Main article: Freelance & Outsourcing Industry - InvestmentWiki

2020 has been an explosion for the remote work industry to which I count freelance companies like Upwork and Fiverr and technology companies like Zoom.

The technology for the whole world to work together irrespective of location had been established for a while but Corona caused mainstream adoption and accelerated technological developments as SaaS businesses sprung up everywhere and secured massive funding rounds.

Internationalization of work is powerful as developed countries are facing an aging population and a shortage of workers and developing countries have an increasingly well-educated young population but attractive local jobs are missing.

Furthermore, remote work offers possibilities and flexibilities for all digital workers like the ability to travel the world while working, which is especially appealing to Gen Z.

When we are looking at Upwork - our current investment in this nascent category - we see that the total volume of transactions flowing through the platform nearly doubled from Q1 2020 (560 million) to Q1 2022 (1001 million).

Now in Q1 2023, the tides have turned and the challenge with this increased volume (called Gross Services Volume or short GSV) is to keep it, which Upwork managed so far (1,003 million).

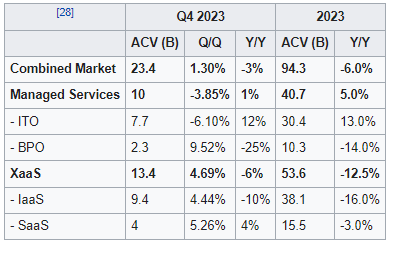

The outlook is uncertain though as central banks are slowing down the economy, job markets will slowly start to ease, people return back to the office, young and innovative businesses which use Upwork lack money and freelancers are the first to lose their jobs.

Considering this, Upwork’s CEO Hayden Brown’s recent announcement to cut costs in order to reach FY 2023 adjusted EBITDA of 36 to 40 million looks more like a defensive move that could prevent Upwork from suffering large losses than a real increase in the businesses underlying profitability.

Personally, I am fine with Upwork not hitting those profitability targets as I like the long-term prospects of the business but missing them drastically could bring Upwork closer to a dangerous loss-making situation. (Their cash situation is alright but they have to repay a large bond in 2026 and should avoid losses at all costs)

Therefore it is very important for us to develop proprietary methods to predict Upwork’s profitability which depends on the volume of work flowing through the platform (GSV).

By doing so we could significantly derisk a risky investment and gain an edge compared to the market.

Our current attempts include studying all available reports about the freelance industry and having a look at the broader outsourcing industry, studying the state of small businesses in the united states which represent 2/3 of Upwork clients and analyzing data on Upwork’s platform.

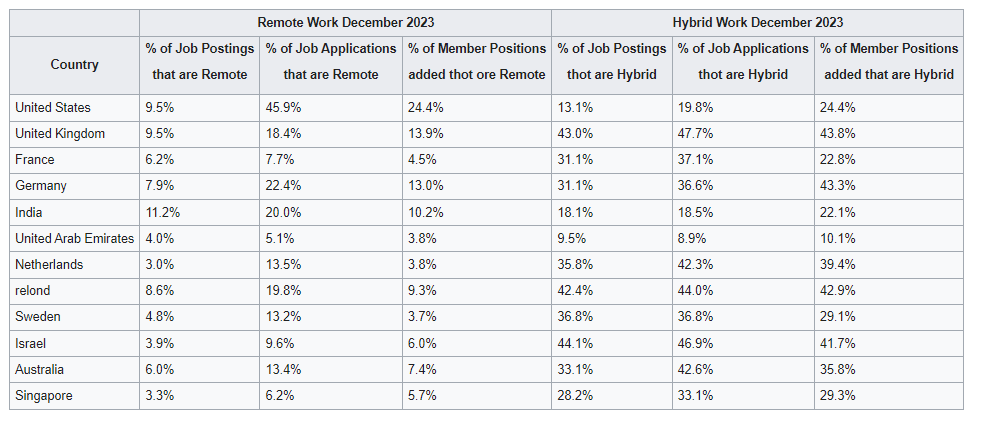

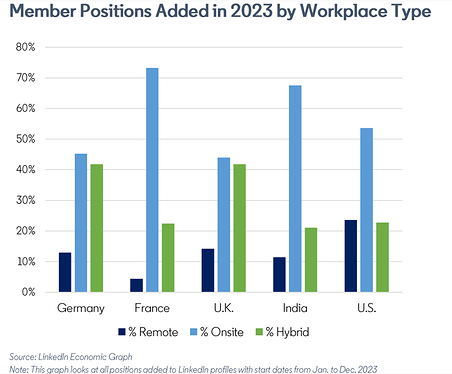

So far we found that longer-term trends towards more remote work should be given, outsourcing and cost savings do not happen during a recession, small businesses in the U.S. should be alright as of now, and data from Upwork’s platform stays stable.

That said I am still struggling with any concrete prediction of GSV. @Magaly @Aron What are your thoughts? Do I miss important points? Do you have any ideas which kind of data we have to look for in order to gain a better understanding?

(Note: For discussions about small businesses or platform insights i suggest we use the above-linked standalone topics)