Q3 2024 MAGNA Forecasts update

As always Q3 updates are only for the US

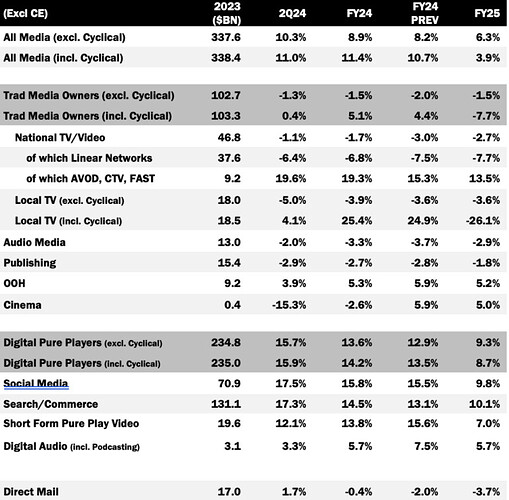

MAGNA expects full-year 2024 ad revenues to grow by 11.4% to $377bn, with non-cyclical growth at 8.9%—the highest in over 20 years, excluding 2021’s post-COVID rebound.

- US ad revenues rose 11% YoY in Q2, slightly exceeding MAGNA’s 10.4% projection.

- MAGNA increased its forecast for non-cyclical H2 ad spend growth to 7.4%, up from 6.4%.

- Search/commerce sales will rise +14.5% (13.1% prev) to $150bn. Retail media networks will see growth of +20% and near the $50bn ($46bn), which is expect them to surpass next year, while core search (i.e., keyword search) will gain +12% in 2024.

- Social media sales will rise +15.8% (15.5% prev) to $82bn, thanks in large part to the AI tools.

- Ad-funded streaming has become one the fastest-growing ad channel in 2024, with a +20% increase in ad spending

- Given the lack of cyclical events, total ad sales (incl. cyclical) will rise only +3.9% above 2024. Digital pure players will again drive the market, growing +9.3% to $289bn, while traditional media owners will erode by -1.5% to $102bn.

Political and Olympic Advertising Boost a Strong US Ad Market Further - MAGNA