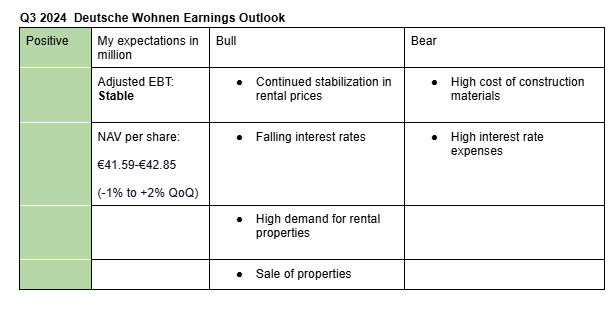

I expect Deutsche Wohnen Q3 2024 results to be stable. It’s hard to estimate the adjusted EBT (the main KPI currently used by the company) and rental revenue since they weren’t reported in past Q3 results.

My estimates for NAV are based on current trends such as declining interest rates. Here is why I am bullish on the earnings;

- Continued growth in rental prices: In Q3, rental prices in Germany continued to stabilize, particularly in Berlin where Deutsche Wohnen has major presence.

- Falling interest rates: Falling interest rates, particularly in Europe will boost net asset value by lowering capitalization rates used in the valuation model.

- High demand for rental properties: Housing demand in Germany remains high. This reduces the vacancy rate, hence boosting rental revenue.

- Sale of properties: Deutsche Wohnen is in the process of selling its nursing segment. As such, the quarter is likely to benefit from some property disposals.

Headwinds during the quarter include;

- High cost of construction materials: Deutsche Wohnen pointed out in Q2 that it expects cost of building materials to remain elevated throughout the year (page 20).

- High interest rate expenses: Though the ECB has began reducing interest rates, it will probably take a while before the effects are reflected in Deutsche Wohnen’s financing structure. As such, I expect interest expenses to still way on the earnings during the quarter.

N/B: There are currently not public analysts estimates.