This topic discusses Sixt Q2 2024 earnings. A summary of our Our earnings preparations and full summary of the results can be found in the Wiki:

05/08/2024

Hertz said in its Q2 2024 earnings that demand is strong while rental pricing is starting to stabilize

-

Hertz Q2 2024 revenue fell 3% y/y to $2.35 billion (analysts estimate: $2.48 billion) mainly due to prioritization of rate over volume while EPS came in at $-1.44 (analysts estimate: $-1.21) impacted by a rise in depreciation costs to $600 million from $197 million a year ago as residual values continued to fall.

-

Hertz said demand during the quarter was strong while the rate of decline in pricing moderated quarter-over-quarter.

“During the quarter, we deliberately prioritized rate over volume. This is especially true in the Americas segment. Collectively, our revenue initiatives are showing early promise and global revenue per day (RPD), while down year-over-year as we guided, was up 5% sequentially. June RPD is marginally down year-over-year by 2%, an encouraging exit rate for the quarter and consistent with our expectations that year-over-year declines are narrowing,” CCO Sandeep Dube said in the earnings call.

-

Looking ahead, Hertz expects strong results due to strong demand and stabilization in rental pricing.

-

The firm said that it recently successfully negotiated with OEMs for cheaper vehicles a strategy that will lower depreciation per unit (DPU) of its fleet to $325 or lower from the current $600.

https://ir.hertz.com/news-releases/news-release-details/hertz-reports-second-quarter-2024-results

Thank you for those insights.

I think competitor earnings call insights in the Wiki could be ordered by topic as well so a reader can immediately focus on the topic he is interested in (E.g. everything in relation to the industry outlook). In addition, we might want to highlight everything that is relevant for Sixt, e.g., by making it bold.

I assume no formal guidance for Q3 order Full 2024 was given?

Sixt is another buy candidate at current prices, in my opinion, and I am considering increasing my position.

Other than that they expect revenue per day (RPD) to be flat or up slightly by 1% in Q3 and depreciation per unit (DPU) to remain elevated throughout 2024, they didn’t provide additional guidance.

Avis Group said it witnessed strong demand and improvement in pricing in Q2

-

Avis Budget Group reported Q2 revenue of $3.05 billion (-2.4%) and EPS of $0.44, both missing analysts estimate of $3.18 billion and $2.60 respectively.

-

Its net vehicle depreciation costs rose 95% y/y to $733 million.

-

Avis said demand was strong while pricing improved sequentially.

"As the second quarter progressed, demand elevated with pricing and vehicle utilization sequentially improving. June pricing finished down slightly and vehicle utilization up a point in the Americas compared to June 2023,” said Joe Ferraro, Avis Budget Group Chief Executive Officer.

-

Ferraro said in the earnings call that they expect Q3 demand to be at the same level as Q2.

-

CFO CFO Izzy Martins said they expect interest expense in the second half to be similar to that of first half.

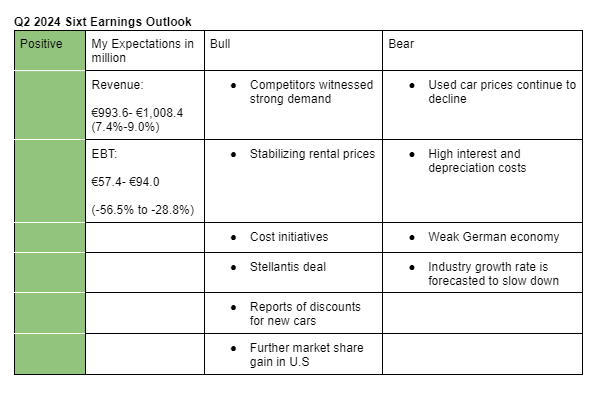

I am positive on Sixt’s Q2 2024 earnings. My estimates take into account current industry trends such as demand, rental pricing and prices for used cars. Here are my bullish points;

- Sixt’s competitors; Hertz and Avis group pointed out that they witnessed strong demand and stabilizing pricing during the quarter. Additionally, the travel industry continued to grow strongly in Q2.

- Hertz said in its earnings call that it was able to negotiate for reduced prices for new fleet. This comes after reports that Tesla was offering rental companies steep discounts for new fleet. This would encourage other players to do the same; hence we can expect depreciation costs to reduce as we approach the end of the year.

- I believe that Sixt got a better deal from Stellantis for the supply of 250,000 vehicles. For instance, depreciation risks could be lower for these vehicles. Already, 30,000 vehicles have been delivered.

- Sixt already initiated some cost cutting initiatives such as a technology that would reduce the number of staff that check for damages in Vehicles. This could offset some depreciation costs going forward.

- Hertz and Avis said they concentrated on value over volume during the quarter. That means some demand were up for grabs for the likes of Sixt which is trying to expand in U.S.

My bearish sentiments include;

- Used car prices continue to decline in U.S and Europe. As such, I expect residual values of Sixt’s fleet to continue falling.

- Hertz and Avis reported a sharp rise in depreciation costs and fleet expenses (caused by high interest rate environment) in Q2.

- Germany’s economy slipped into contraction territory again in Q2. That would lower consumer spending habits such as travel.

- Growth of travel and tourism industry is forecasted to decelerate going forward. As such, there is some uncertainty over performance in the second half though Hertz and Avis expects demand to hold up. My estimates for 2024 includes a revenue of €3,903 million (+7.8%)and EBT of €406 million (-12.6%).

N/B: Here are the management and analysts expectations;

Q2 2024 management outlook for EBT: €60-€90 million (€75 million or -43.2% at the midpoint)

2024 management outlook for EBT: €350-€450 million (€400 million or -13.9% at the midpoint)

Q2 2024 analysts estimate for EBT: €63.3 million (-52.2%)

Q2 2024 analysts estimate for revenue: €991.2 million (+7.1%)

2024 analysts estimate for EBT: €376.5 million (-18.9%)

2024 analysts estimate for revenue: €3.923 billion (+8.4%)

Sixt lowers EBT forecast for 2024 after a slight miss in Q2

-

Sixt’s revenue rose 8.9% y/y to €1.01 billion, topping analysts estimate of €991.2 million while EBT came in at 62.9 million, slightly below analysts estimate of €63.3 million (management midpoint guidance: €75 million)

-

Sixt said while demand for its mobility services remains high and rental prices stabilized, there is a high degree of uncertainty regarding residual values and is, therefore, lowering its EBT forecast for the full year to a a range of €340 to €390 million (analysts estimate: €376.5 million) from €350-€450 million previously.

-

Revenue growth was strongest in North America (+26.8%) and weakest in Europe (+1%). Germany revenue was up 4.3%.

-

Its depreciation of rental vehicles increased 64% y/y to €226 million, led by North America which rose from €16 million to €97 million (Sixt said it has a higher share of risk vehicles in U.S). Depreciation of rental vehicles in Germany fell 23% to €49 million while that of Europe grew 37% to €80 million.

Assessment

Though the data indicated that residual values are still declining, I expected the company to managed it well from Q2 and beyond given the measures put in place such as fleet rotation. Given the uncertainty surrounding residual values, I think it’s possible to see a downward EBT revision as we move through the year.

Sixt’s significant growth in North America proofs that the company could be taking market share from the likes of Hertz and Avis who aren’t doing well operation-wise. Performance in Europe was disappointing though.

- Buy, €120: Analyst Constantin Hesse of Jefferies said the adjusted EBT guidance for 2024 is roughly in line with expectations. He added that the average prices achieved are robust.

- Buy, €140: Analyst Christian Obst of Baader Bank criticized the further reduced outlook.

- Buy, €135: Warburg Research analyst, Marc-Rene Tonn, expects the coming quarters to bring an improvement.

I increased my Sixt position by 36% at a price of €49.25.

Even after the increase, Sixt remains my smallest stock position, but I might be interested in expanding it further, especially if prices continue to fall or we can find even more evidence that Sixt can continue to operate well under it’s next generation of Sixt leaders.

My main reasons are:

- The Sixt stock price got significantly more attractive during the last months and I have been considering an increase for a while.

- The business appears to be performing well on an operation level, as can be seen by the 13% increase in EBITDA and accelerated growth in the United States.

- I see the decline in residual values as a temporary problem. Therefore, it makes sense, in my opinion, to consider not only EBT but also EBITDA.

- Procurement conditions for new cars improved. Sixt is now able to get new cars with 98% repurchase agreements in the European market. This means the depreciation risk will improve over time as the European fleet is renewed. (I think that takes on average 9 months)

The U.S. depreciation risk will continue, but I think it should only be elevated for a maximum of the next years as used vehicle prices decline from elevated levels. After that the industry will hopefully adjust with higher prices even if the spread between used and new cars stays persistently large.(Car rental companies buy new cars and sell used cars and therefore want a tight spread)

I think we might want to focus on both U.S. used and new car prices (in nominal terms) and it’s spread as part of an automotive tableau @Magaly - The larger problem of pricing improved for Sixt and it’s U.S. competitors due to focus on value over volume esp. from it’s competitors. Sixt now claims it also wants to operate a tighter fleet. The problem of pricing can be seen by the fact that Sixt rental vehicle assets increased by 20% from H1 2023 to H2 2024 to 5.54 billion while revenue only rose 8.9%.

- The tourist industry is still strong and performing well.

- I like Sixt’s improved social media marketing and think their website, which makes it incredibly easy to book a car instantly, is well made.

- I rented a Sixt car in the United States from Sixt and thought it was a very good experience similarly to my experience with Sixt in Europe.

@Aron, What is your take? Do you think I am missing any key points? Why do you think performance in Europe was disappointing? What was expected? What could be the reasons?

If needed, I would always be happy to revert any decision.

Ps: It would be interesting to study costs per region and their revenue /ebitda performance in more detail. As an example, it would be interesting if we could find out which part of interest rate payment and depreciation increase we could attribute to U.S. growth to see if growth in the region was actually profitable or if there is are region with larger problems.

Our findings would influence our assessment of management and the position of the company.

Unfortunately I need to go now and will be back in a couple of hours.

I think you have captured all the key points. I would point out that its Corporate EBITDA (EBITDA excluding depreciation of rental vehicles and fleet-related interest result) was down 34% y/y in Q2. But again, deceleration slow down quarter-over-quarter (Q1: -65%). I also believe that the fall in residual values is temporary.

I think Corporate EBITDA per region can tell us profitability per region (since the higher the depreciation and fleet-related interest expense, the lower the Corporate EBITDA). For instance, Corporate EBITDA in Germany was up by 183% y/y to 72 million while that of Europe was down by 35% to 63 million. Corporate EBITDA in U.S was -17.7 million (-133% y/y).

It’s hard to tell reasons for the poor revenue performance in Europe. It could be due to macro slowdown, poor pricing or reduction in the number of fleet in the region. I saw that it closed down 24 branches in Europe in H1 but grew branches in other regions. However, given that revenue growth for Germany has exceeded that of Europe by an average of 5% in the past four quarters, perhaps Q2 revenue performance for Europe was as expected (or even better).

Yes, I agree that corporate EBITDA can show us how profitable the region has been in the last quarters and years.

That said numbers can fluctuate a lot because esp. depreciation can be very volatile.

Ideally, I would like to have a metric that shows the true underlying strength of the business in the regions and excludes temporary effects like especially high depreciation.

This is why i added regular EBITDA to all regions and even experimented with EBTDA for the U.S. (This number shows us profitability adjusted for interest payments but without taking depreciation into account.)

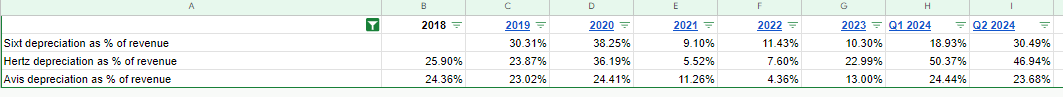

By playing around with the numbers i also just realized that the “North America Depreciation of rental vehicles as % of total revenue” has been 30% and 38% in 2019 and 2020 respectively.

This is quite worrisome as i always assumed the current depreciation of 30% is quite high and an expectation.

Can you add more prior years to our model to investigate this further and check how high Sixt competitors’ depreciation is usually in comparison to their revenue?

We obviously know that the last years have been very good with very low depreciation and high used car prices but if 30% is the normal this could be a problem for the business model in the U.S. and means prices need to be raised urgently to be profitable.

Its competitors in U.S also experienced high depreciation in 2019 and 2020. Sixt started reporting regional numbers in 2020. Either way, depreciation as a percentage of revenue for Sixt rose quarter-over-quarter in Q2 while that of Hertz and Avis declined.

I think in 2020, it was an industry issue. Maybe @Magaly can find out what exactly happened.

“Our vehicle depreciation results were impacted by residual values on certain models, as well as, the impact of lower retail car sales as a result of the COVID-19 shutdown of retail car lots, where our fixed expenses were not fully offset by car sales gains,” Hertz said in its Q1 2020 earnings call.

“Depreciation Per Unit Per Month was impacted by residual values on certain vehicle models, and lower year-over-year retail sales volume during the quarter,” Hertz said in its Q4 2020 press release.

I think what happened in 2020 was that vehicle sale volumes cratered at the beginning of Covid due to the uncertainty. Therefore Hertz could not sale it’s vehicles and conducted firesales at lower prices and went bankrupt. This is according to a documentary about it that I saw a while ago.

What is more important though for us is to focus on long term depreciation rates before Covid to be able to have a clear indication how we should think about depreciation in the U.S. going forward.

Therefore it would be great to get longer timelines (if available). We would want to have at least 10 pre-Covid years esp. from competitors.

For Sixt we could also try to dig a little bit deeper. I just had a quick look at an older annual report and saw that they differentiated between Germany and abroad. Maybe it would be possible to find ways of getting an indication how much of this abroad revenue and depreciations have been coming from the United States. If not it would not be ultra important so I think we should not overinvest at this particular question but we could investigate it a bit more.

I also would be very interested to learn when exactly Sixt entered the U.S. and how it’s growth trajectory there looked in the beginning.

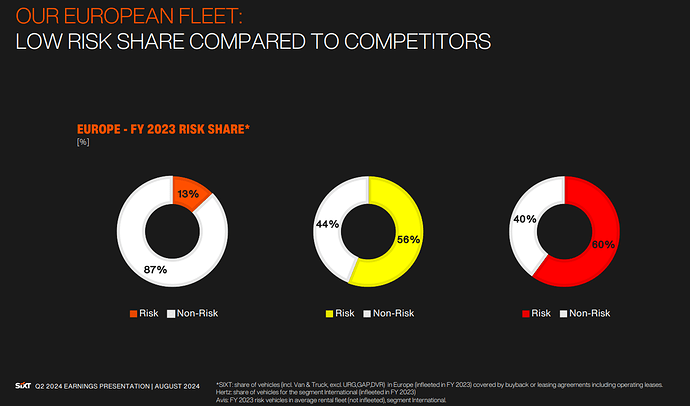

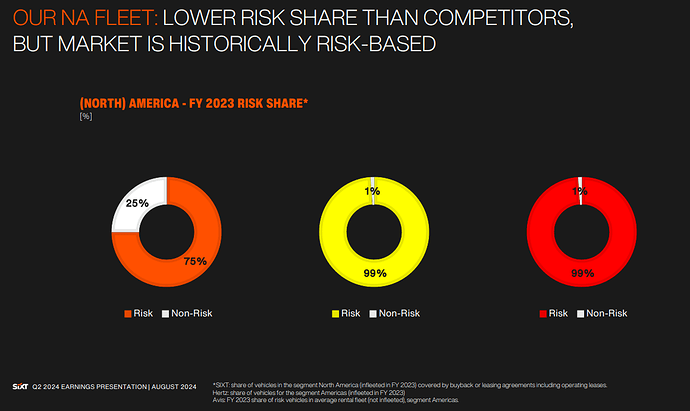

- During its Q2 earnings presentation, Sixt said the percentage of its fleet that is currently subject to residual value risk is 21% (or around 39,000 as of Q2 2024).

- Sixt pointed out that in Europe and North America, the percentage of risk vehicles was 13% and 75% respectively, better than that of its competitors.

- The company pointed out that they have reduced the number of risk BEVs to a low four-digit number at the end of Q2.

- Sixt had said in February 2024 that the percentage of risk EVs in their electric fleet was around half as high as at March 2023 (Sixt had around 30,000 all-electric, plug-in and mild-hybrid vehicles at the end of 2023). According to Manager Magazine Weinberger pointed out that little has changed since then.

The breakdown for Germany and Abroad was only for revenue and not depreciation. But Sixt has said in the above post that North America has historically been risk-based.

Though Sixt entered the U.S market in 2011, it was not until 2015 when the company started giving insights on revenue performance. Sixt said that its 2015 revenue had doubled while 2016 revenue had recorded double-digit percentage increase. In 2017 and 2018, its revenue grew by 11% and 18% respectively.

Between 2010 and 2020, depreciation as a percentage of revenue for Hertz and Avis was in 20s.

Good insights. I think reflecting on them and starting to model them into our next valuation model update would be interesting. (I think we should have valuation model updates always as soon as we have substantial new findings like a potentially higher U.S. depreciation rate than previously assumed)