This topic discusses the upcoming Q4 2023 Meta Plattform earnings. It will include our final assessment and decision before the earnings release. We will also summarize the results here. You can find our earnings preparation and full summary of the results in the Wiki:

Summary of Tinuiti Digital Ads Benchmark Report Q4 2023:

- Meta ad spend rose 13% y/y (Q3 2023: +19%), impressions rose 16% y/y(Q3 2023:+46%) while CPM fell 3% y/y(Q3 2023:-19%) as advertisers run up against easier comparisons in the previous year.

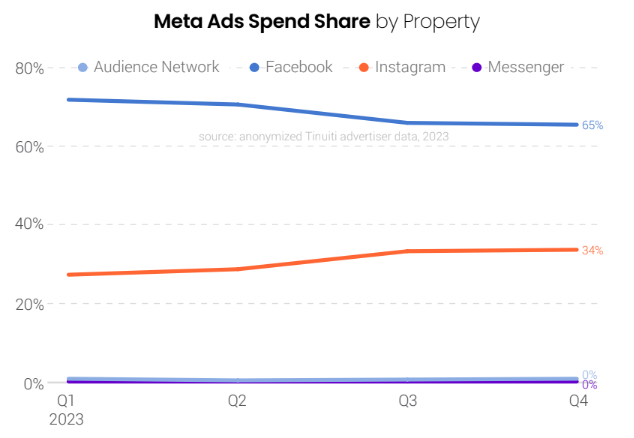

- Facebook ad spend rose 8% y/y (Q2 2023: +16%), CPM declined 5% y/y(Q2 2023: -20%) while impression slowed to 14%(Q1 2023: +46%).

- Instagram ad spend grew 27% y/y (Q3 2023: +25%), CPM rose 2% y/y (Q3 2023: -11%)-the first y/y growth since Q3 2022, impression slowed to 24% from 41% growth in Q3 2023.

- Instagram Reels impression remained steady throughout 2023, growing by 11% y/y in Q4.

- TikTok ad spend rose 64% y/y (Q3 2023:+12%)-the fastest growth since Q4 2022 (+84%), impressions grew by 44% y/y (Q3 2023: +21%) while CPM rose 14% (Q3 2023: +8%).

Assessment

It appears weaker comparison periods are coming to an end for Meta, especially on ad spending and impressions. But it’s good to see pricing recovery (supporting analysts’ opinions). What doesn’t look good is TikTok outperforming Meta in all fronts. That said, Meta’s revenue may grow by less than 15% this time round.

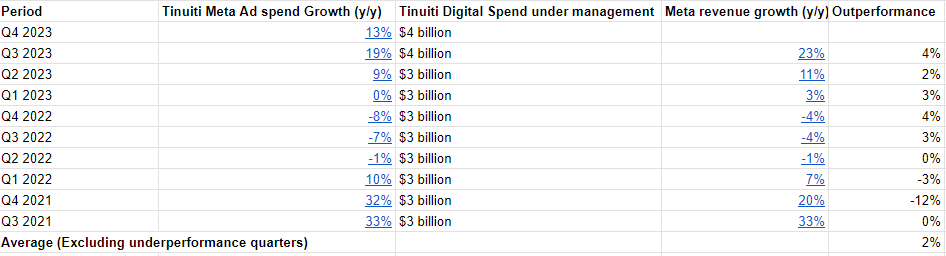

I see analysts are expecting a 21.5% growth, this means META would need to outperform the Tituiti report by 8.5% to just match it. Has this happened before, or is it always just a moderate outperformance (2-3%)?

If it’s just ~13% it would still come by the lowest point of guidance.

In the past three quarters, Meta outperformed the Tinuiti report by an average of 3.3% (Q1:3%, Q2:3% and Q3:4%).

But there is also the possibility that the report underestimated the performance of Meta last quarter because analysts are quite positive again this time round.

Maybe we should do a table comparing Tinuiti ad spend results vs Actual Revenue Growth since the beginning that they were released to see how much is possible for Meta to outperform the report results, and if they are patterns or seasonality. However since adjustments in methodology could have happened, recent quarters are the most relevant.

Because from only those past 3 recent quarters, it seems there could be an analyst revenue expectation miss if they don’t adjust it again by Wednesday.

- In the past nine quarters, Meta Platforms y/y revenue growth has outperformed Tinuiti ad spend growth by a maximum of 4%.

- Meta Platforms revenue growth underperformed Tinuity ad spend growth in only two quarters, Q4 2021 and Q1 2022. The underperformance was more pronounced in Q4 2021. The only explanation I can think of is that Tinuiti probably underestimated the impact of Apple privacy changes which came into effect in April 26, 2021. In their Q3 2021 report, Tinuiti said, “The effects of the Apple App Tracking Transparency (ATT) prompt are continuing to become

clearer.” That means they weren’t sure about its impact. - Excluding, Q4 2021 and Q1 2022, Meta has outperformed Tinuiti by an average of 2%.

- The only thing that has changed in Tinuiti Methodology is the amount of digital spend under management.

I=4

- Skai report indicates paid social ad spend grew 15% y/y while that of Meta grew 10% in Q4 2023.

- Skai points out that the current trends may not be comparable to that of prior periods.

As of this report, paid social analysis has expanded beyond Meta and Pinterest to include performance from TikTok, YouTube and LinkedIn. Growth rates may therefore not be directly

comparable to previous reports. - Skai said the analysis is based on advertiser compaigned data managed and the sample is based on $9 billion in spending over five quarters.

Assessment

- My trust level on this data is weak given that their prior analyses gave growth rates for paid social that were completely different from what were being observed. I would have expected their growth rates to track that of Meta or Pinterest given that the analyses were based on the two companies. But maybe there is another explanation for the divergence.

I compared your Tinuiti analysis with Meta’s management guidance.

If we take Tinuitis Meta ad spent growth of 13% y/y and add the maximum of 4% y/y that Meta outperformed that number in the past, we only reach 17% y/y growth. That is below management’s Mid-Point Guidance.

On the other side, almost all analysts are bullish on ad spent on Meta in Q4 2023 and see strength from esp. Chinese clients.

While this is almost impossible at the current stage, if you weigh all available information based on credibility, which conclusions would you reach for Q4 2023 revenue?

Some example questions that came to my mind that could help with weighing:

- Do we understand which regions Tinuities’ clients mainly come from? Do they have a sufficient number of Chinese clients to reflect Chinese Meta ads spent?

- Does Tinuiti track all forms of ads spent, like click-to messaging?

- Which analyst is more or less credible? How was analyst performance predicting Meta’s quarters in the past overall?

- Which additional insights or reports could clarify the current stage of ad spending on Meta? When do we get that data? How does this data change the overall picture?

Where do you see or why are you saying they mainly see strength in China?

Is China that relevant in terms of revenue contribution to have that significant impact?

It was highlighted by two analysts. See the analyst opinion section of the Meta Q4 2023 article that @Aron aggregated in the Wiki. It seems to be relevant given that it was highlighted multiple times during the last conference call.

There is probably no way to quantify advertisers origin on Meta or is there?

It appears Chinese advertisers continue to spend on Meta.

-

According to Sensor Towers [1], Temu’s digital advertising spend in U.S grew by 280% y/y in Q4 2023, making it the fifth largest digital advertiser in U.S compared to a year ago when it was the 65th biggest advertiser.

-

Similarly, Shein saw its digital ad spend rise by 120% y/y, making it the 16th largest U.S advertiser compared to a year ago when it was ranked 48th.

-

46% of Temu’s total ad spend and 44% of Shein’s ad spend went to Meta in Q4.

-

Temu and Shein were Meta’s 2nd and 4th-largest advertisers in Q4.

-

MediaRadar estimates that Temu spent $517 million in U.S advertising in Q4 2023 while Goldman Sachs projects that Temu spent $1.2 billion on Meta in 2023 [2].

Context

-

Sensor Tower is a market research firm that provides real time insights on digital advertising.

“Our data scientists and algorithms process trillions of aggregated data points from a variety of proprietary research panels, to craft our unique breed of market intelligence.”[3]

-

MediaRadar provides advertising analysis to over 4 million brands across multiple media platforms such as TV, digital, mobile, email, events, social media, and print [4].

- The Tinuiti report is based on anonymized clients data, so we can’t accurately tell where the clients are mainly coming from or their individual spend. But in 2019, its featured clients included Bombas, BB&T, Eddie Bauer, Ethan Allen, Etsy, Jet.com, Rite Aid, Seventh Generation, The Honest Company, Tommy Bahama, Terminix, Vitamin Shoppe. None of these companies is Chinese. So probably most of its top clients are American.

- My gues is that they track Click-to-Messenger ads under Messenger Ads category though they don’t state it.

I=8

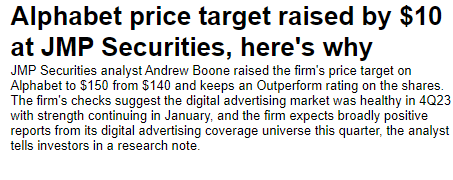

- Google’s advertising revenue rose 11% y/y to $65.5 billion in Q4 2023, less than analysts’ estimate of $65.9 billion (+11.6%) while YouTube ads rose 15.5% y/y to $9.2 billion (analysts estimate: $9.21 billion).

- Revenue grew 13.5% y/y to $86.3 billion, above analyst estimate of $85.3 billion (+12.1%) while earnings per share was $1.64 versus $1.59 expected by analysts.

- Google cloud revenue was $9.19 billion vs. $8.94 billion expected.

- Alphabet shares fell 4% in extended trading due to Google ad revenue miss.

Here are the relevant statements from Alphabet’s Q4 2023 earnings call;

“In Google advertising, Search and other revenues grew 13% year-on-year, led again by solid growth in the retail vertical. We had particular strength in retail in APAC, a trend that began in the second quarter of 2023 and continued through the end of the year,” said Philipp schindler Alphabet’s Senior Vice President & Chief Business Officer.

“In Q3, we indicated that we were seeing early trends of consumers being very price-conscious, and we saw this play out in Q4.”

https://seekingalpha.com/article/4666190-alphabet-inc-goog-q4-2023-earnings-call-transcript

My take

- The fact that Google saw strength among APAC retailers confirms Sower Tower’s report that indicated Chinese retailers continue to spend in U.S digital ad market, which is positive for Meta.

- Weakness among consumers may cause advertisers to pull back on ad spend, especially if their ROI was not impressive in the past quarters. On a positive note, they could switch to ad sites that provide more targetted advertising such as Meta.

Here are analysts’ opinions on Alphabet’s ad results;

“We would like to point out that this is a fundamentally stronger quarter – Gross Revenue, Search, YouTube, and Cloud and Google Other Revenues all accelerated,” Mahaney writes. “That said, we believe the price actions following the print reflect the higher expectations that weren’t exceeded,” Evercore’s Mark Mahaney pointed out [1].

"Alphabet reported healthy advertising results, but not enough,” said Stifel analysts [2]

“In my general conversations with public market investors and sell-side analysts, few have a correct view of the advertising market,” Brian Wieser, Madison and Wall analyst said. “Many think that growth can continue at double-digit levels for the fastest-growing companies for much longer a period of time than is realistic to expect.”[2]

“Alphabet’s disappointing ad-revenue numbers suggest that corporations worldwide are still uncertain about the pace of interest-rate cuts from global central banks, thus keeping some powder dry while waiting for more clues before opening up their wallets,” said Thomas Monteiro, senior analyst at Investing.com [3].

Seems as if indeed analysts were as equally bullish about Alphabet’s ad spending.

Meta and Alphanet obviously operate in a different ad segment, and social is the one growing the most, so their results come could out very differently.

I quickly found what some of the recent ones were saying before their earnings.

BofA:

JPM:

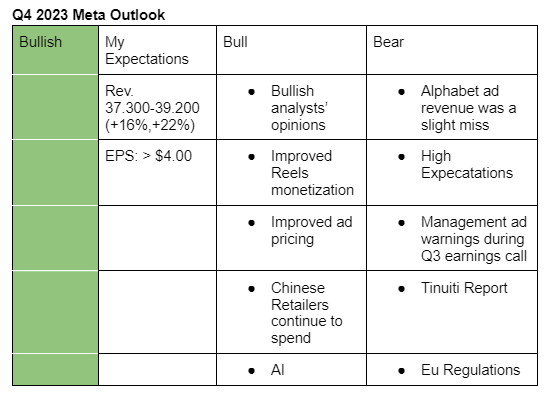

Note: My expectations are guestimates based on weak Tinuiti ad spend data and the fact that Meta has beaten its revenue mid-point guidance in the past five consecuitive quarters.

I am positive on Meta’s fourth-quarter results given that;

-

Alphabet’s ad revenue miss was small, and the likes of Mark Mahaney of Evercore believe that it was in line with the estimates. Also, as @Magaly notes above, social is the one growing the fastest; hence Meta’s ad revenue won’t necessarily follow in Alphabet’s steps.

-

Chinese retailers who contribute a significant portion of Meta’s ad revenue continue to spend.

-

Magna projects that social media ad spending will grow significantly in H2 compared to H1. The firm also raised its 2023 revenue forecast for digital media owners from +7.9% to +9.6% in the September report.

-

Analysts such as Mark Mahaney (Evercore) and James Lee (Mizuho) whose projections in the past were in line with actual results are bulish on Q4 2023 earnings.

-

Tinuiti and Skai reports indicated that there was an improvement in ad pricing in Q4 2023.

-

Data checks by some of the top analysts (such as Ronald Josey of Citi) ranked by TipRanks points to improvement in Reels ad loads and monetization.

Some of the risks include;

- Market expectations on Q4 2023 results are high: A small miss could cause the stock to fall by alot. In my opinion, this is the greatest risk given that Meta is depleting its weak comparison periods. Though highly unlikely, my worst case scenario is a revenue growth of 16% y/y.

- Management ad spending warning given during Q3 earnings call: Though the management said this was included in the guidance, there tend to be miscalculations.

N/B:

Management Guidance (Revenue): $36.5 billion- $40 billion (13.5-24.3%)

Analysts’ Estimate (Revenue): $39.09 billion (+21.5%)

Interesting take and good consideration of many arguments.

My take is more cautious or even bearish in the near term for the following reasons:

- Midpoint expectations of management 38.25b (+18.9%y/y) and analysts 39.09b (+21.5%) are very high.

- Tinuiti reports proved to be a reliable indicator in the past based on our experience and correlation testing. It only saw Meta growth of 13%y/y in Q4 and was never outperformed by actual Meta results more than 4% in the past.

- While ad prices on Tinuiti rose, ad impression growth fell. This might indicate that Meta is reaching limits on how much advertising they can and want serve their users.

- There could be a Warning on outlook as Meta tends to be more transparent than Alphabet on what it is projecting for the future and we might finally see a weakening economy.

- Analysts have been slightly too optimistic on Alphabet and might have been too optimistic on Meta as well.

That said, while I believe that the likelihood of seeing a local maximum is increasing the long term story of Ai personalized ads and better messaging monetization is largely intact and Meta is facing no significant threat from competition, regulation etc.

I am also more cautious about the results.

I have been thinking for a lot of time that analyst expectations are too high currently, and most of this is priced into the stock. So a disappointment could not be good for the price near term.

But at the same time they are not wrong to be bullish, because fundamentally speaking the result will probably still be good, and social ad spending is growing very strongly, but their expectations could just be a bit too high.

I also have more trust in the correlation with Tinuiti, and while China might be having strong growth currently, this has been happening since the past quarter, and the Tinutiti relationship holded the same.

But I think this is the first quarter where we see this divergence, so it will be the first test to know in what to lean more in the future.

Revenue is also not the only variable, maybe there is a slight miss on revenue, but everything else is so good that it will not cause any negative reaction, as it could add to the negativity. Probably their outlook will be much more important.

Upon reflection I decided against changing the position. I think digital advertising is still in a long term adoption cycle + the world continues to be prosperous, so the advertising market should continue to grow in the next 10+ years.

Additionally I continue to believe that „discovery“ will be gaining in importance compare to more specific „search“ with the advancement of AI.

That means I expect Meta to gain market share from e.g. Google in a growing advertising market as consumers are spending time following their interests on social media and are forming product decisions while doing so.

Lastly digital businesses proved quite adjustable in their costs structure. That means depending on the pace of investments at Meta they should be easily able to maintain EPS of 15$+ in most circumstances.