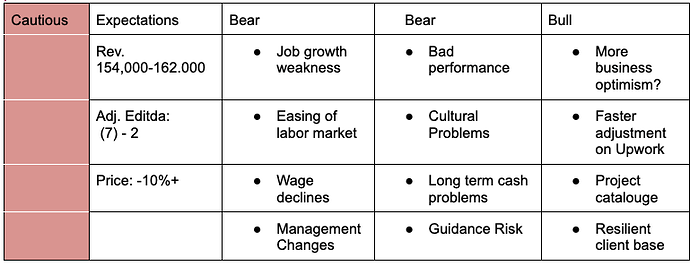

Our expectation for Q2 2023 Upwork Earnings is bearish/cautious.

GSV

We suspect there is a high likelihood that Upworks Plattform Volume called “Gross Service Value” or GSV is going to decline. It appears like this is currently not sufficiently forecasted by management.

There are important data points were are seeing currently that we consider concerning

- Jobs posted on Upwork decline slightly during the quarter, but remain mostly on a stable level

- Labor markets are also easing, with job posting in a declining trend

- We are starting to experience wage pressures to the downside in the economy, which has been experienced inside Upwork too and could persist. This trend is expected to continue, even in a soft landing scenario.

Management

- There have been several management changes recently, and the majority of key roles are new. This leads us to believe there could be some cultural problems that disincentive the long term stayed in the company

We are also unsure about the performance that a completely new team could have, especially in challenging times and we witnessed problems in multiple departments ranging from development to sales, to marketing, to financial control.

Cash

- Upwork cash is currently only 500M, if the burn rate increases at some point due to a challenging macro, we are unsure of their ability to raise debt in that environment, creating potential cash flow problems. A major 350M loan has to be repaid in 2026.

Upside Surprise

On the upside, there is a possibility that the increase in businesses optimism lately along with a reported resilient client base, and the potential for Upwork clients to have adjusted faster to the economic uncertainty due to its flexibility. They could be therefore ahead of the curve when it comes to cost cuts- This could create a scenario where GSV started to increase again in Q2 2023, beating the current expectations.

Additionally, some of Upworks’s client base might be resilient given that Freelancers are core to many Client Businesses according to Upwork.

The project catalog is making some progress.

Mindmap

We created a draft mindmap with all arguments here.

Summary

Overall we believe that this quarter’s earnings hold a significant risk of missed potential and we get increasingly cautious about the management performance of Hayden Brown after massive leadership changes and internal problems.

I am therefore reducing my position. (Already reduced 28%, considering further reductions)