This topic discusses Volkswagen’s Q3 2024 earnings expectations and results. A summary of our earnings outlook will be posted here. You can find an article on the earnings in the wiki:

Tesla’s Q3 2024 revenue slightly missed estimate while EPS topped estimates signaling a rebound in the EV market

- Tesla Q3 2024 revenue came in at $25.18 billion (+8% y/y) versus analysts estimate of $25.37 billion, adjusted EPS was $0.72 versus $0.58 estimate while automotive gross margin (excluding regulatory credits) rose to 17.1%, beating analysts’ estimates and up from 14.6% a year ago.

- The company said revenue was boosted by growth in vehicle deliveries (+6% y/y) and higher regulatory credit revenue among others, but was impacted by a decline in average selling price of its vehicles.

- In the earnings call, Elon Musk said cheaper EVs that they will launch next year gives him confidence that they will achieve a 20% to 30% growth in deliveries in 2025.

- Seth Goldstein, Morningstar analyst, said Tesla benefited from higher volumes, reduced unit costs and stabilizing prices.

General Motors Q3 2024 revenue and EPS topped analysts estimates, boosted by continued strength in pricing

-

General Motors’ Q3 2024 revenue rose 10.5% y/y to $48.76 billion, exceeding analysts’ estimate of $44.59 billion while EPS came in at $2.96 versus $2.43 estimate.

-

GM’s results were boosted by continued strength in pricing.

“Pricing for the quarter was up $900 million year over year and better than what we assumed in our guidance. About half of this pricing benefit was from really strong performance from our midsized SUVs, especially the Chevrolet Traverse. The rest was primarily from pricing adjustments that we made on our full-size SUVs and the Corvette in the fourth quarter of last year, which have now been fully lapped,” CEO Paul Jacopson said in the earnings call.

-

Jacopson said in the media briefing that the consumer remains strong.

“The consumer has held up remarkably well for us,” he said. “Nothing we see has changed from where we’ve been for the last several quarters.”

-

GM raised its full-year 2024 adjusted EBIT to a range of $14 billion and $15 billion (previously: $13- $15 billion).

Renault topped revenue estimates, helped by pricier new models

-

Renault’s Q3 2024 revenue rose 1.8% y/y to 10.7 billion euros, exceeding analysts estimate of 10.35 billion euros.

-

Renault said pricing was stable while product mix effect was strong.

“Our Q3 revenue is starting to benefit from our unprecedented product offensive, with 10 new launches this year, representing 18% of our invoices over the quarter,” Renault said.

-

Renault CFO Thierry Pieton told journalists that the product offensive this year is bringing up average price, which should continue into 2025.

-

Unlike some of its competitors, Renault is not facing supplier problems or inventory management issues.

-

Renault is also Europe’s 2nd hybrid leader. In Q3, electrified vehicles accounted for 30.2% of Renault Group’s passenger car sales with fully-electric vehicles accounting for 7.6%. Hybrid vehicles demand in Europe is high compared to a slump in BEVs demand.

“In terms of potential difficulties at the end of the year, the order book is pretty good, we have a big quarter ahead of us, at this stage it is simply execution,” Pieton told journalists.

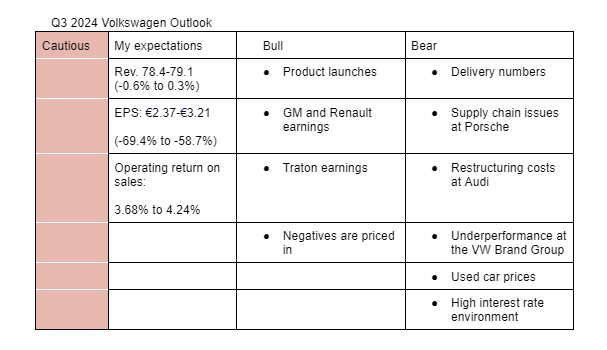

I am cautious on Volkswagen’s Q3 2024 earnings. My estimates take into account Q3 2024 delivery numbers, restructuring costs at Audi, continued supply chain problems at Porsche, underperformance at Volkswagen Brand Group Core, among others.

Here is a description of my bullish points;

- Product launches in 2024: I expect the product offensive particularly at Porsche and Audi to keep prices stable during the quarter. Almost all the new models come with a premium over that charged for the old models.

- GM and Renault earnings: GM and Renault earnings benefited from stable pricing during the quarter.

- Traton earnings: Traton Q3 2024 earnings topped estimates.

- Negatives are priced in: Most of the bearish sentiments in the table above are already priced in. Therefore, I don’t expect the stock to react excessively negative if the earnings miss analysts estimates.

Here is a description of my bearish points;

- Delivery numbers: Volkswagen Q3 2024 deliveries fell 7.1% in Q3 2024 versus growth of 2% for the full year that was initially guided by the management.

- Supply chain issues at Porsche: During the Q3 2024 pre close call, Volkswagen said Porsche continued to be impacted by the supply chain issues. The supply chain issues will lead to more production costs.

- Restructuring costs at Audi: During the Q3 2024 pre close call, Volkswagen said Audi booked the 1.3 billion euros (page 16) restructuring charges associated with the Brussels plant. This impacts Audi’s operating return on sales.

- Underperformance at the Volkswagen Brand: There have been reports that Volkswagen Brand’s restructuring measures are not going according to the plan. Volkswagen also said recently that market developments have downgraded expectations at the Volkswagen Brand.

- Used car prices: While used car prices are stabilizing, they are still down year over year. This will be a drag on Volkswagen Financial Services (VFS) operating results.

- High interest rate environment: While key interest rates are trending downwards in Europe and U.S, it will probably take sometimes before this is reflected on the books. As such, VFS could still book a high interest rate expense in Q3. Additionally, VFS recently lowered their 2024 operating profit guidance to 3.2 billion euros from 4 billion euros.

N/B: Here are the analysts estimates and management guidance for 2024:

Analysts estimates for Q3

Revenue: EUR 79.53 billion (+0.87% y/y)

Operating return on sales: 3.7%

Analysts' estimates for 2024

Revenue: EUR 320.5 billion (-0.6%)

Operating return on sales: 6.6%

Management outlook for 2024

Revenue: EUR 320 billion (-0.7%)

Operating return on sales: ~5.7%

Mercedes-Benz earnings declined by more than 50% in Q3

- Mercedes-Benz Q3 2024 revenue fell 7% to €34.5 billion, net profit declined 54% to €1.7 billion while adjusted return on sales in the car division fell to 4.7% from 12.4% last year, missing the company’s target of 8% and worse than expected by analysts.

- Mercedes said revenue were impacted by “a slight decrease in unit sales, unfavorable product and market mix, negative net pricing effects and negative development of the exchange rates”.

Porsche Q3 results missed analysts estimates, guidance for the full-year reiterated

-

Porsche’s Q3 2024 revenue fell 6% to 9.11 billion (calculated), missing analysts estimate of

9.24 billion while operating profit declined 41% to 974 million. -

Its operating return on sales was 10.7%, below analysts estimate of 11.3%.

-

When I adjust for the usual difference between figures at the group level and at the subsidiary level, Porsche’s Q3 revenue will likely miss my estimate by 100 million euros while operating return on sales of 10.7% is below by estimate of 12.9%.

-

Porsche reiterated its forecast for 2024.

-

Porsche said in the publication that it continue to face ongoing supply challenges.

"In China, we are dealing with a structural shift in demand. In addition, the global transformation towards electric vehicles is proceeding more slowly than originally assumed. For this reason, we are reviewing our product line-up and ecosystem, as well as our budgets and cost position. All with the aim of increasing our flexibility and resilience even further,” CFO Lutz Meschke said in the press release.

Volkswgan Group Q3 2024 revenue and operating return on sales missed analysts estimate

- Volkswagen Group Q3 2024 revenue fell 0.47% to €78.5 billion (calculated) versus analysts estimate of €79.5 billion while operating return on sales came in at 3.64% (analysts estimate: 3.7%).

- Excluding the €1.2 billion restructuring charges associated with Audi Brussels plant, the Group’s operating return on sales could have been 5.17% in Q3.

- Automotive division net cash flow was up 38% y/y to €3.4 billion in Q3 due to release of working capital (9M 2024: €3.2 billion or -34% y/y).

- This comes after the company recently adjusted its guidance for 2024.

Here are the main insights from the earnings call;

- CFO Arno Antlitz pointed out that pricing nearly stabilized in Q3 and that next year they expect pricing headwinds from BEV incentives as automakers race to meet the CO2 targets.

- Antlitz said car sales in Europe were 16 million before the pandemic and 14 million after the pandemic and that current trends indicate sales will see a slow growth in the next five years. He projects a 1% to 2% growth next year. He added that Volkswagen’s markets share remains stable at 25%.

- Antlitz pointed out that 2025 will be challenging with regards to the CO2 targets and that the worst case scenario is a penalty of less than 4 billion euros. He said they want to achieve the target themselves without losing profitability but may consider pooling as well.

- Antlitz said they still target an operating return on sales of 6.5% at the Volkswagen Brand Group Core but the cost savings target is now higher than the initial €10 billion since the assumptions such as competition and pricing have gotten worse.

- Antlitz pointed out that they cannot rule out additional restructuring in Q4.

Assessment of the Q3 2024 results

Volkswagen Q3 2024 revenue and operating return on sales were within my target range and comments during the earnings call were positive for the year. I particularly like how pricing at the main brands developed during the quarter. However, headwinds such as labor unions issues and CO2 targets remain high.

Analysts say the results were as expected

- Sell, €84 (preference shares): UBS said Q3 2024 results were in line with expectations and that all eyes are on restructuring measures.

- Neutral, €114: Analyst George Galliers of Goldman Sachs said the results largely met expectations and that the restructuring of the group remains the predominant topic.

- Buy, €140: Analyst Philippe Houchois said Q3 clearly demonstrated the need for a restructuring.

- Outperform, €102: Analyst Tom Narayan of RBC said Q3 was as expected after the profit warning in September.

- Neutral, €128: Analyst Jose Asumendi pointed out that Q3 was characterized by restructuring but the cash in flow was strong and liquidity remains high.

Cool thank you. Are you going to work on a detailed summary of the call in the Wiki?

I think we should include a line for CO2 costs and penalities to the Volkswagen model? Maybe below line 62 financial result?

Do you maintain your last assessment that costs on that item would only be 575million in 2025 or do you now think significantly higher costs are more likely?

Yes, I am working on a detailed summary of the call.

According to GPT, cost of carbon credits are reported as part of operating expenses since they are part of sales. So maybe below line 49?

Yeah, noting as changed in my estimate.

Oh yes, sure, you are right. I would say below line 48.

Ok, this means the 4 billion is just the worst case, but reality should be way better?

Once we have added the line and incorporated it into our calculations, I will be able to see what you are projecting for 2025 and the years beyond on that line item and it’s impact on results overall.

Yes, Rolf Woller, head of investor relations actually said in the Q&A that reflecting on the current situation, it should be much lower.

“We have also seen very good reports by – not only by you, but also by others analyzing the CO2 situation coming up with in part quite drastical headwinds for 2025. And as said during the road show activities as well, we don’t think actually that the worst case scenarios we are calculating up to €4 billion headwind that this is the (inaudible)-- reflects the current situation should be much, much lower.”

Audi is now guiding the lower end of its guidance

- Audi said it’s now targeting the lower end of its 2024 guidance (revenue of 63 billion euros and operating return on sales of 6%).

- The company cited intense competition in Europe and China and the ongoing product launches as reasons for the underperformance.