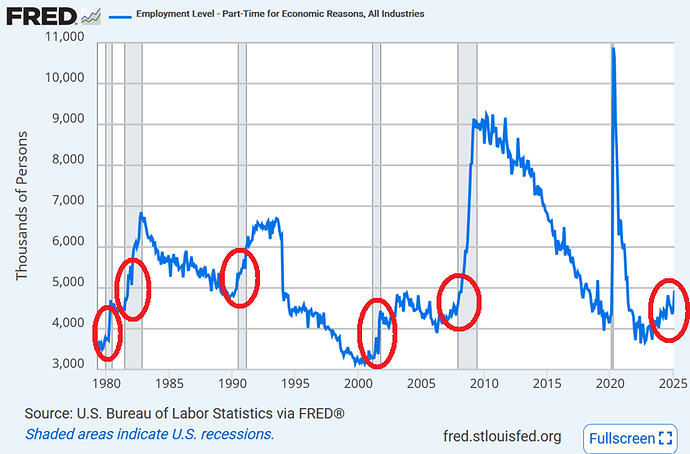

Pople working part-time for “economic reasons” (meaning they could not find a full-time job) jumped by +460,000 to 4.9 million. It’s currently at the highest level since May 2021.

-

Labor Force Participation Rate dropped -0.2 ppts to 62.4%, its worst mark since Dec 2022

-

Weather may have been a drag in Jan/Feb with an average of 520k workers not at work due to bad weather

-

Education and Health Services continue to drive job gains. Leisure and Hospitality has now lost jobs in back to back months.

- Federal government employment fell by 10K, but this was more than offset by a 20K rise in local government employment and a 1K increase in state government jobs.