This topic discusses the upcoming 1&1 Q3 2024 earnings. It contains our earnings outlook and a summary of the results. Here is our Wiki article on the same:

I am cautious regarding 1&1’s Q3 2024 earnings. My estimates takes into account regulatory effects, competitive pressure and network failure at the end of Q2 2024 among others. Here is a description of my positive points above:

- The telecommunications sector is considered immune to inflationary pressures since people cannot do without it. As such, the decline in Germany’s economy is unlikely to have much impact on the sector.

- 1&1 network buildout seems to be now progressing well. There aren’t any recent reports on network buildout delays or special effects associated with it. For instance, 1&1 added 450 antenna sites in Q2, bring the total to 1,781. At this rate, 1&1 should be able to meet its 3,000 target for 2024. As such, I expect comments on network buildout progress to be positive when the results are released.

- A recent report by Teltarif indicates that customer migration from O2 to 1&1 network has began again. Its calculations based on O2’s Q3 numbers indicate that 1&1 could have migrated 39,000 customers in Q3. This process is important since 1&1 has until the end of 2025 to migrate its customers from O2’s network. Also, the start of customer migration signals that the problem associated with network failure at the end of Q2 are likely over.

I am cautious because of the following:

- Regulatory effects: Customer cancelations as a result of halving of mobile termination fees at start of the year are still pronounced. For instance, O2 largely blamed its 1.8% y/y decline in its service revenue in Q3 to this regulatory effect.

- Further contract cancelations due to network failure in Q2: It’s possible that there were further contract cancellations in Q3 as a result of the network failure in Q2.

- Competitive pressures and strong pricing comps: O2 pointed out that they are seeing competitive pressures at the rock-bottom offers. Similarly, 1&1 is facing strong pricing comps in Q3 due to the price increase in Q2 2023.

- Some notable analysts such as Keval Khiroya of Deutsche Bank, are cautious about 1&1’s earnings.

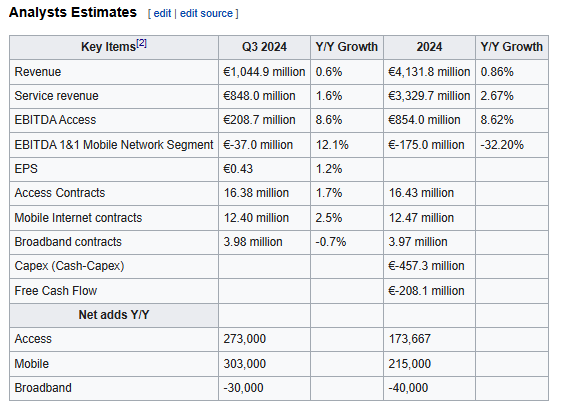

Here are the analysts estimates for Q3 2024 and full year 2024:

1&1 Q3 2024 results missed analysts estimates, the company lowered its service revenue guidance for 2024

- 1&1 Q3 2024 revenue fell 3.6% y/y to €1,001 million (analysts estimate: €1,044.9 million), service revenue was flat at €834 million (analysts estimate: €848 million), hardware segment revenue dropped 18% y/y to €168 million (analysts estimate: €196.9 million), EBITDA fell 30% y/y to €136 million (analysts estimate: €172 million) while EPS was €0.34 versus analysts estimate of €0.43.

- Access contracts came in at 16.35 million (analysts estimate: 16.38 million), mobile contracts 12.38 million (analysts estimate: 12.40 million) while broadband contracts were 12.97 million (analysts estimate: 3.98 million).

- 1&1 said Q3 2024 results were impacted by the consequences of the network outage in Q2 and continued intense competition in the mobile segment.

- The company added that the network outage delayed the launch of its two additional core data centres but they went live on November 2024, allowing for resumption of customer migration.

- 1&1 lowered its 2024 service revenue estimate to €3.31 billion from €3.33 billion but confirmed its guidance for EBITDA at the access segment (€860 million) and at the 1&1 startup (-€174 million) while pointing out that broadband contracts in Q4 should come in at the same level as in Q3 while mobile contracts in Q4 should faster than in Q3.

- The company said they are seeing solid progress in the construction of their network, pointing out that they had 2,016 antenna site at the end of Q3.

- The shares are down 1% pre-market.

What’s your overall assessment of results?

2,016 antennas seem low given that they had already 1,781 at the end of Q2? How many of them are equipped and operational?

Here are my main takeaways from the earnings call:

- CFO Markus Huhn said they are currently in discussions with partners to compensate them for the losses associated with the disruption of customer migration in Q2 (min 7:00). He said the EBITDA guidance given in August includes this headwind but if the agreed compensation will be higher than expected, they will have to update the guidance (min 57:57). This headwind is also expected to impact the 2025 results (min 44:00).

- Huhn said that 741 base stations are now equipped with glass fibre versus 546 in Q2 (min 10:30). He couldn’t give the exact number of active stations but said it should be around 500 to 550 (min 58:00).

- Huhn said they are currently doing 10,000 migrations per day but that should increase to 30,000-50,000 in the coming weeks (min 6:50).

- Huhn said they still expect to complete the customer migration by the end of 2025 (min 52:09).

- They are still in discussions with partners to sell and then lease the passive infrastructure; hence they still expect an headwind of EUR 100 million to 150 million on cash capex in 2025 if they don’t find the partner (min 35:00).

- They expect changes in offers to drive subscriber growth in Q4 2024 and in 2025 (min 23:22).

- Huhn said they brought unlimited offers to their shops in Q4. However, it’s only the Vodafone national roaming agreement which allows for these offers i.e Telefonica NRA doesn’t (min 46:10).

Assessment of the earnings

The subscriber numbers were within my estimates. It’s the pricing which was less than expected. The other thing which came as a surprise is the compensation to the partners as a result of the network outage. Though the management is positive that they will arrive at favorable agreement with the partners, the fact that they didn’t have visibility over it in Q2 is an area of concern.

The 235 antenna sites added during the quarter were also much less than my 500 estimate and the 447 added in Q2. At this rate, the possibility of reaching their 3,000 target in 2023 is now low.

I agree with them that they can still migrate all their customers from O2 to their own network by the end of 2025. For instance, between November 1 2024 and end of 2025, there are 304 days (excluding weekends) remaining. If they were to do 40,000 migrations per day, they will migrate 12.2 million customers by the end of 2025. However, that assumes everything will go as planned which hasn’t really been the case at 1&1.

Here are the analysts opinions regarding the Q3 2024 results:

- Buy, €21: Analyst Polo Tang of UBS said 1&1’s Q3 EBITDA missed analysts expectations by more than 20% driven by higher costs for the network expansion. He pointed out that this doesn’t change the investment thesis.

I don’t really understand the comments about network partner compensation.

Can you link the call here and include the timestamp of the exact section? (Calls should always be linked and timestamps are always great for quick access)

Was the low EBITDA contributed only to that factor? Why do they expect to meet their yearly EBITDA targets nevertheless?

What happend to United Internet? Why are they down 17.5%? (We should always have an eye on the mother company United Internet as well)

My understanding from management’s comments on the compensation is that the network rollout is in phases, hence a delay in one phase affects the next phase. Similarly, the partner in charge of migrating customers could have asked for compensation for the stoppage in migration.

They haven’t made compensation to the partners yet. EBITDA was impacted by the reduced national roaming savings due to the delayed migrations and of course lower-than expected revenue.

They expect strong EBITDA growth in Q4 due to savings on national roaming following resumption of customer migration, Opex savings (i.e on marketing campaigns) and contributions from worthy customers won in the past year.

United Internet’s Q3 2024 revenue of €1,560 million and EBITDA of €316 million were below analysts estimates of €1,615 million and €347 million respectively. The parent company also lowered its 2024 revenue guidance to €6.35 billion from €6.40 billion.

I just listened in very briefly (because i am on the go) but I think 1&1 is seeking damages from it’s partners and don’t need to compensate them?

I think they likely seek compensation from the large software/equipment partner that they mentioned last quarter to be responsible for the outage. (Not Rakuten)

Is that the only reason that United Internet dropped as sharply? A 17.5% drop is very large and does not happen often. I would be interested if there could be any reason for it that they gave in their report or conference call that has some implication for 1&1 as well.

A theoretical example of this could be that they said they are not going to buy back their stock because they need the money for 1&1.

You are right. Its investor relations just confirmed to me. The statements in the call were conflicting probably due to the German to English translation. I think in that case the partners who were responsible for constructing the network will be liable. According to Telcotitans, Rakuten, Cisco, Mavenir, and NEC are the suspects.

Asked how they will use money if there won’t be a spectrum auction, United Internet’s CFO, Ralf Hartings said in the earnings call that they can’t spend money they don’t have and if they will have the money, they will use it to reduce debt which has been increasing and consider boosting the dividend payout (min 22:30). He also said that they are still in the heavy investment phase.

“And with regards to free cash flow, no, I don’t think we’re going to see next year a positive free cash flow. We are still in the heavy investment phase,” CFO Ralf Hartings said (min 22:00).

However, I don’t think these comments were responsible for the sharp drop in the share price. The share price was already down sharply before the earnings call and yet the report didn’t have any other negative comments. Goldman Sachs, Warburg Research and UBS only flagged disappointing Q3 results.