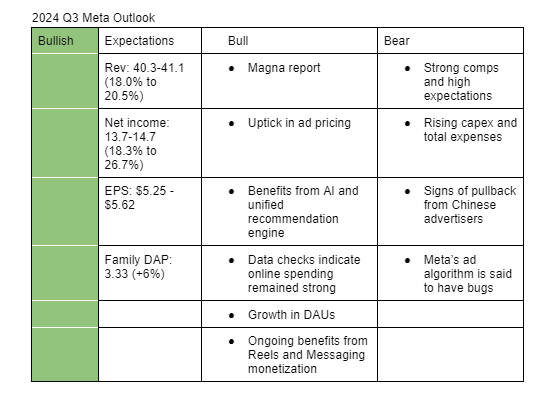

Based on insights at hand, I am bullish on Meta’s Q3 2024 earnings. My estimates take into account continued uptick in ad pricing, positive ad spend data, growing DAUs and benefits of AI among others.

Here is a description of my bullish points;

- Recently, Magna upgraded its U.S ad spend (including cyclical events) for 2024 to 11.4% from 10.7%. It now expects social media ad spend (excluding cyclical events) to grow 15.8% in 2024 (previous projections: +15.5%).

- Data checks by equity research firms such as Raymond James, Keybanc, Mizuho, and UBS indicate sustained growth in ad spending in Q3 2024.

- Revealbot data points to continued growth in Meta Platforms CPM.

- Sensor Tower data analyzed by BofA indicates Facebook’s daily active users (DAUs) were up by an average of 3% y/y in Q3 while that of Instagram were up by an average of 5% y/y.

- I expect Meta to continue benefitting from its progress in AI and unified recommendations system. Meta said during its connect event that ad campaigns created with AI ad features had 11% higher click-through rate and 7.6% higher conversion rate compared campaigns that didn’t use these features. High-performance campaigns will attract more advertisers to the platform. Unified recommendations system, on the other hand, will result in more engagement particularly with Reels as pointed out by CEO Mark Zuckerberg in the last earnings call.

- I expect Meta to continue benefiting in Reels ad loads optimization and monetization of Click-through-messaging. UBS said their checks indicate Meta is still benefitting from Reels.

Risks during the earning season include;

- Strong comparison periods and high expectations: Periods of low comps ended in Q2 2023. Additionally, analysts expectations for a solid third quarter are high. Any small miss in Q3 results could lead to a large drop in the share price.

- Investors will be keen on comments related to total expenses and capex. If return on such investments are below bar or if the capex and total expenses exceed estimates, the share price could fall sharply.

- Some analysts have flagged a pullback in ad spend by Chinese advertisers. Though I don’t expect the impact this quarter, any comments by the management confirming it could cause volatility in the share price, especially since Temu and Shein have been responsible for much of the growth in the CPM.

- Some advertisers have claimed that Meta’s ad algorithm has bugs leading to underperformance or higher spending than expected. However, a number of them still sees Meta’s algorithm as the best.

N/B: I may adjust my estimates as more insights such as that of Tinuiti comes in. Here are management’s and analysts’ expectations;

Management Guidance (Revenue): $38.5-$41.0 billion (+12.8% to +20.1%)

Analysts’ Estimate (Revenue): $40.3 billion (+17.8%)

Analysts’ Estimate (EPS): $5.23 (+19.1%)