This topic discusses the upcoming Q3 2023 Meta Plattform Earnings. It will include our final assessment and decision before the earnings release. We will also summarize the results here. You can find our earnings preparation and full summary of the results in the Wiki:

Summary of Tinuiti Digital Ads Benchmark Report Q3 2023:

Meta Platforms

- Meta ad spend rose 19% year-over-year versus 9% growth in Q2 2023, strongest growth since Q4 2021 for Tinuity advertisers.

- Meta impressions rose 46% year-over-year(Q2 2023:+44%)

- Meta Platforms CPM fell 19% year-over-year(Q2 2023:-20%).

- Advantage+ accounted for 23% of retail spend on Meta ( Q2 2023: 19%).

- Facebook ad spend rose 16% year-over-year, (Q2 2023: 2%) as year-over-year comps got easier.

- Facebook CPM declined 20% year over year(Q2 2023: -25%)

- Facebook impression rose 46%(Q1 2023: 37%), as composition of Reels videos and overlay grew to account to 12% of Facebook ad impressions.

- Instagram impression rose 41% year-over-year (Q2 2023: 84%)

- Ad spend grew 25% year-over-year (Q2 2023: 31%).

- Instagram CPM declined 11% year-over-year(Q2 2023: -29%).

- Instagram Reels CPC was 13% lower than that of Instagram Feeds, compared to 19% in Q1 2023.

TikTok

- TikTok CPM declined 8% year-over-year(Q2 2023:-4%).

- Impression rose 21% year-over-year (Q2 2023: +16%).

- Ad spend rose 12% year-over-year ( Q2 2023: +11%)

My thoughts

- Meta Q2 revenue may grow by more than 19%(ad spend growth rate) as it has been the case in the past four quarters.

- It’s good that Instagram CPM is declining faster than TikTok’s as it could result in increase demand for Instagram ads in the long-run.

- Its good that Instagram impression is rising faster than the decline in CPM as this could result in more ad spend.

I=7

- Alphabet Q3 2023 revenue rose 11% y/y to $76.69 billion, beating analyst estimate of $75.97 billion (+10% y/y).

- Google advertising revenue grew 9.5% y/y to $59.65 billion (analyst estimate: $58.94 billion or +8.2% y/y), YouTube ads growing 12.5% y/y to $7.95 billion (analyst estimate: $7.81 billion or +10.5% y/y).

- Google cloud revenue rose 22.5% y/y to $8.41 billion (analyst estimate: $8.62 billion or +25.5%), causing the stock to shed around 5% in after hours.

I=7

-

Snap’s revenue rose 5% y/y to $1.19 billion, beating analysts estimate of $ 1.11 billion (-1.8% y/y).

-

Snap global daily active users rose 12% to 406 million, in-line with 405.79 million estimate ( +11.8% y/y).

-

Its average revenue per user was $2.93 vs. $2.74 expected.

-

Snap said its AI-powered chatbot, My AI, launched in February 2023, now has over 200 million people (who have sent more than 20 billion messages).

-

Snap said it’s seeing an impact from Israel-Gaza war on its advertising revenue.

“We observed pauses in spending from a large number of primarily brand-oriented advertising campaigns immediately following the onset of the war in the Middle East, and this has been a headwind to revenue quarter-to-date. While some of these campaigns have now resumed, and the impact on our revenue has partially diminished, we continue to observe new pauses and the risk that these pauses could persist or increase in magnitude remains.”

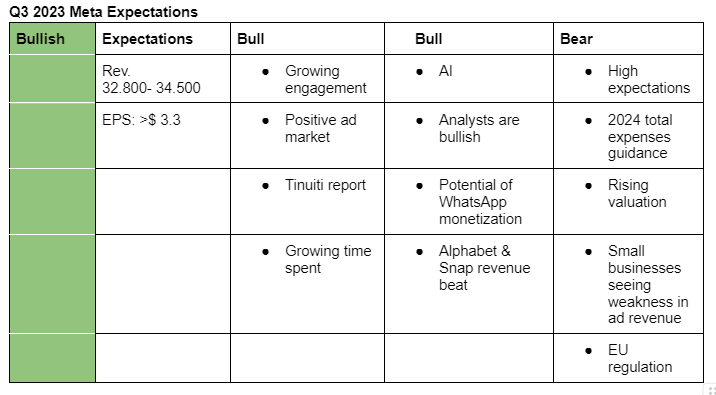

Note: My expectations are guestimates based on expected industry performance in Q3 and the fact that Meta has beaten if not come in-line with its upper guidance in the past two quarters.

I am positive on Meta’s third-quarter results given that;

-

Magna projects that social media ad spending will grow significantly in H2 compared to H1.

-

Tinuiti report, which has been insightful in the past in our predictions, points to a sharp growth in ad spending on Meta in Q3.

-

Alphabet ad revenue topped analysts estimate. Snap also reported a revenue beat.

-

Analyst’s have cited third-party data that indicates user engagement and usage in Meta’s Family of Apps grew in Q3.

-

Recently launched AI chatbots are likely to increase engagement in Family of Apps.

Potential risks to the stock include;

- If Meta Platforms gives 2024 cost guidance that exceeds what the market is expecting, the stock may see a sharp drop.

- EU regulation on personal data usage.

I=10

- Revenue grew 23% y/y to $34.15 billion, above analysts estimate of $33.4 billion (+20.6%), and above management midpoint guidance ($32 billion-$34.5 billion).

- EPS was $4.39, beating expectations for $ 3.57 while operating margin rose to 40% from 20% in Q3 2022.

- Facebook DAUs rose 5% y/y to 2.09 billion, topping expectations for 2.07 billion, Facebook MAUs rose 3% to 3.05 billion, in-line with estimates, Family daily active people (DAP) rose 7% to 3.14 billion, exceeding expectations for 3.09 billion and Family monthly active people (MAP) rose 7% to 3.96 billion versus 3.88 billion expected.

- Meta is guiding revenue of $36.5-40 billion in Q4 2023 (expectations: $38.7 billion), is lowering full-year 2023 total expenses and capex to $87-89 billion from $88-91 billion and $27-29 billion from $27-30 billion, respectively.

- Meta is also guiding full year 2024 total expenses to be in the range of $94-99 billion (expectations: < $100 billion).

In the earnings call,

-

CFO Susan Li said they expect macro volatility in 2024.

“You asked about what are some of the significant puts and takes, and I’d maybe point back to what I said earlier about the Q4 outlook just to highlight what a volatile macro environment we believe we’re in. I think that will obviously have a big impact on the advertising market next year, and it’s something we’ll be keeping a very close eye on. But ultimately, we’re very subject to volatility in the macro landscape,” she answered.

-

Li said ad revenue acceleration in the quarter was mainly driven by ad spend by Chinese advertisers.

“Within ad revenue, the online commerce vertical was the largest contributor to year-over-year growth, followed by CPG and gaming. Online commerce and gaming benefited from strong spend among advertisers in China reaching customers in other markets.”

-

Li said they widened their Q4 revenue guidance to accomodate for some volatility they are seeing at the start of the quarter due to uncertainty caused by tensions in the Middle East.

“While we don’t have material direct revenue exposure to Israel and the Middle East, we have observed softer ad spend in the beginning of the fourth quarter, correlating with the start of the conflict, which is captured in our Q4 revenue outlook,” She said.

-

CEO Mark Zuckerberg said Reels has driven “more than 40% increase in time spent on Instagram since launch”, now net neutral to overall company ad revenue, and is anticipated to be a “modest tailwind to revenue in 2024”.

Preliminary earnings call notes (Mindmap)

I=5

- Outperform, $435->$425: Evercore ISI analyst Mark Mahaney cautioned that the “BIG negative” from the earnings call was the callout that advertising spend softened at the start of Q4

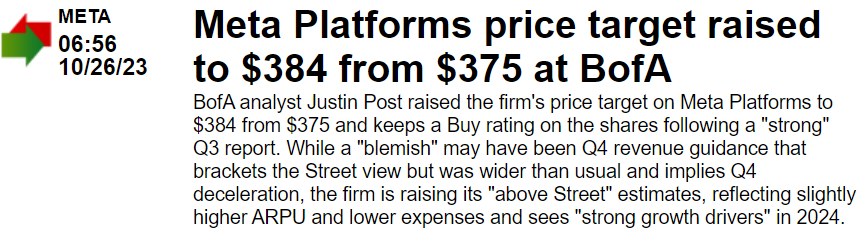

- Buy, $375->$385: Bofa analyst Justin Post cautioned that the Q4 guidance was “blemish” and implies deceleration, but he sees strong growth drivers in 2024.

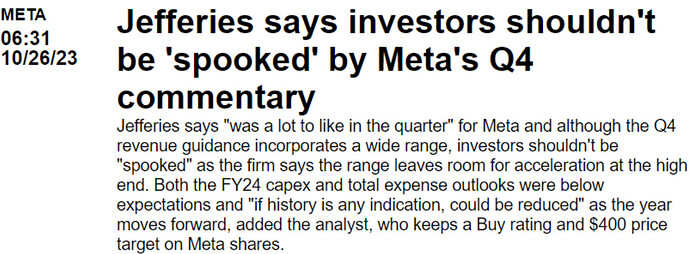

- Buy, $400: Jefferies praised 2024 capex and total expense guidance, saying “if history is any indication, could be reduced” as the year moves forward.

- Buy, $375: Bernstein excited that expense and capex guidance were below the most bullish estimates and that Meta’s growth story remains intact.

- Outperform; $370->$380: Wolfe Research analyst Deepak Mathivanan remains confident on Meta’s fiscal 2024 growth drivers despite concerns on Middle East conflict.

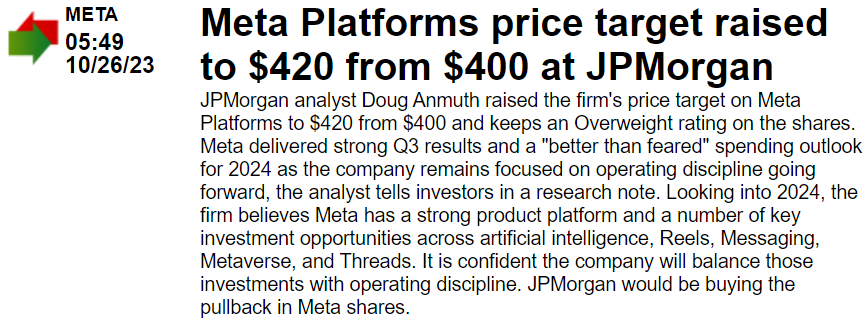

- Overweight, $400->$420: Going into 2024, JPMorgan analyst Doug Anmuth stated that Meta has strong product platform and a number of important investments across artificial intelligence, Reels, Messaging, Metaverse, and Threads, and that they will buy the stock during its pullback today.

- Overweight, $365->$355: Piper Sandler assessed that Middle East conflict looks temporary to Meta Platforms and that opex/capex guidance for 2024 was better than feared.

Amazon CEO’s statement that they are seeing weakness on the top-of-funnel advertising is interesting for Meta as it shows that weakness might go beyond advertisers being afraid of their ad showing up close to news about the Gaza conflict.

It’s good to see that ad revenue exceeded expectations, but top-of-funnel weakness might be worrying. I think it’s worth looking in their past conference calls for similar comments to assess if this is something new.

ToFu is the stage in an advertising funnel at which new demand is created while lower funnels capture existing demand. I am not 100% sure if it works that way but in a looming downturn, I would expect advertisers to scale back ToFu strategies like brand advertising first while continuing to advertise BoFu in order to sell existing inventory.

-

Trade Desk gave revenue guidance of at least $580 million for Q4 2023, which is below $610 million that analysts were projecting.

"Starting about the second week of October, we began to see some transitory cautiousness around certain advertisers, " CEO Jeff Green said in the earnings call.

“For example, we saw some reduction in brand spend in verticals such as automotive and consumer electronics, for instance, specifically around cellphones and media and entertainment. Some of these industries have been recently impacted by strikes such as the U.S. auto industry. So the first week in November, we have seen spend stabilize.”

Context:

- Trade Desk operates a “demand-side platform” software that enables advertisers to buy ads across the internet, including Connected TV.

- In 2022, it handled $7.7 billion in ad spend and had 2,770 full-time employees, majority coming from North America (63%).

- However, it is more geared towards traditional media and larger brands and does not include channels like meta, snap, google and pinterest.