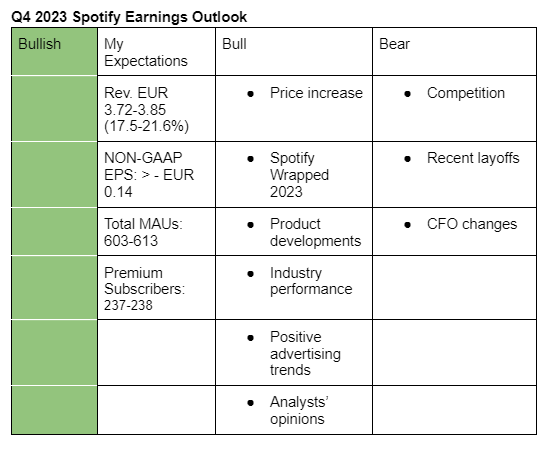

I am positive on Spotify’s Q4 2023 earnings. My guestimates are based on its past performance and business trends.

Here is why I am bullish on the quarter;

-

Price increases announced in July will likely be a tailwind to its Q4 2023 revenue growth. The management expects the price increase to be a positive mid-single-digit ARPU benefit to Q4, FX neutral.

-

Spotify Wrapped 2023 likely contributed to more engagement and user growth. According to Sensor Tower, Spotify’s global DAUs spiked by 14% DoD (2022: +13%) when Spotify 2023 Wrapped went live while global downloads rose by 35% DoD (2022:+23%). Spotify acknowledged in Q4 2022 earnings that Spotify Wrapped 2022 contributed to their Q4 success.

“A notable call out in the quarter was our eighth annual Wrapped campaign, which was a big contributor to our Q4 success, and we broke all sorts of records and reached several all-time highs with an increase of over 30% in user engagements,” CEO Daniel EK said.

-

I expect product developments such as Daylist, AI DJ and the addition of audiobooks to the premium subcription to have contributed to more engagement and user growth during the quarter.

-

Global revenue forecast for 2023 was revised upward while 22% growth in on-demand audio song streams for 2023 (reported in Q3 2023) was unchanged at the end of the year.

-

Spotify’s ad business probably benefitted from the ongoing improvement in advertising trends. Meta Platforms and Alphabet recently posted positive ad growth results.

-

Analysts seem to have moved beyond Q4 2023 and are now forecasting solid performance in 2024.

Some of concerning areas include;

- The recent layoff may indicate impending slowdown in revenue growth; hence (though low), the company’s outlook for 2024 could come below estimates. This could cause a drop in the stock price.

- Growing competition, particularly from YouTube Music. Recently, YouTube announced that its YouTube Music and Premium subscribers had crossed 100 million. That’s up from 80 million announced in November 2022 and 50 million given in September 2021.

- The company hasn’t found a new CFO. Hence the perfomance of the department may not be optimal.

N/B:

Management Guidance: Revenue (3.7 billion or +16.9%), MAUs (601 million), Premium subscribers (235 million)

Analysts estimate (revenue): 3.72 billion (+17.5%)