Magaly’s assessment Trump April 2 tariffs Announced

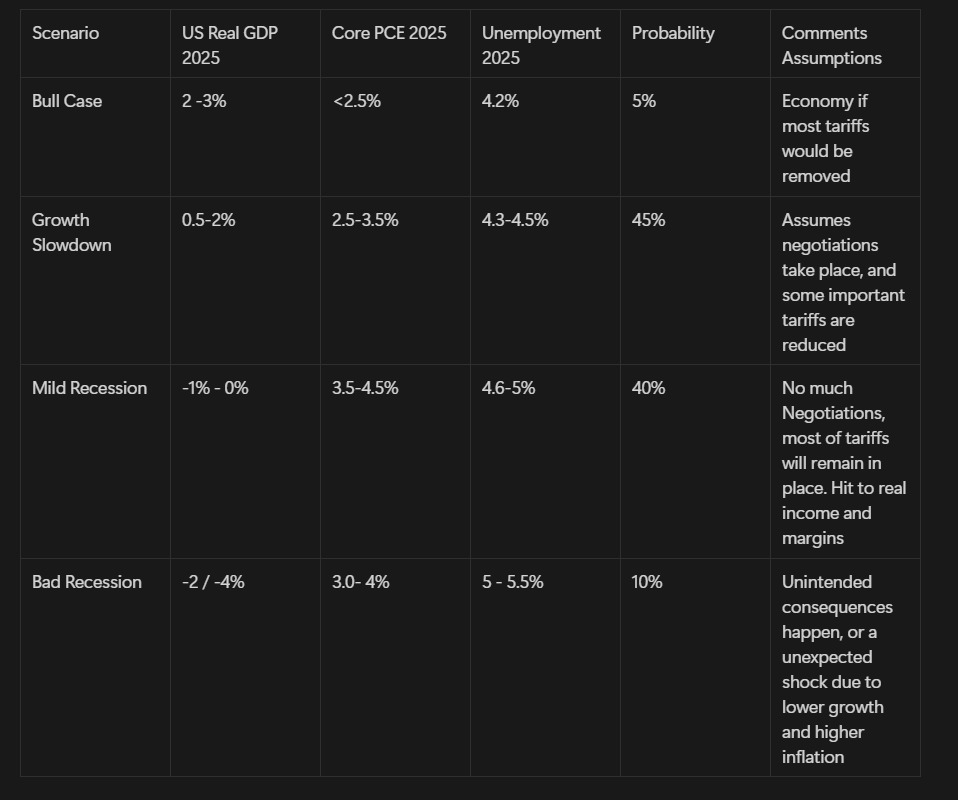

This could changed as more data and analysis start to come out

The overall outlook from analyst estimates, if tariffs remain in place, is

- The economy would fall or be very close to a mild recession

- PCE inflation would increase ~ 1 -2%, close to 4%

- Since prince increase is a one-time effect, the growth consequences would be more long-lasting

These are my current probabilities (with information as of now and uncertainty), and without taking much into account about other policies as spending cuts or less immigration.

In my opinion, these levels of tariffs increases significantly the risk of experiencing a recession in the next year, these are the arguments:

- A 20% effective rate from 4% as its being estimated on all imports (~4.1 Trillion in 2024) would be a ~$650 billion cost headwind. This is 3.2% of consumer spending, 17% of US corporate profits, and 2.2% of GDP. (my assumptions is consumer and businesses will divide the price increases hit)

- PCE inflation increasing to ~4%, would bring real disposable income close to zero or negative (disposable income currently growing at 4.4% y/y, but slowing), creating an additional headwind to consumer spending. Especially, if uncertainty continues to depress sentiment and increase the consumer saving rate.

- Hit to margins (not all costs expected to be passed to consumers) from importers (small share of total businesses), and from slower spending, but mostly uncertain outlook also expected to continue pausing or completely delaying investment spending.

- If retaliation happens, the economic consequences could be worse, since exports could also be hit with higher tariffs by partners (exports 11% of GDP)

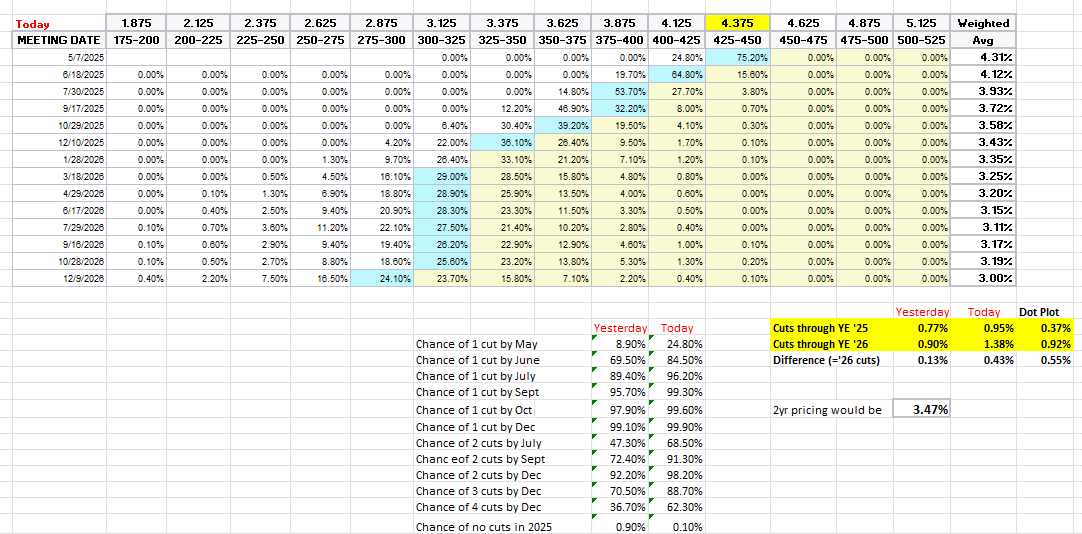

The market is now pricing a 62% probability of four cuts in 2025 (up from 37% yesterday). The cuts are priced in June, July, Oct, and Dec (95bps, up from 77)

- There’s an additional 43bps priced for 2026 (so still over 1.5 cuts), 138bps through Dec '26.

- I think the FED is in a difficult place, the market is more convinced they will focus on weak growth more than inflation (because of 1 one-time price effect only), but I think the FED could be more hesitant to cut if they see inflation increasing beyond 3% again.

- Despite today’s sell-off, the market is still only down by ~12%, IMO the market is still not currently completely pricing a recession or in panic mode (usually 20-30% sell-offs), and bigger sell-off could come if data start to get worse, or no much transaction in negotiations take place.