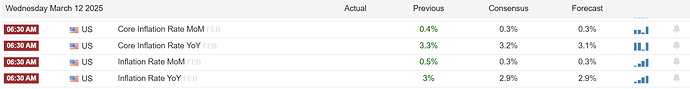

CPI Expectations for February 2025

Progress for February CPI is still minimal and is expected to continue to be stuck in the same range since early 2024.

Tomorrow’s report will also be crucial for the markets due to all the uncertainty with tariffs and the economy, so the impact on the FED path could be important because of the fears currently of a stagflationary type of environment in the coming months.

Due to this, I think that even a slight miss on the numbers will not be taken positively by the markets and will continue to fuel the market sell-off, contrary to this any improvements beyond expectations will most likely create at least a temporary rally tomorrow

The fear is also that the front running of tariffs on goods could start to be evident on CPI, because goods have been a good source of disinflation.

Potential Market Reaction:

These are just guesstimates; the underlying context and details sometimes can be more important than the headline number.

- If numbers >0.4% m/m → negative market reaction ( over -1%)

- In line → positive to flat market reaction

- If <0.3% → positive market reactions (over +1)

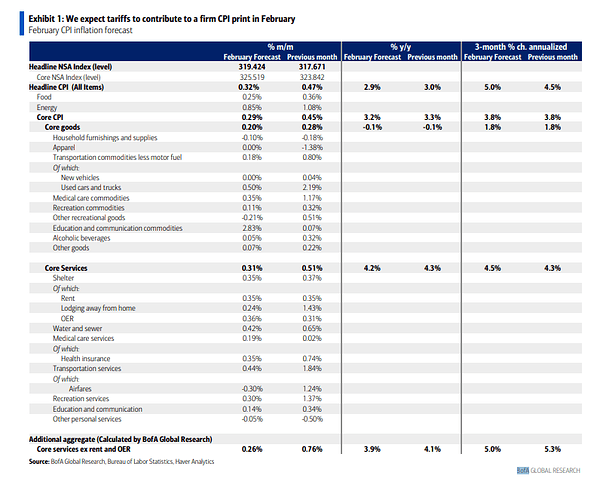

Bank of America more detailed expectations by Item, showing particularly moderation on core services:

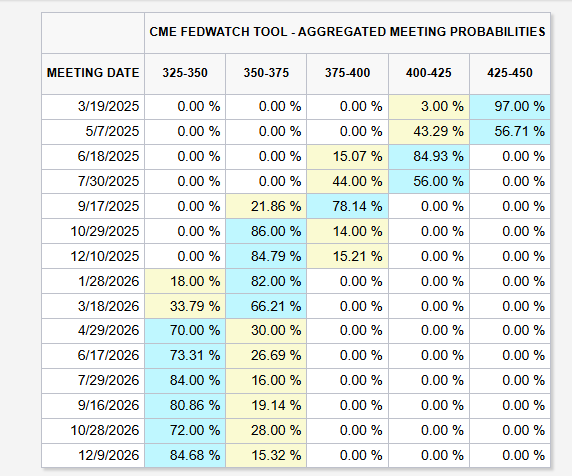

The market has already increased its rate cut expectations to 3 before February CPI, that’s why any slight miss could create a significant market reaction

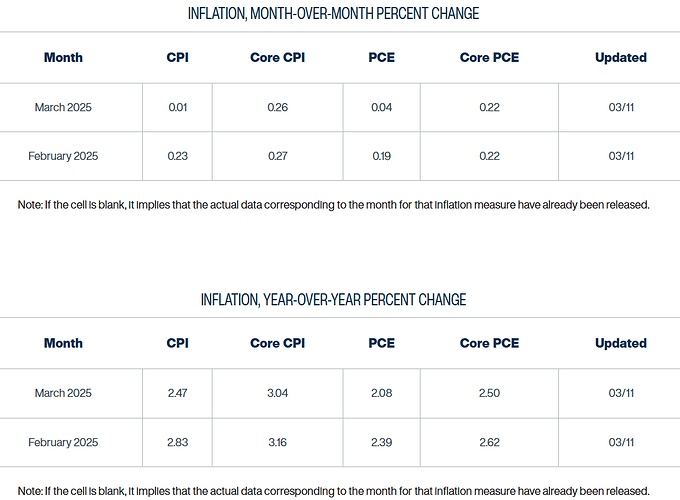

Some Developments during the month:

- Wages gains continue to be relatively high annually but had relief during the month (0.28% m/m vs 0.5% in the previous month, 402% y/y)

- Home prices growing about 3.9% currently (~3.8%in previous month). Rent prices have been slightly increasing recently, but still -0.4%

- Food prices increased 1.6% n/n, and remained elevated at 8.2% y/y

- Oil prices declined -5.6% m/m, and are negative -7% y/y.

- Used car prices declined in February, and only 0.1% y/y.

- New Car Prices declined by -1.3% m/m, and are only up by 1% y/y.