This topic focuses on the US 2024 presidential election and the election of the House and one-third of the Senate that takes place at the same time.

I=9

Attempted assassination of Donald Trump

@Magaly @moritz this could have a negative impact on the market?

Trump injured after shots fired at rally, ex-president will be ‘fine,’ campaign says

Though similar events have had short-lived impact on the market.

My take is that the failed assassination attempt is increasing the chances of Trump winning even further after Biden had a series of weak appearances including the famous and disastrous first debate and refuses to end his campaign despite growing and public calls from within his own party.

If I had to guess, I would say the chances of Trump winning might be as high as 80-90% by now.

The market should favor a Trump presidency as Biden is pushing to raise taxes while Republicans want to keep the Tax cuts introduced under the last term of Trump.

If Trump wins and extends his tax cuts the part on individuals tax alone which would have expired in 2025 make a $4 trillion difference over the next 10 years according to new estimates of the CBO.

In addition Trump a trump presidency should also be good for crypto markets as he changed his stance to endorse crypto and could even lead to a Trump induced rally.

I also think we need to have a close eye on any major consequences for Meta in a Trump presidency.

I agree Trump chances of winning only increased with this failed attempt, but Trump’s policies are expected to be inflationary at the same time, which ultimately could mean higher rate levels

These are some of the most relevant policies that could end up in higher inflation:

- Higher tariffs: Trump has proposed a 10% across-the-board tariff on imports and a 60% or higher tariff on imports from China. Deutsche Bank estimates a universal tariff of the sort Trump has outlined would increase overall prices by 1% to 2%.

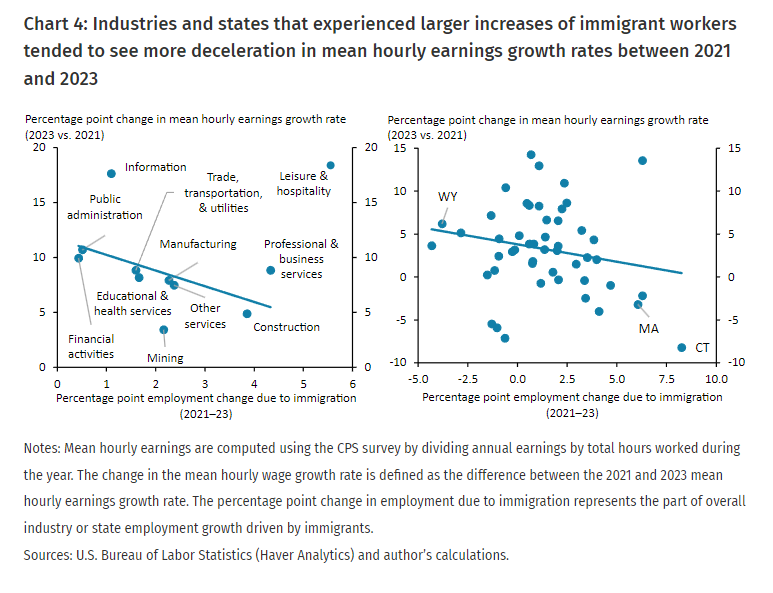

- Fighting immigration: He has also promised the largest deportation of unauthorized immigrants in history, which might reduce the supply of labor in some industries. Immigration has been a key factor even mentioned by the FED in alleviating shortages and helping with inflation.

- Tax cuts: extending them will increase fiscal deficits, on a time when deficits are already very large for a still-growing economy.

The Journal’s survey, conducted July 5-9, received responses from 68 professional forecasters from business, Wall Street and academia. Of the 50 who answered questions about Trump and Biden, 56% said inflation would be higher under another Trump term than a Biden term, versus 16% who said the opposite. The remainder saw no material difference.

Hmm those are interesting points. I would have expected inflation effects from tarrifs to be worse though. To have one single year in which inflation is higher by 1-2% or to have those 1-2% be stretched out over multiple years appears quite manageable to me.

Of course certain products would be effected more and others less and individual companies could be effected but on an economy scale its not a major change.

How was the Deutsche Bank study conducted? Did it take into account that if those tarifs are “successful” in the sense that there are no massive retaliations from other countries and domestic production and employment increases the labor shortage problem would worsen and lead to rising wages and therefore more inflation from that vector as well.

The Deutsche Bank study does not seem to be available for free, it has been quoted on news only. So, the assumptions are not clear.

Assuming Trump’s universal, 10% baseline tariff represents a “top up” of existing rates for those imports currently below that level, the bank’s economists expect a 120 basis point increase in headline personal consumption expenditure, or PCE, and a 140 basis point uptick in core PCE prices, they wrote. If the average tariff rate on Chinese imports were to jump from 12% to 50%, they added, that would raise headline and core PCE prices by some 20 to 30 basis points.

I saw some days ago a presentation by Goldman Sachs, and they estimated a similar price level increase increased of ~1.1%.

These are their assumptions:

- US imposes a 10% tariff on all imports, and other countries retaliate by raising tariffs by 10% too.

- Additional tariff revenue is recycled into tax cuts, so is fiscally neutral.

- Trade policy uncertainty rises to the levels seen at the peak in the 2018-2019 trade war.

A 1%-2% increase in the price level seems manageable under normal circumstances, but in the current environment, even a slight rise in inflation could be viewed negatively. This could potentially put pressure on the Federal Reserve to take action.

We also do not know the potential indirect effects as you mentioned in the labor market.

At the same time, I think immigration policies could have a more significant impact than tariffs. Although I haven’t found studies estimating this impact.

Employment has expanded largely due to foreign workers rather than nationals. Any disruptions to labor supply could lead to wage increases in sectors more dependent on immigration, eventually causing inflation.

- According to the Kansas Fed, wage growth slowed by roughly 0.7 percentage points for every 1.0 percentage point increase in an industry’s immigrant employment growth.

In the end, its the combined impact of these three policies, and not isolated. They have the potential to increase output and labor demand while simultaneously disrupting its supply. Changes in labor market dynamics could be the most significant factor imo.

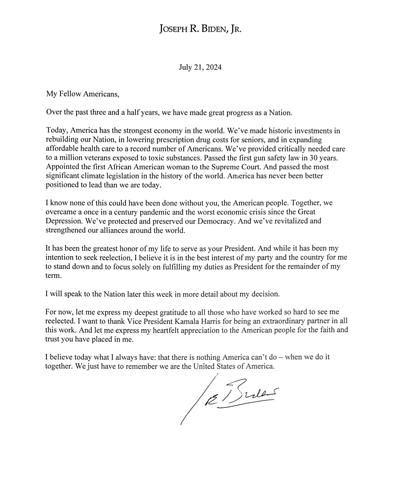

Biden campaign withdrawal imminent?

Very interesting reporting about what it is going on at the inner circles of Biden.

If the report is correct a Biden campaign withdrawal is imminent. Donors are apparently pushing for a nomination procedure instead of nominating Kamala Harris as the fixed choice.

He just officially withdraw for reelection, seems he is endorsing Kamala

I think volatility around this election will be interesting and will continue

https://x.com/JoeBiden/status/1815080881981190320?t=gJ88XRSQaOBZUpx892FpRw&s=19

https://x.com/JoeBiden/status/1815087772216303933?t=sfnwu9YCwITJeWw3cAywVQ&s=19

I am not sure if I agree. I think the withdrawal of Biden increases the chances of democrats but I believe that Trump continues to be in a solid lead and chances of democrats winning is still quite low as of now (Maybe 20-30% max)

Yes, I don’t disagree with you in that.

I was just meaning that it will continue to be a relevant topic from now on, meaning than since last week the importance seems to have escalated.

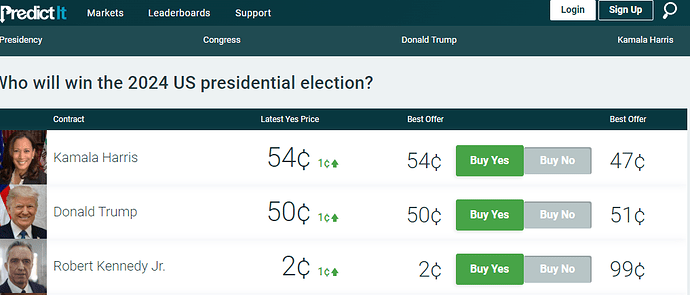

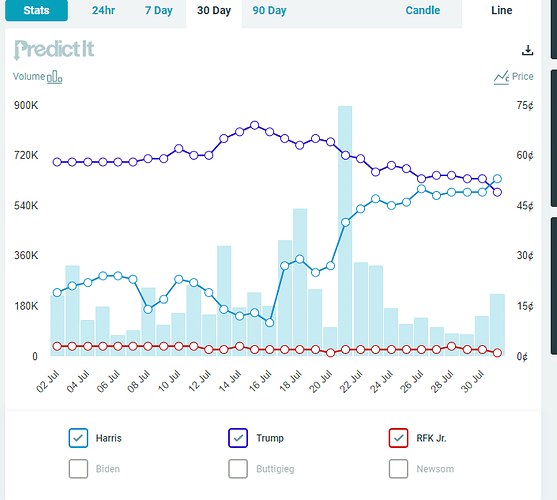

Apparently, Kamala Harris’s perceived chances of winning have been increasing according to the predicting market.

PredictIt is a New Zealand based online prediction market that offers exchanges on political and financial events.

Is the one I have seen being more referenced by analysts on X or News

https://www.predictit.org/markets/detail/7456/Who-will-win-the-2024-US-presidential-election

Yes heard this as well. I still believe that a Trump is more likely (60%+) but Harris had a good start with a smooth transition, funding etc.

I think prediction markets are quite interesting as an indicator what people currently believe but also saw them fail often in the past (e.g. on topics like Brexit which have been thought of being unlikely at the time)

Therefore we should consider them but always keep in mind that the people who are betting could be quite wrong as well.

Yes, I agree, I also read that they are sometimes wrong, that’s why I put that this is only the perceived chance of winning as of now.

However, I also read Kamala Harris is starting to lead in polls too (I don’t know how trustworthy they are). And also that some of the market reaction since last week (probably a minor effect) could have been the unwinding of a Trump presidency.

So, I think Trump chances are not as high anymore as of now or are way more balanced, but this could change a lot over these months.

Based on what I have read as well, polls are starting to turn against Trump. But I agree with Moritz that these polls could be wrong. Look at the 2016 polls which projected a Clinton win.

Today, Trump returned to X.

I’ve listen to most parts of the associated Trump Elon Musk interview on X in which Elon Musk strongly endorsed Trump.

Topics included

- the assassination attempt

- illegal immigration

- government deficit spending and inflation (1h 44min)

- too much regulation

- pro energy policies

- too weak law enforcement

The interview has over 100M views as of now and 19M people turned in only 3h after its release.

Assessment

I have always admired the clarity with which Elon Musk can describe reality and highlight why certain things are obvious or common sense.

The same is true for this interview. Most points discussed are compelling and make instinctive sense in my opinion.

They are also in line with most of what I’ve heard or read without having done deeper research on all the topics. (More Trump critical topics e.g. potential threats to some institutions, are not addressed)

Given the large amount of admirers that Elon has and the fact that he has a more moderate voice, I think this interview and Trump’s return to X could have a profound impact on some moderates and the election overall.

This is the second high profile endorsement from Silicon Valley that I’ve watched after Andreessen Horowitz came out to endorse Trump.

Elon’s influence is certainly at another level, and I think there will be discussions about the power of owning the most political social media platform, and he will be described as kingmaker.

Overall, I continue to believe that a Trump victory is quite likely (60%+), which should have a positive impact on markets, esp. on crypto/defi.

Kamala Harris first economic plan details

Kamala Harris recently unveiled several economic proposals (without major details yet). Some of these, in my view, seem highly inflationary and could also exacerbate the already severe U.S. fiscal deficits.

Estimates suggest her plan could add around $1.7 trillion to the deficit over the next decade, and be offset by higher taxes on the wealthy

Is as if they did not learn that government stimulus is not the solution to inflation. And that price control was already proven to be a disaster to control inflation in the '70s

However, I have read these proposals will be difficult to implement due to the divisions in Congress, so I think at the same time both candidates are just trying to be very populist currently, but it gives an idea of what kind of policies she is going to be after.

These are some of the proposals

Housing affordability:

- Plan would allow over 4 million first-time buyers over four years to get significant down payment assistance on average of $25,000 (economist say this will just be passed onto the price)

- Creating a tax incentive to encourage builders to build starter homes

- An expansion of existing tax incentives “for builders that build rental housing that is affordable”

- Creating a $40 billion innovation fund that would “empower local governments to fund local solutions to build housing”

Price controls:

- Harris proposed the first federal ban on price gouging related to food

- Seek legislation capping all Americans’ out-of-pocket costs for prescription drugs at $2,000 annually for seniors

- Effort to limit insulin payments to $35 per month.

Middle class/ Lowe income stimulus:

- Expand the child tax credit to $3,600 from $2,000 per dependent, with a super-sized $6,000 credit for newborns.

- Harris does vow to continue the Biden policy of opposing any tax increase on Americans making under $400,000 a year.

Haris Supper PAC president says the polls are “much less rosy” after interviewing 375,000 Americans.

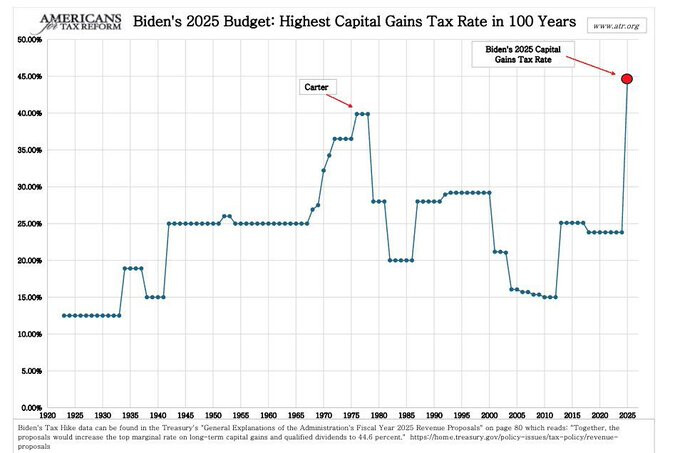

Kamala Harris supports the tax increases President Biden put forward in his recent budget proposal, according to her campaign. Between, the most prominent proposals include:

- Increasing the corporate tax rate to 28% from 21%

- Capital gains tax proposal which would raise long-term capital gains tax rates to 44.6%. This would mark the highest long term capital gains tax rate since 1922.

- A new minimum tax of 25% on the wealthiest 0.01% of Americans, particularly those with wealth exceeding $100 million. This is intended to address the lower effective tax rates that many billionaires pay on their income, which can be as low as 8% due to preferential tax treatment on capital gains.

- Raising the tax rate on U.S. multinationals’ foreign earnings from 10.5% to 21%.

- Households making over $1 million would pay a 39.6% marginal tax rate on their income, aligning the tax rate on capital gains and dividends with that on wages.

- The budget would deny corporate tax deductions for all compensation over $1 million per employee.

Is difficult for me to understand how it is that she has significant support from Wall Street with these kinds of proposals, maybe because they know passing these tax increases in Congress would be pretty difficult.

Hmm, I think Ray Dalio is right, and both sides of the political spectrum are getting more extreme.

I agree. I think only some people on Wall Street are supporting her. This could be also due to other reasons like liberal beliefs or fear of Donals Trumps impact on institutions, dislike of Trump due to divisiveness etc.

I would assume most people on Wall Street are not taking sides openly but support the business-friendly policies of Trump.

RFK JR just droped out of the presidential race in 10 key states and endorsed Trump

Probably a huge blow to the democratic party, the rest of the Kennedy family is calling this a betrayal