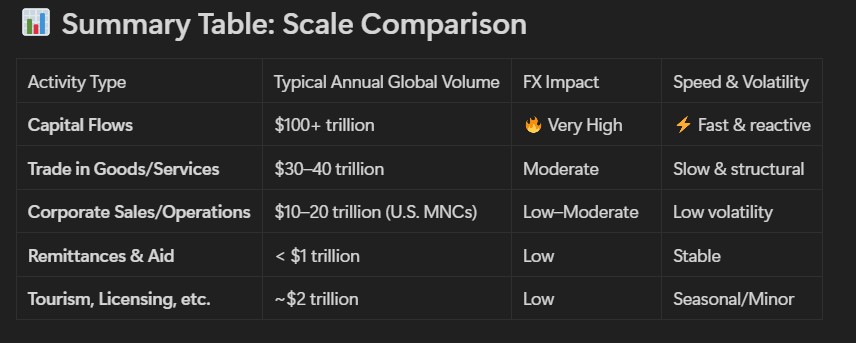

Currently, I think the short and medium term is probably most likely about capital flows, asset allocations, and risk perceptions of each economy.

Trade and business activity movements are probably smoother and with a longer-term impact, unless we are already in a full-blown recession or crisis, which is currently not the case.

I explores this with GPT, this was also his summary:

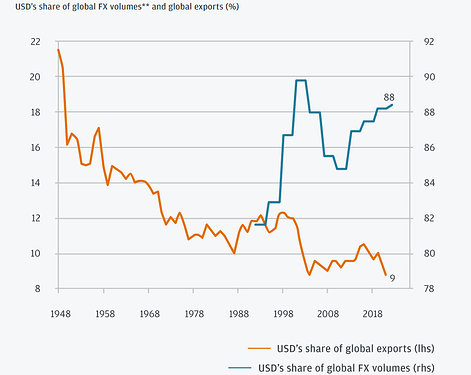

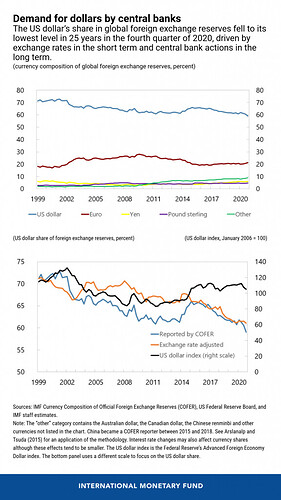

On top of this, dollar exchange rates are influenced not only by these cyclical and market-specific factors, but also by the U.S. dollar’s role as a global reserve currency and its significant share in most world transactions. This structural demand has kept the dollar [overvalued for extended periods (GPT).

So even if there are shifts in risk perceptions for the US, if there is ever a global USD liquidity shortage or USD needs increase, the dollar will still get strong in these events.

I agree that FX swaps are mostly neutral, unless there is a USD global liquidity crisis (GPT), which doesn’t seem to be the case currently. So, most of the movements are probably spot and forward contracts currently.

From my research, I found is true that the current foreign US exposure is very large ($62 trillion assets), and it has grown significantly in the past 5 years. Everyone was indeed betting on “US exceptionalism”.

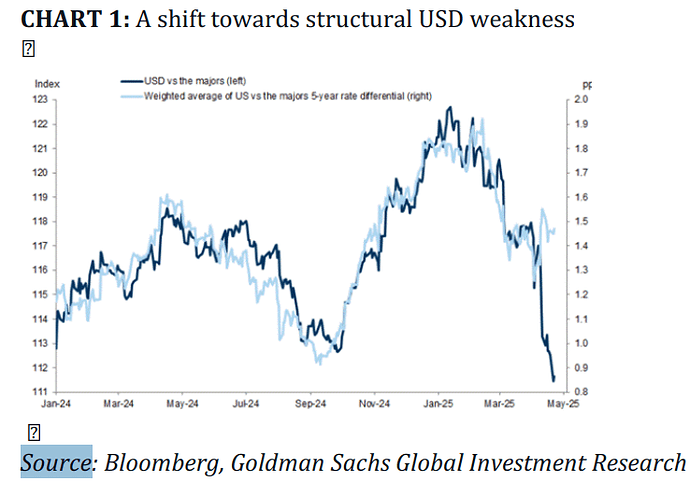

I also found they also have been seeling in 2025, the most in years, which for me it makes sense, if you have significant exposure to US assets, and you have had significant gains in the past few years, is natural for me that investors take profits and diversify away a bit from the US when significant headwinds start to appear.

So for me, we need to focus on the short and medium term on:

- Risks and rate differentials: growth outlook, rates outlook, inflation outlook, fiscal policies outlook of each economy, since this will change asset allocations based on risk perceptions

- Global dollar liquidity, since during times of stress, the dollar instead gets very strong because there is a shortage for all the global USD needs.

(btw I am just responding you question here, but I will create a more detailed assessment of what I think could be happening. As you said, this is a very complex market, and will take me time to really get a good understanding of it)