I had asked GPT before to explain FX swaps, It is basically a contract between two parties to exchange currencies today and reverse the exchange at a specified future date at a pre-agreed rate. It is more about borrowing USD (using EUR as collateral for example), so allows institutions to borrow or lend dollars without moving on-balance-sheet debt.

And since this is mostly related to getting funding and getting dollar liquidity, this market has been central to major USD global shortage financial crisis (deepresearch from GPT). In times of stress, this is the USD global market the primarily breaks due to its short term maturity nature (2008, 2012, 2020), and the one that needs monitoring because it can cause fire sales of assets.

Use cases, there is no data how much is used for each, but since the primary counterparty are banks and financial institutions, it seems it is mostly used for funding needs to get us assets and hedging exposure.

Now, there is no data available to establish how much hedge or unhedged there is necessarily, but BIS surveys have data on the size of each FX market and the counterparties.

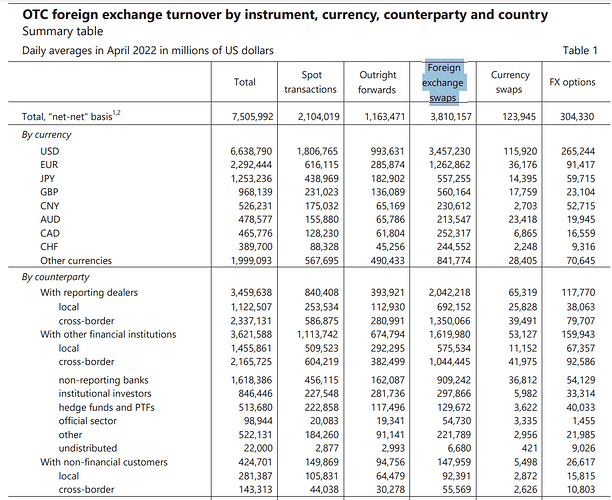

According to the 2022 BIS Triennial Survey, the average daily turnover in the global foreign exchange market was approximately $7.5 trillion. The breakdown is as follows:

- FX Swaps: $3.8 trillion (51%)

- Spot Transactions: $2.1 trillion (28%)

- Outright Forwards: $1.1 trillion (15%)

- FX Options and Currency Swaps: $0.4 trillion (5%)

About counterparty, it seems banks dominate the FX swap markets and FX market overall, and the corporations are only a small proportion of the total. It seems to me that most use cases go beyond business activity, and the majority of FX market flows are related to other acivites.

And for this kind of deal settlements you put as example, probably outright forwards are mostly used.