This topic discusses Q3 2024 Meta Platforms earnings. It includes our final assessment and decision before the earnings release. We will also summarize the results here. Here is our Wiki article on the same:

Based on insights at hand, I am bullish on Meta’s Q3 2024 earnings. My estimates take into account continued uptick in ad pricing, positive ad spend data, growing DAUs and benefits of AI among others.

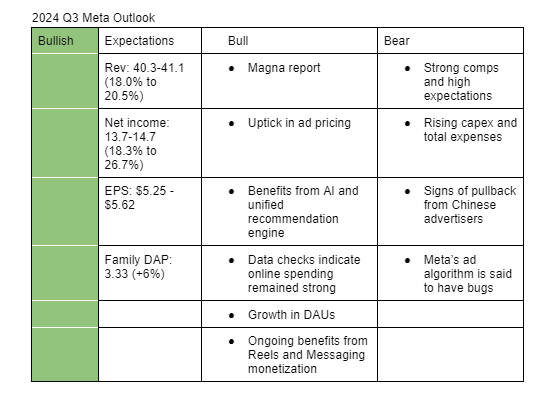

Here is a description of my bullish points;

- Recently, Magna upgraded its U.S ad spend (including cyclical events) for 2024 to 11.4% from 10.7%. It now expects social media ad spend (excluding cyclical events) to grow 15.8% in 2024 (previous projections: +15.5%).

- Data checks by equity research firms such as Raymond James, Keybanc, Mizuho, and UBS indicate sustained growth in ad spending in Q3 2024.

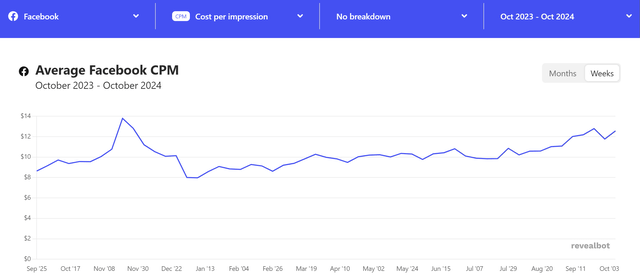

- Revealbot data points to continued growth in Meta Platforms CPM.

- Sensor Tower data analyzed by BofA indicates Facebook’s daily active users (DAUs) were up by an average of 3% y/y in Q3 while that of Instagram were up by an average of 5% y/y.

- I expect Meta to continue benefitting from its progress in AI and unified recommendations system. Meta said during its connect event that ad campaigns created with AI ad features had 11% higher click-through rate and 7.6% higher conversion rate compared campaigns that didn’t use these features. High-performance campaigns will attract more advertisers to the platform. Unified recommendations system, on the other hand, will result in more engagement particularly with Reels as pointed out by CEO Mark Zuckerberg in the last earnings call.

- I expect Meta to continue benefiting in Reels ad loads optimization and monetization of Click-through-messaging. UBS said their checks indicate Meta is still benefitting from Reels.

Risks during the earning season include;

- Strong comparison periods and high expectations: Periods of low comps ended in Q2 2023. Additionally, analysts expectations for a solid third quarter are high. Any small miss in Q3 results could lead to a large drop in the share price.

- Investors will be keen on comments related to total expenses and capex. If return on such investments are below bar or if the capex and total expenses exceed estimates, the share price could fall sharply.

- Some analysts have flagged a pullback in ad spend by Chinese advertisers. Though I don’t expect the impact this quarter, any comments by the management confirming it could cause volatility in the share price, especially since Temu and Shein have been responsible for much of the growth in the CPM.

- Some advertisers have claimed that Meta’s ad algorithm has bugs leading to underperformance or higher spending than expected. However, a number of them still sees Meta’s algorithm as the best.

N/B: I may adjust my estimates as more insights such as that of Tinuiti comes in. Here are management’s and analysts’ expectations;

Management Guidance (Revenue): $38.5-$41.0 billion (+12.8% to +20.1%)

Analysts’ Estimate (Revenue): $40.3 billion (+17.8%)

Analysts’ Estimate (EPS): $5.23 (+19.1%)

Here is a summary of Q 2024 Tinuiti Digital Ads Benchmark Report:

-

Meta ad spend by Tinuiti advertisers rose 9% y/y in Q3 2024 (Q2 2024:+10% y/y), CPM was down 3% y/y (Q2 2024:+5% y/y) while impressions were up 12% y/y (Q2 2024: +4% y/y).

-

Ad spend on Facebook rose 5% y/y (Q2 2024:+4%), CPM fell 12% y/y (Q2 2024: +1%) while impressions rose from 5% in Q2 2024 to 20%-driven by Reels.

-

Ad spend on Instagram was up 14% y/y in Q3 2024 (Q2 2024:+24%), CPM rose 19% y/y (Q2 2024:+23%) while impressions declined 4% y/y compared to flat growth in Q2 2024.

-

Ad spend on TikTok rose 28% y/y (Q2 2024:+10% y/y)-the largest increase since Q4 2023, CPM was up 14% y/y (Q2 2024:+49% y/y) while impressions grew 12% y/y (Q2 2024:-26%).

-

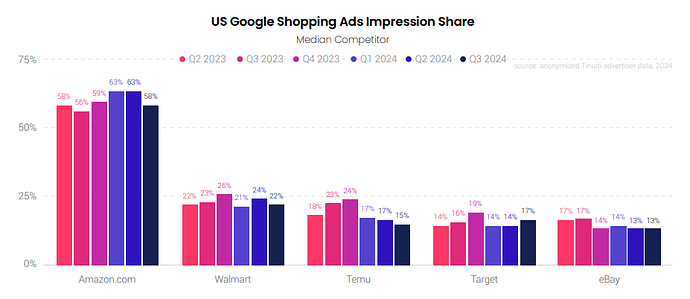

According to Tinuiti, TikTok’s share of Google Shopping ads impressions are now considerably lower compared to a year earlier but more stable compared to the beginning of the year.

-

Ad spend on Google search was up 11% y/y (Q2 2024:+14% y/y), click through rate (CTR) was steady at 3% while cost per click (CPC) growth slowed to 8% from 12% in Q2.

Assessment

In the most recent three quarters, Meta revenue outperformed Tinuiti Meta ad revenue by an average of 11.7%. As such, I am reiterating my above estimates.

It’s not good to see Meta’s CPM falling though. One explanation I could think of is that Chinese advertisers in the platform (that were driving up CPM) may have reduced their spend as evidenced by Temu’s impressions in Google Shopping ads. Rockerbox also pointed out recently that Meta’s return on an spend (ROAS) has decline by 12% between July 2023 and July 2024. As such, some advertisers maybe shifting ad dollars to high-performing alternatives such as TikTok. Ad pricing will be one of the key metrics to watch in the earnings call. In the most recent three quarters, Meta’s average price per ad has outperformed the Tinuiti CPM by an average of 5.33%.

Great overview. Return on ad spend (ROAS) is an interesting new metric. Does Rockerbox or others give an overview of ROAS for all major advertising platforms?

Understanding how profitable advertising is could give us insights into the future development of the overall advertising market and be one of the factors considered in predicting who can gain market share.

Obvs. we have to be careful not to take their indications as facts as it is probably impossible to estimate how high ROAS really is. What is their methodology of doing so?

Rockerbox calculates the ROAS by dividing revenue generated from the ad campaign by the total ad spend. It looks like that’s how Meta calculates it as well.

In June Meta said its ROAS had grown by 12% in two years, from $3.31 in 2022 to $3.71 in 2024. Meta said this numbers are based on a study of more than one million ad campaigns by advertisers in the US.

I was only able to find this case study by Workmagic. According to the study, Meta’s in platform ads achieved an ROAS of 12% while Google’s Performance Max achieved an ROAS of 18% in the first incrementality test. Given that they were able to increase that of Meta by 113% and that of Google by 72%, it occurs to me that ROAS metric is subjective.

Ok so for every dollar spend in advertising Meta claims that on average advertisers on their platform have a revenue of $3.71 in 2024 (ROAS).

Have you been able to investigate any causes of the discrepancy between Metas reported numbers (+12% since 2022) and what Rockerbox reports (-12% since July 2023).

This could be explained for example by the possibility of growth in 2022 with subsequent declines since mid July 2023. (In this case both numbers could be coherent)

Other explanations should be different client bases, or Meta over reporting numbers.

For me the thing to know in a situation like this is which numbers are most likely the more reliable ones and which ones are not and why.

Did you find the average ROAS of competitors like Google, Snapchat, Pinterest?

Workmagic is an advertising analytics and optimization product that tries to market itself. In my interpretation it is saying that sales increase on average by 12% and 18% when conducting marketing on Meta and Google and they claim that they can help optimize ad spend by measuring how large the incremental increase in revenue is which is attributable to each ad campaign.

All of this is completely irrelevant for analyzing Meta.

I only shared that Workmagic as an example pointing to my conclusion that ROAS largely depends on how the ads have been optimized. I have found many other comments claiming that Meta overestimates its ROAS.

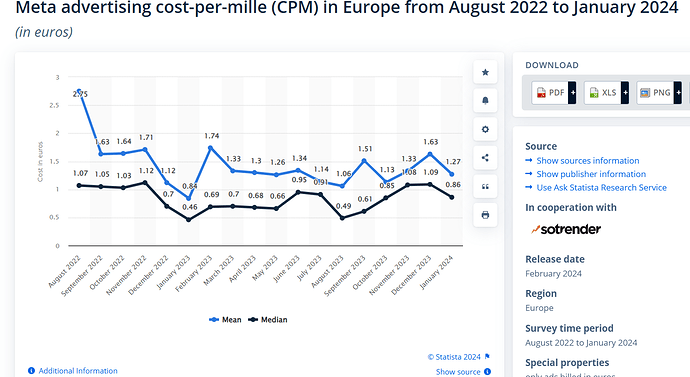

I wasn’t able to find much on the discrepancy. My current thinking is that Meta ROAS in 2023 should be significantly higher than in 2022 while CPM should be significantly lower. This is because 2022 is one of the years that was heavily impacted by Apple Privacy changes. For instance, Calla Murphy, vp of digital strategy & integrated marketing at Belardi Wong said at the beginning of 2024 that their tracking of Meta ads returned a 22% y/y decline in CPM and a 32% y/y increase in ROAS at the end of 2023. Additionally, as you can see from the Statista chart below, Meta’s CPM in 2022 was elevated. Meta had to improve the performance of its ad tools such as Advantage+ so as to offset the Apple privacy changes. This coupled with a lower CPM in 2023 probably lead to a significantly higher ROAS compared to 2022. In 2024, those tailwinds are no longer much there (see Revealbot chart below), hence a decline in ROAS compared to 2023 is possible. Even if we assume that Meta’s ROAS grew 20% in 2023 to $3.97 from $3.31 estimated by Meta in 2022, 2024’s ROAS of $3.71 will be lower than that of 2023.

Revealbot Facebook CPM Chart

Revealbot Instagram CPM Chart

Varos, a firm that tracks over $6 billion of ad spend by over 6,000 companies, publishes ROAS for Facebook, Google and TikTok but I haven’t found a company that collates these data for months or years.

Alphabet’s Q3 2024 results beat analysts estimates

-

Alphabet Q3 2024 revenue came in at $88.3 billion, exceeding analysts estimate of $86.44 billion while EPS was $2.12 versus $1.85 estimate.

-

Google advertising revenue rose 10.4% y/y to $65.85 billion, in-line with analysts estimate of $65.5 billion.

-

YouTube advertising revenue was $8.92 billion, in-line with analysts estimate of $8.89 billion while cloud revenue rose 35% y/y to $11.35 billion, above analysts estimate of $10.88 billion.

“The momentum across the company is extraordinary. Our commitment to innovation, as well as our long-term focus and investment in AI, are paying off with consumers and partners benefiting from our AI tools," CEO Sundar Pichai said.

Snap’s Q3 2024 revenue in-line with analysts estimate

- Snap’s Q3 2024 revenue rose 15% y/y to $1.37 billion, in-line with analysts estimate of $1.35 billion while adjusted EPS of $0.08 exceeded analysts estimate of $0.05.

- Its Daily Active Users (DAU) were 443 million vs 441 million estimated by analysts.

Alphabet’s ad revenue in Q3 was impacted by strong comps in second half of 2023, capex growth in 2025 to slow down compared to 2024

- The strong performance in Google Search and other advertising revenue was broad-based, led by financials and followed by retail.

- Year-over-year growth in total advertising revenue was impacted by strong comps in Q3 2024, particularly from APAC-based retailers. This headwind is expected to continue into Q4.

- They expect capex spending in Q4 to be at the same level as in Q3 ($13 billion versus analysts estimate of $12 billion).

- CFO Anat Ashkenazi said capex in 2025 is likely to be higher than in 2024 but the level of increase will be lower than seen in 2024.

Meta tops revenue and earnings estimates, misses on user growth

-

Meta Q3 2024 revenue rose 19% y/y to $40.6 billion, above analysts estimate of $40.2 billion, EPS came in at $6.03 versus analysts estimate of $5.23 while operating margin of 43% exceeded analysts estimate of 40%.

-

Family daily active people (DAP) grew 5% y/y to 3.29 billion, below analysts estimate of $3.32 billion.

-

Meta’s capital expenditures during the quarter were $9.20 billion, below analysts estimate of $11 billion.

-

Meta is guiding Q4 2024 revenue in the range of $45-48 billion (analysts estimate: $46.3 billion), adjusting its 2024 total expenses to a range of $96-98 billion from $96-99 billion and updating its capex to a range of $38-40 billion from $37-40 billion.

-

It reiterated that it continue to expect a significant capital expenditures in 2025 and a significant acceleration in infrastructure expense in 2025.

“We continue to expect significant capital expenditures growth in 2025. Given this, along with the back-end weighted nature of our 2024 capital expenditures, we expect a significant acceleration in infrastructure expense growth next year as we recognize higher growth in depreciation and operating expenses of our expanded infrastructure fleet,” the press release reads.

Here are the analysts opinions following the earnings;

-

Buy, $630->$660: Bofa raises its 2025 revenue estimate by 3% and EPS estimate by 6% (from $27) to reflect higher ad monetization offset by rising R&D expense.

-

Overweight, $575->$650: Piper Sandler said Meta has earned the benefit of the doubt but the near-term free cash flow estimates dips.

-

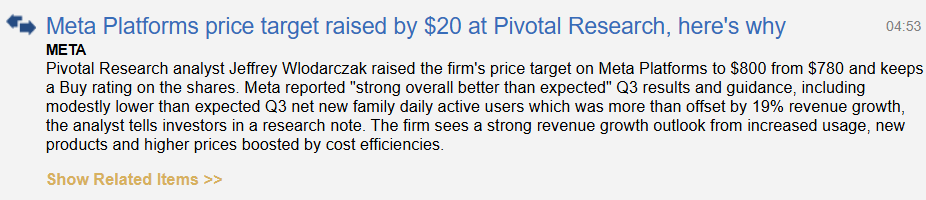

Buy, $780->$800: Pivotal Research expects strong revenue growth outlook due to increased usage, new products and higher prices boosted by strong efficiencies.

-

Buy, $645->$705: Citi pointed out that Meta continues to gain share of the overall ad budgets.

-

Overweight, $550->$630: Barclays said Meta seems to have its “mojo back” and that these efforts could be scary at the same time.

-

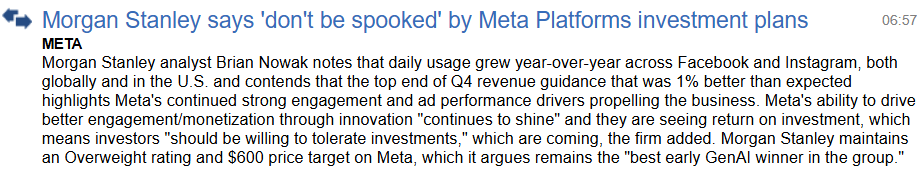

Overweight, $600: Morgan Stanley said investors should be willing to tolerate higher investments since Meta remains the best early GenAI winner in the group.

-

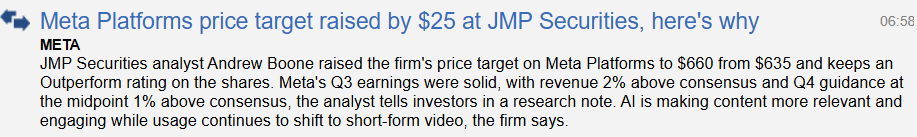

Outperform, $635->$660: JMP Securities said AI is making content more engaging and relevant and usage continues to shift to short-form video.

-

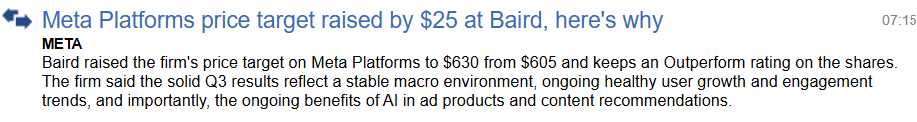

Outperform, $605->$630: Baird said ad products and content recommendations continue to benefit from AI.

Here are the main insights from the earnings call;

-

CFO Susan Li said they expect positive advertising trends in 2025, boosted by performance of its ad recommendation systems.

“When we think about the Q4 outlook and when we think about going into next year, we generally expect growth to continue to benefit from the healthy global advertising demand that we’ve seen. We think that our investments in improving our ads performance will continue to accrue benefits to advertisers. But obviously there’s a big range of possible macro backdrops and that’s something that we try to reflect in the range of revenue guidance that we give,” she said," she said.

-

Pricing growth was mainly driven by increased advertiser demand, in part due to improved ad performance but offset by increased impression, particularly from lower monetizing regions and surfaces.

-

Li pointed out that ad revenue growth decelerated in Asia Pacific from 28% to 15% due to lapping of a stronger demand from China-based advertisers.

-

While Zuckerberg and Li couldn’t quantify the user cases of AI, they pointed to some of the opportunities they are seeing such as efficiency benefits, AI generated or AI summarized content, improved Reels and Feed recommendations, ad generation tools, and business AI agents.

-

Other than reiterating that capex and total expenses will rise significantly in 2025, they did not quantify them.

Assessment of the earnings

Though the Q3 2024 results were positive, the outperformance during the quarter was minimal. This is probably due to the lapping of strong ad spend by Chinese-based advertisers. Therefore, revenue growth in the coming quarters should decelerate.

Like in the past quarters this year, the call was positive but I feel that the management was withholding some things such as more insights on capex and total expenses in 2025 and quantification of benefits that they are starting to see from GenAI. Maybe they did that so as not to spook the market. What was really positive was their comments surrounding their ads recommendations system and engagement trends in the platform.