This topic discusses the development of the US fiscal deficits. It will include monthly developments, forecasts, and assessments from us or analysts.

Main Article: US Fiscal Deficit - InvestmentWiki

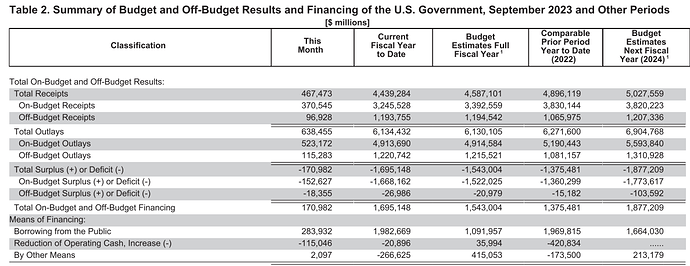

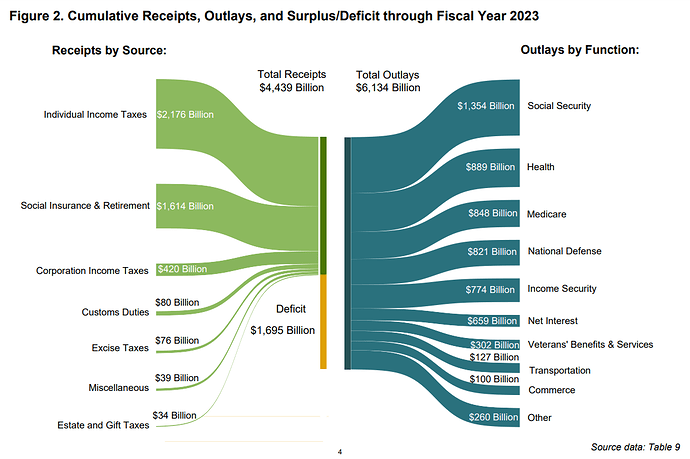

The US ended FY 2023 with a 1.695 Trillion deficit, a 23.24% y/y, or 320 B.

This represents approx. 6.2% of GDP. More worrisome is that for FY2024 a 1.87 T deficit is already expected.

While outlays or spending did decline by about 137 billion, tax receipts more than offset that with a 457 billion decline.

https://www.fiscal.treasury.gov/files/reports-statements/mts/mts0923.pdf

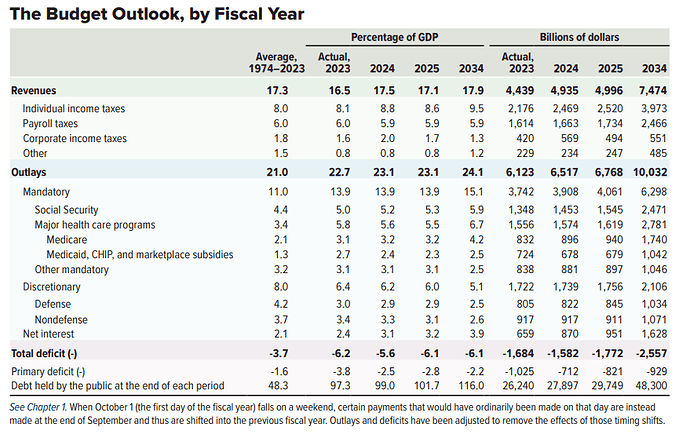

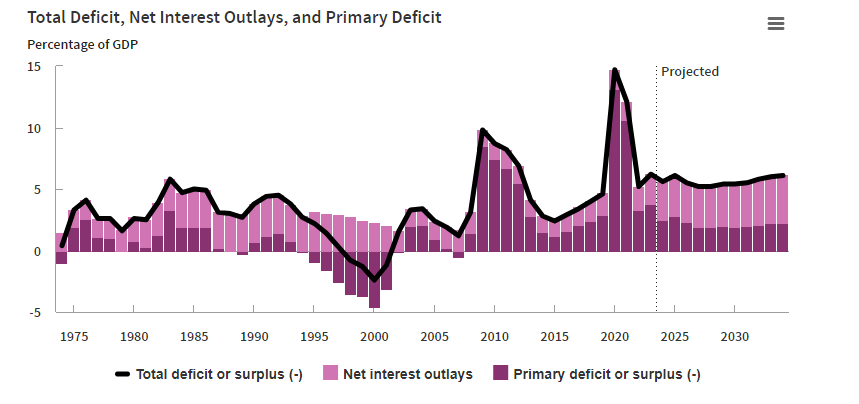

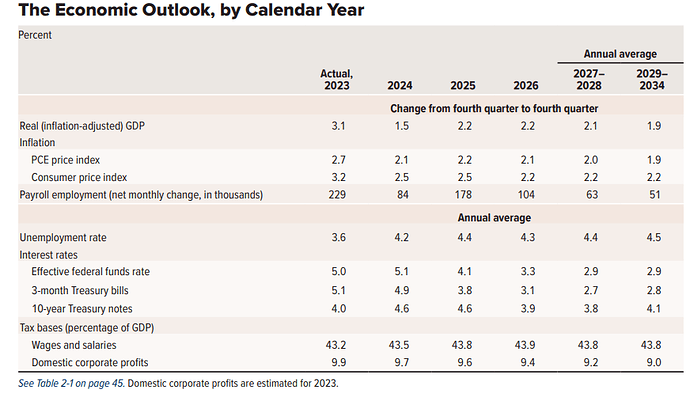

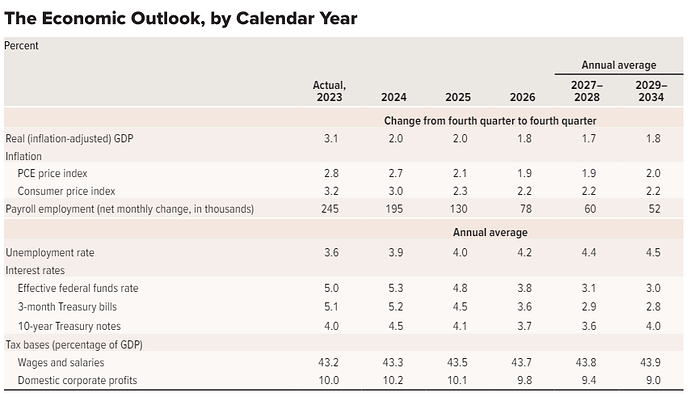

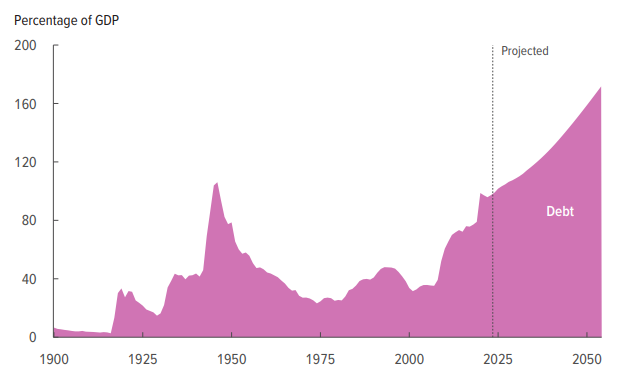

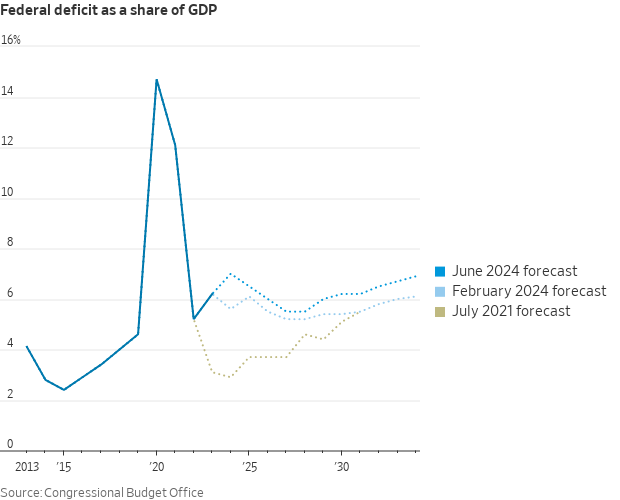

New projections by CBO show that high deficits against GDP will become the norm going forward. This instead of getting better, I think will look worse each year. There is no desire in US Congress to change this.

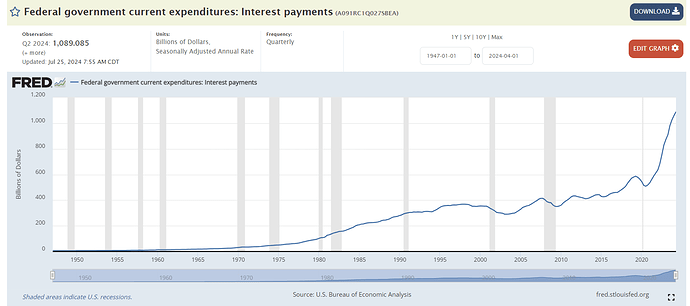

Interest payments will reach almost 4% of GDP by 2034.

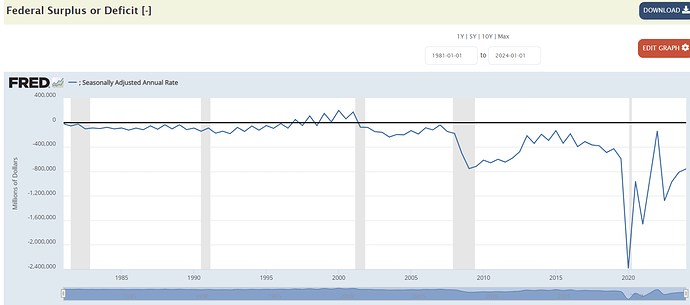

Deficits this high were not common before outside of recessions.

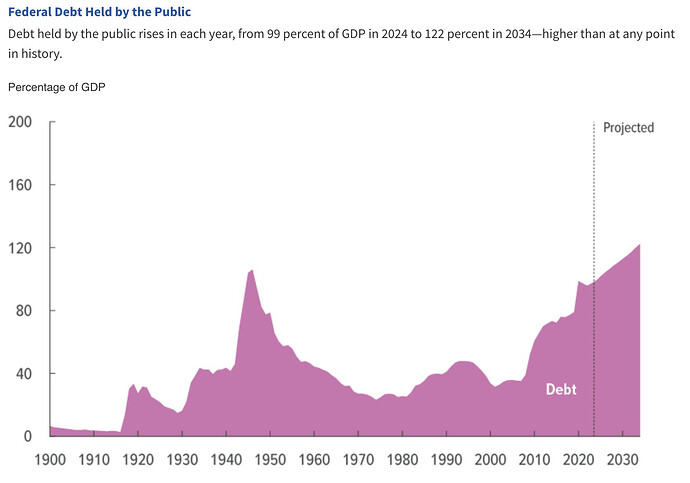

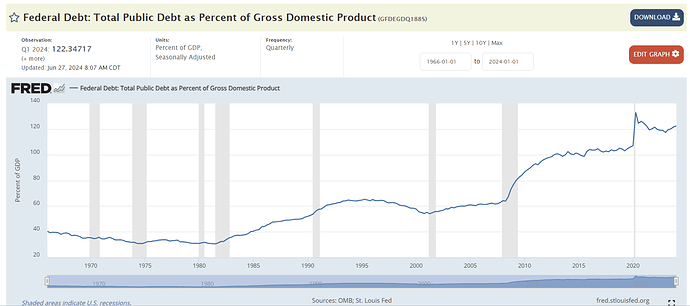

Federal debt held by the public increases each year in CBO’s projections, swelling to an all-time record of 116 percent of GDP in 2034. In the two decades that follow, growing deficits cause debt to soar to 172 percent of GDP by 2054

They are not projecting any recession during this period. So 1 can imagine how deficits could look like now inside a recession.

Their projections are usually not accurate too, in 2023 there were forecasting a deficit of -1,394T, and it ended up being -1,684.

CBO June 2024 Projection Update

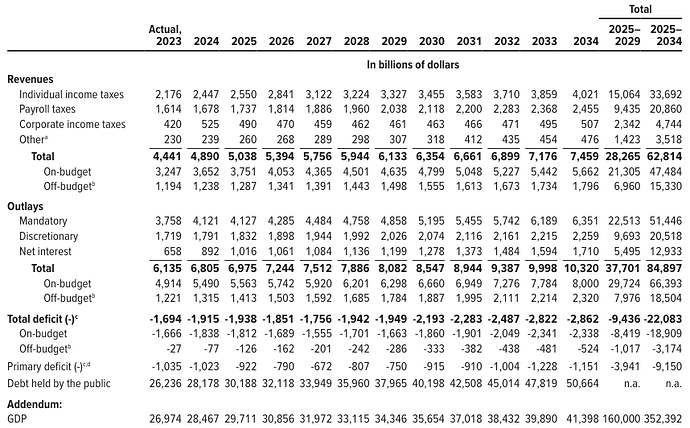

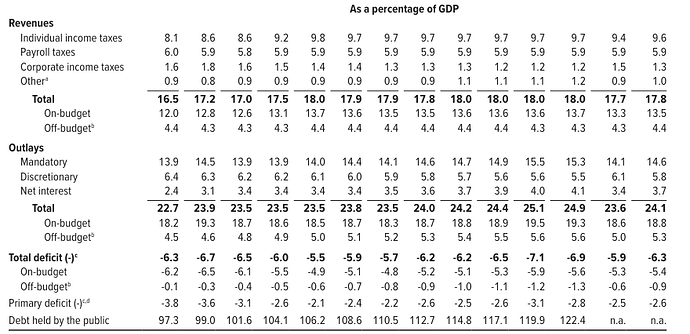

Now projects a federal deficit of $1.9 trillion in fiscal year 2024 , that amount is $0.4 trillion (or 27 percent) larger than the agency estimated in its previous baseline projections, published in February 2024.

The cumulative deficit over the 2025‒2034 period is now projected to total $22.1 trillion, which is $2.1 trillion (or 10 percent) more than previously projected.

Debt swells from 2024 to 2034 as increases in interest costs and mandatory spending outpace decreases in discretionary spending and growth in revenues.

In my opinion, their economic assumptions are optimistic. Therefore, it might be safer to assume that the debt and deficit are more likely to turn out worse than expected rather than better.

Instead of improving, each update is projecting larger deficits. Personally, I have serious doubts that there will be any move towards austerity. They are implementing depression-level fiscal stimulus in an inflationary economy with low unemployment.

1H 2024 Fiscal Deficit ended at 758 Billion vs 971 Billion in 1H 2023 (-21% Y/Y)

At this rate the year would end 2024 with a deficit of 1.516 Trillion dollars, which would mean ~5.4% of GDP, down from 6.2% in 2023 (1.783 T Deficit).

The lower fiscal deficit is due completely to higher tax receipts

- Federal Outlays finished the 1H2024 at 3.40 Trillion vs 3.35 Trillion in 1H2023, 1.5% Y/Y (6.30 T in all 2023)

- Federal Tax receipts ended 1H 2024 at 2.64 Trillion vs 2.37 Trillion in 1H2023, 11% Y/Y (4.52 T in all 2023)

Total government debt currently stands at 35.23 Trillion, which is 123% of GDP.

This is up almost 9% Y/Y from Q2 2023, or 3 Trillion.

Interest Payments are just a bit over 1 Trillion, 3.8% of GDP, and ~20% of tax revenue.

This is up 19.7% Y/Y from Q2 2023.

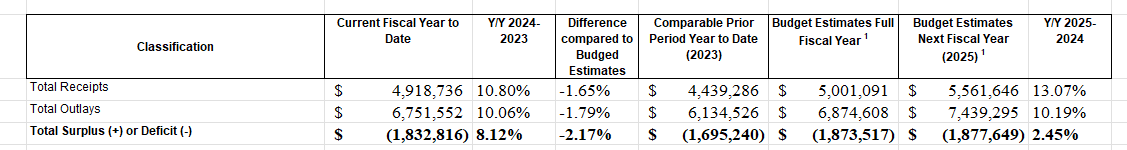

FY 2024 Fiscal Deficit ended at $1.83 Trillion, an 8.12% increase compared to FY2023

- Fiscal deficits represented ~6.4% of GDP in FY2024 from ~6.2% in FY2023

- Receipts increased by 10.8% and outlays by 10.06%

- Fiscal deficits are estimated to be 1.87 T in FY2025, a 2.45% increase

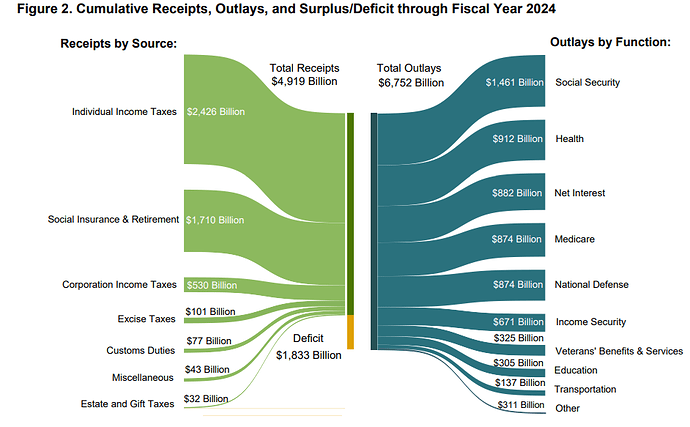

Net interest represented 13.06% of outlays in FY2024 from 10.7% in FY2023

Net Interest is not the third-biggest expenditure category (6th in 2023). Social programs combined (which are mandatory spending) continued to be the biggest category.

https://www.fiscal.treasury.gov/files/reports-statements/mts/mts0924.pdf