Topic to discuss the small businesses developments

This is our current article on the topic, where I have included my own assessment Small Businesses - InvestmentWiki

Topic to discuss the small businesses developments

This is our current article on the topic, where I have included my own assessment Small Businesses - InvestmentWiki

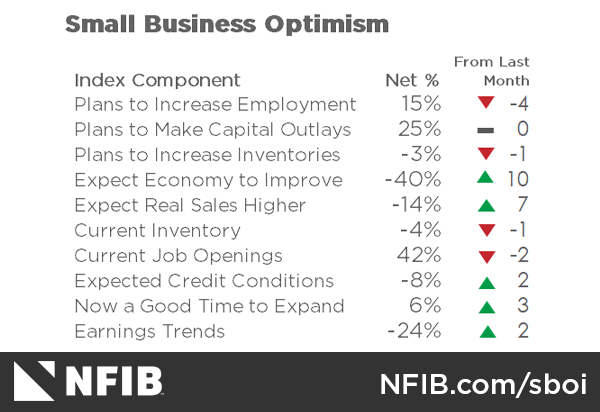

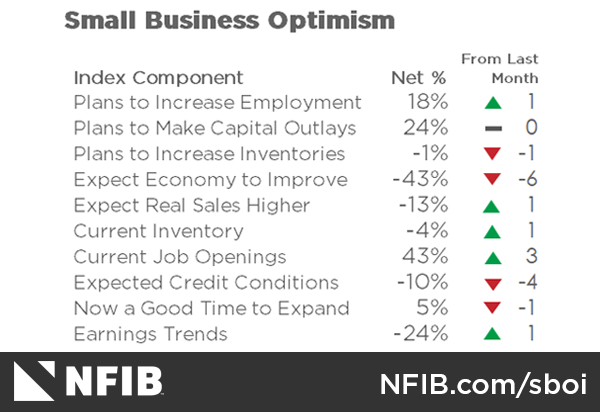

June 2023 NFIB survey:

Sentiment seems to be improving, but still at very low levels. Could be that conditions are relatively stable, and they are adjusting to the challenges because numbers dont seem particularly strong in the survey. Labor seems to be cooling a bit, but still job openings are historically high. Insights in the article.

" Small business owners remain very pessimistic about future business conditions and their sales prospects. But in some industries, such as construction, health care, transportation and some consumer services, spending and therefore labor demand remains strong. But overall, the number of firms reporting employment gains has been falling gradually. Capital spending and inventory investment are down. Overall, economic growth is falling. This will help put a damper on inflation, but at the cost of lower employment."

I think it would be good if you could summarize your assessment again here in the Forum with just a few sentences or even bullet points as it makes catching up for people easier that do not have the time or interest level to read the full assessment in the Wiki.

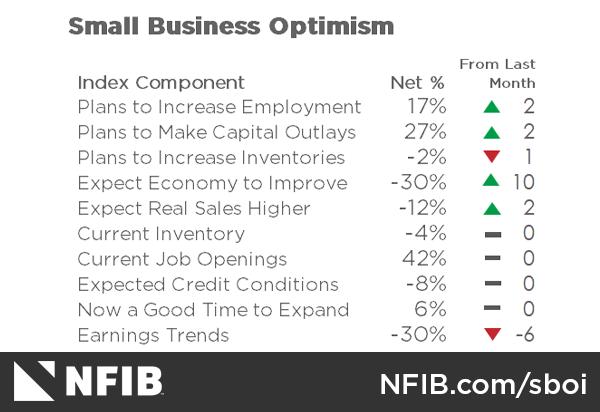

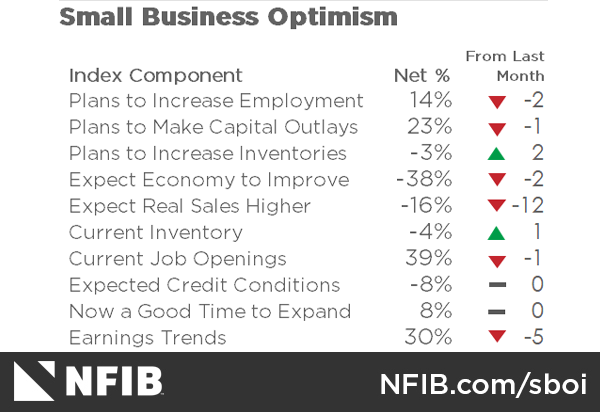

July 2023 NFIB survey:

Sentiment continues to improve. This probably influences the fact that hiring and investment plans pick up a bit during the month and the expectation of higher sales from still low levels.

Interestingly they are now expecting sales to not be so negative and better outlook, even though sales and profits decline during the month.

Seeing a similar trend in small businesses than in the PMIs and other reports, somewhat lower economic activity, a softening in labor market and investment plans, but inflation plans still rising.

The Optimism Index decreased 0.6 of a point in August to 91.3. This is the 20th consecutive month below the 49-year average of 98

Small business owners expecting better business conditions over the next six months deteriorated seven points from July to a net negative 37%, however, 24 percentage points better than last June’s reading of a net negative 61% but still at recession levels.

Small-business bankruptcy filings are rising this year, a signal that increased interest rates, tighter lending standards and higher operating costs are straining entrepreneurs. At the same time, some government aid programs that helped entrepreneurs through the Covid-19 pandemic have ended.

Context:

Congress created Subchapter V, which took effect in February 2020, because standard Chapter 11 bankruptcy filings were expensive and too restrictive for small companies, making it difficult for them to get a fresh start . Increased familiarity with the new options has contributed to an increase in filings, as has a temporary lift in the debt limit for Subchapter V filings to $7.5 million from $2.7 million, bankruptcy attorneys say.

Important to mention that this is just a small subset of the small businesses in trouble:

More than 90% of small-business closures occur outside of bankruptcy, estimates Brook Gotberg, a visiting law professor at the University of Chicago. Many small businesses don’t have enough debt to make a bankruptcy filing worthwhile, she said.

Small businesses ended the quarter with lower optimism about its conditions.

The NFIB Small Business Optimism Index decreased half of a point in September to 90.8. September’s reading marks the 21st consecutive month below the 49-year average of 98.

“Owners remain pessimistic about future business conditions, which has contributed to the low optimism they have regarding the economy,” said Bill Dunkelberg, NFIB Chief Economist . “Sales growth among small businesses have slowed and the bottom line is being squeezed, leaving owners few options beyond raising selling prices for financial relief.”

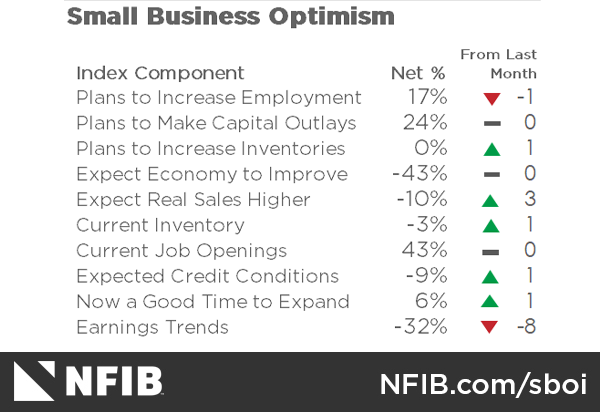

Small Businesses had a minimal decline in optimism in October, however, there was a significant decline in current earnings and sales trends. While plans to raise prices and compensation increased, and hiring plans declined a bit.

“The October data shows that small businesses are still recovering, and owners are not optimistic about better business conditions. Small business owners are not growing their inventories as labor and energy costs are not falling, making it a gloomy outlook for the remainder of the year.”

The Optimism Index decreased 0.1 points in October to 90.7. This is the 22nd consecutive month below the 50-year average of 98.

A net negative 17 percent of all owners reported higher nominal sales in the past three months, down 9 points from September and the lowest reading since July 2020.

The frequency of reports of positive profit trends was a net negative 32%, down eight points from September.

43% of all owners reported job openings they could not fill in the current period, unchanged from September. Owners’ plans to fill open positions remain elevated, with a seasonally adjusted net 17 percent planning to create new jobs in the next three months, down 1 point from September

The net percent of owners raising average selling prices increased 1 point from September to a net 30 percent seasonally adjusted. Seasonally adjusted, a net 33 percent plan price hikes (up 3 points).

My take is that sales and earnings are two of the most significant data points of the survey to understand what is currently going on because we get insights into what respondents answer to questions about their current actual numbers and not only an outlook or feeling about the future.

Do you agree with that or could there be some special circumstances which caused sales and earnings being weaker this month while outlooks and optimism kept stable? Could there be rational reasons why outlooks did not decrease or is the most likely interpretation that small businesses are simply judging the coming economic situation wrong?

No, I agree with you on this, I also think questions about their current circumstances are the most important ones from this type of survey. Based on this, I consider this a very weak report, even if optimism and outlooks are stable.

IMO most small businesses probably don’t have the resources to have very sofisticated models to be able to forecast their outlook with much accuracy, if it’s the case that they have models. Their outlook could just be based on hope, news they hear about the economy/industry, or seasonal patters they have experienced before.

So I personally, don’t pay much attention to outlook based on their sentiment. Maybe only hiring plans, investment, price plans, but this could also change a lot based on the overall economy.

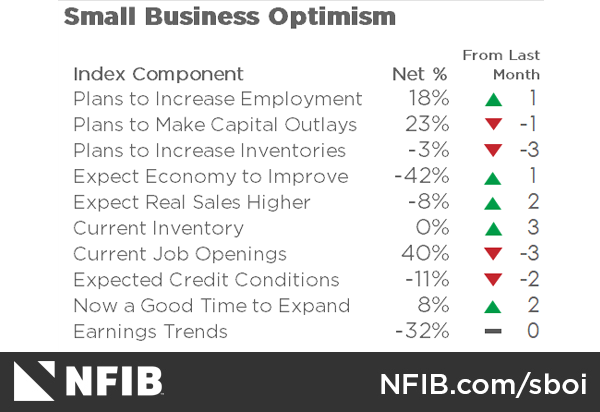

Small Business had a stable month in November from last month’s levels. Unchanged profits and sales trends, and outlook.

The Optimism Index decreased 0.1 point in November to 90.6.

The frequency of reports of positive profit trends was a net negative 32 percent, unchanged from October.

A net negative 17 percent of all owners reported higher nominal sales in the past three months, unchanged from October. The net percent of owners expecting higher real sales volumes improved 2 points to a net negative 8 percent.

43% of all owners reported job openings they could not fill in the current period, down 3 points from

October.

The net percent of owners raising average selling prices decreased 5 points from October to a net 25 percent seasonally adjusted. A net 34 percent plan price hikes (up 1 point).

Small businesses very low sentiment continues, but remains stable around the current levels. No improvement, but also no is not getting worse.

Small Business Optimism fell to 89.9 vs. 92.3 est. & 91.9 prior.

“NFIB’s Small Business Optimism Index ended 2023 where it started, at 91, leading into a 2024 economy in which economic growth is expected to deteriorate,” Dunkelberg added. “Only 10% of the respondents expect better business conditions by mid-year, 44% expect worse. Only 21% expect their real sales volumes to improve, twice as many expect declines. Six percent think it is a good time to expand their business, while 61% believe it is not.”

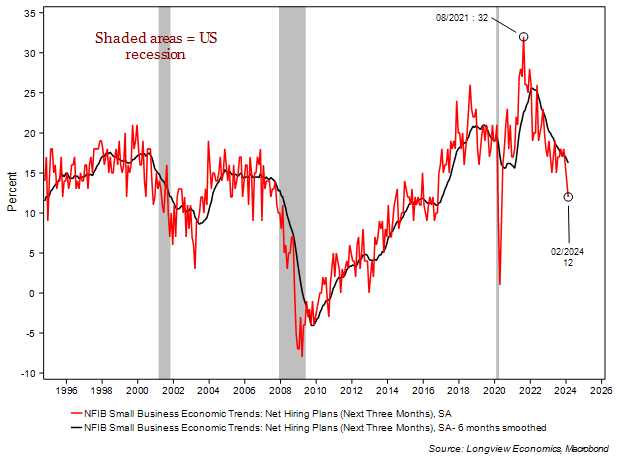

NFIB, Forbes Discuss Small Business Optimism in 2024

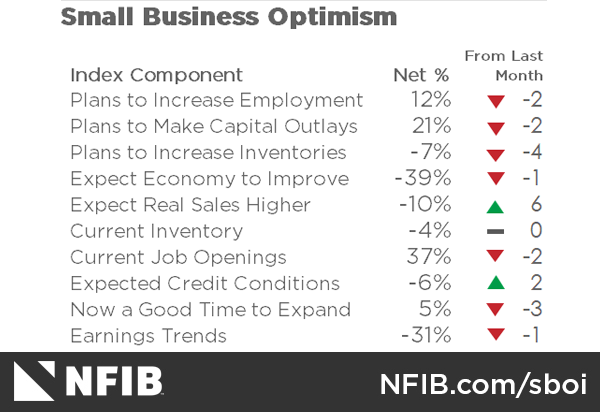

Not much improvement for small businesses in February 2024.

“While inflation pressures have eased since peaking in 2021, small business owners are still managing the elevated costs of higher prices and interest rates,” said NFIB Chief Economist Bill Dunkelberg . “The labor market has also eased slightly as small business owners are having an easier time attracting and retaining employees.”

The NFIB Small Business Optimism Index decreased in February to 89.4, from 89.9 last month and vs 90.7 expected.

Their investments and hiring plans continue to come down.

Both sales and earnings trends decline too.

Prices and compensation plans are also moderating.

https://strgnfibcom.blob.core.windows.net/nfibcom/SBET-Feb-2024.pdf

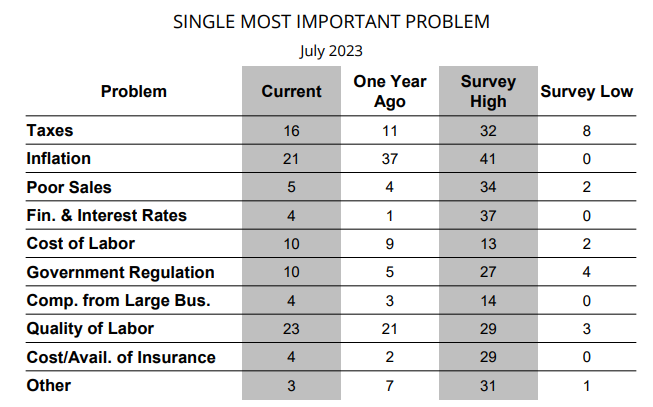

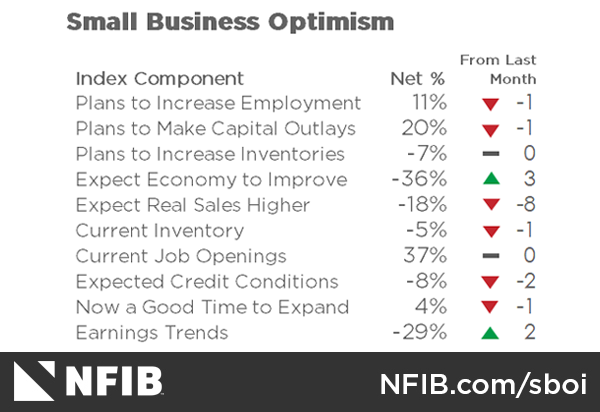

A somewhat weaker report for small business sentiment in March against expectations (88.5 vs 90.2 expected) This time is mostly due to deterioration in hard components that have become weaker.

“Small business optimism has reached the lowest level since 2012 as owners continue to manage numerous economic headwinds,” said NFIB Chief Economist Bill Dunkelberg . “Inflation has once again been reported as the top business problem on Main Street and the labor market has only eased slightly.”

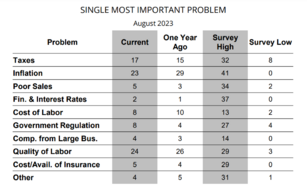

Inflation is still their biggest problem, poor sales have started to increase but still low, and labor issues are easing.

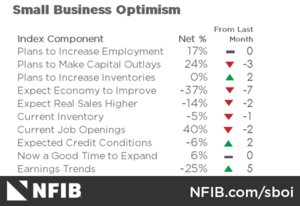

This increase appears to be politically driven following Trump’s victory, raising questions about how permanent the sentiment will be, especially since much of it is fueled by expectations components.

That said, it could still bolster positive momentum in the short term, especially if businesses start to be more optimistic about investments and hiring

“The election results signal a major shift in economic policy, leading to a surge in optimism among small business owners. Main Street also became more certain about future business conditions following the election, breaking a nearly three-year streak of record high uncertainty. Owners are particularly hopeful for tax and regulation policies that favor strong economic growth as well as relief from inflationary pressures. In addition, small business owners are eager to expand their operations.”

https://www.nfib.com/news-article/monthly_report/industry-report-july-2024/