Summary 2025 US Outlook from Analyst

Macroeconomic Themes

The prevailing consensus for this year points to a U.S. economy expected to continue outperforming most of the developed world. However, many analysts acknowledge that potential policy shifts under Trump, retaliatory measures, or other geopolitical tensions could significantly alter the outlook, introducing a higher degree of uncertainty compared to previous years.

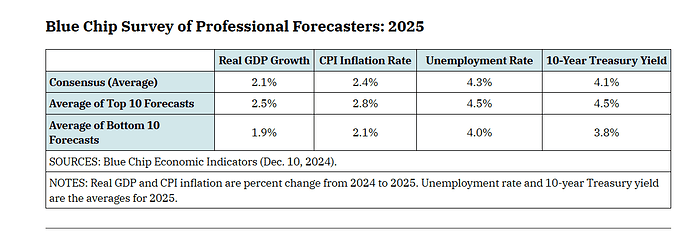

These are some of the expectations:

- Most reports suggest the U.S. economy is on track for a soft landing, with growth moderating slightly but recession risks considered very low. For 2025 real GDP growth, the highest forecasted value is 2.7% and the lowest is 1.5%.

- The consensus view anticipates inflation will continue to ease, though potential shifts in tariffs, immigration and tax cuts policies introduce significant uncertainty.

- The labor market is expected to weaken only slightly, providing ongoing support for consumer income and spending.

- Housing market activity is likely to stay subdued, as mortgage rates remain higher, near 7% currently.

- U.S. and global trade flows face potential disruptions from new tariff measures.

- Business investment is projected to remain robust, particularly in sectors such as artificial intelligence, energy infrastructure, and power.

- Governments are expected to sustain investments in green initiatives and reshoring efforts. But spending could slowdown due to efficiency initiatives.

- Deficits are expected to balloon, driven by tax cuts, escalating debt servicing costs, and limited scope for spending reductions in mandatory programs like Social Security and Medicare.

- Currently, only 2 rate cuts are expected in 2025.

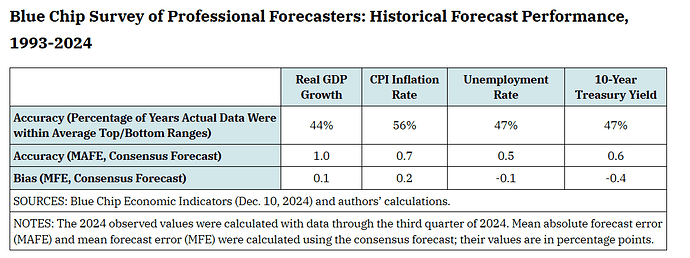

However, as the St. Loius FED shows, actual values of real GDP growth, unemployment, and interest rates were within this range of forecasts less than half the time.

- The MAFE for the real GDP growth forecast is 1 percentage point, indicating the actual 2025 growth will likely fall within 1.1% to 3.1% if the consensus is incorrect.

- For most indicators, the MFE is near zero, indicating little to no forecast bias toward either overshooting or undershooting.

SP500 Targets

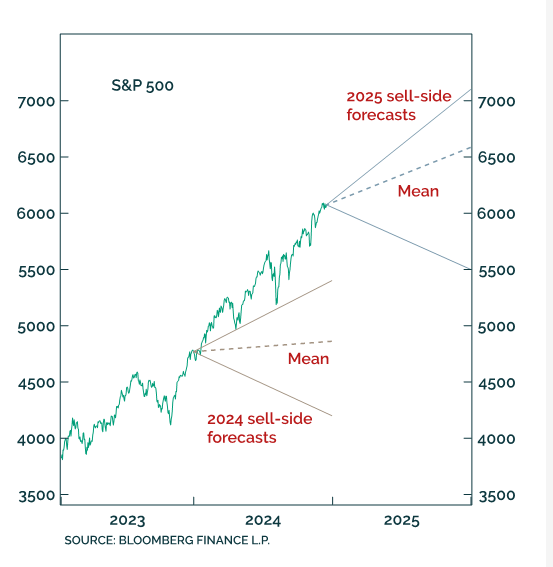

SP500 returns to be more moderate than 2024, however, most targets are above the end of 2024 price levels

- Earnings growth is expected at ~12% currently, with growth expected to be more broad among sectors. Earnings growth for the Mag 7 is expected to decelerate to a (still solid) 20% annual pace while accelerating for the rest of the market

- Some think a 10-15% correction is probably long overdue, especially with the uncertainties around policies and rates currently, 2025 expected to be much more volatile than 2024

Same as with economic forecasts, the accuracy for the stock market targets is usually very low.

Investment Opportunities

One of the most common themes found is the recommendation from analysts that investors should broaden their exposure beyond the few tech names, and build a portfolio that could be resilience in most scenarios due to the high uncertainty surrounding the outlook this year

There are the most common recommendations/opportunities from them:

- Higher starting yields currently and a potential for a continuation in the easing cycle may encourage investors to extend duration from cash into fixed-income sectors like securitized markets, corporate credit, and municipal bonds.

- AI, energy, and security spending may boost sectors such as data center real estate, engineering, nuclear and renewable power, energy transmission, gas-powered electricity, cooling tech, and electrical components.

- M&A and private markets (private credit/equity) are most likely to accelerate in 2025 as financing conditions have improved, though default risks remain.

- With US equities possibly overvalued, global diversification could be attractive, especially in emerging markets (India, Mexico, Brazil), Europe, and Japan.

- Tax cuts and deregulation could favor small/mid-caps but investors should avoid unprofitable or highly leveraged ones.

- Value stocks remain significantly discounted compared to growth stocks, presenting opportunities for more traditional value plays.

- Gold could stay appealing as a hedge amid ongoing volatility and uncertainty

- Alternatives, such as infrastructure, real estate, and real assets, may offer the potential for higher returns and diversification benefits

Risks

2025 is shaping up to be one of the most volatile and uncertain years in a while. With factors like new fiscal policies, the FED unclear path, and ongoing geopolitical tensions, the range of possible outcomes is very ample currently, making it even more critical to stay on top of potential risks.

Some of the key risks highlighted in the reports include:

- Valuations are Elevated: SP500 Forward P/E near 24 and very low risk premium. Growth and earnings expectations are very high with limited risk priced in, leaving little room for negative surprises.

- Rising Yields: Yields are increasing despite Fed rate cuts, yields above 5% could potentially trigger a bigger market pullback.

- Low Credit Spreads: Current credit spreads are also pricing in a lot of optimism, meaning any negative economic surprise could sharply raise credit risks

- Fiscal Uncertainty: Tariffs, immigration, tax cuts, and deregulation Trump proposals have created a lot of policy uncertainty with no clear direction yet, the possible range of outcomes for the economy is very ample.

- Fed Volatility: The Fed’s extreme data dependence is adding to market uncertainty, causing potential big market swings from policy shifts.

- Tech Valuation Risks: High valuations and market concentration in AI-driven mega caps pose risks if their ROI fails to materialize.

- Sticky Inflation: While cooler, inflation could persist due to tariffs, geopolitical tensions, immigration policies, fiscal deficits, and supply chain restoring, the uncertainty is currently increasing.

- Debt Refinancing Risks: Corporate debt continue to face refinancing risks from elevated rates despite still low default rates, especially since maturities accelarates this year.

- Protectionism Threats: Tariffs and growing protectionism risk slowing global trade and global economic growth.

- Oil Price Risks: Vulnerable to geopolitical tensions (Middle East, Russia-Ukraine), oil prices remain critical for inflation control.

- Fiscal Sustainability Concerns: Record deficits during full employment and high debt levels increase the vulnerability of the economy to shocks and also decrease the appetite for US treasuries.

- Strong Dollar Impact: A stronger USD could weigh on earnings, liquidity, and global growth.

Notes and sources: Notion – The all-in-one workspace for your notes, tasks, wikis, and databases.