“There is a blue ocean for the entirety of the music streaming industry to grow.”

This is a central part of Spotify’s investment thesis and the main underlying reason and argument for Spotify’s growth in the foreseeable future.

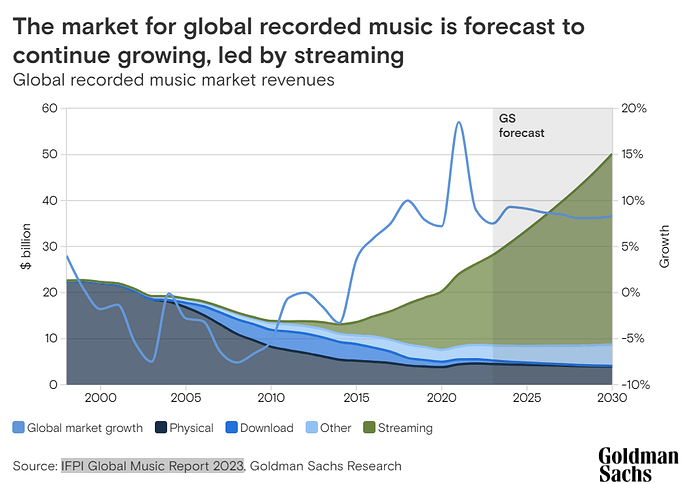

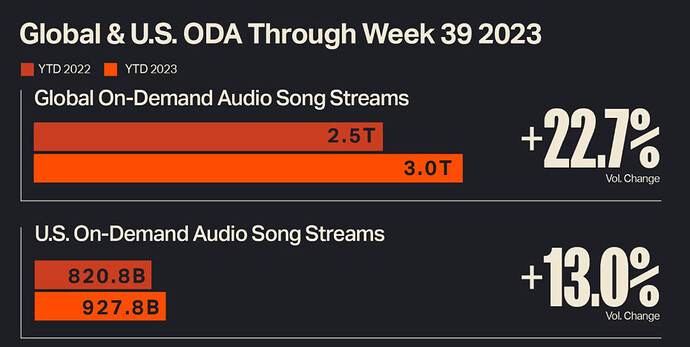

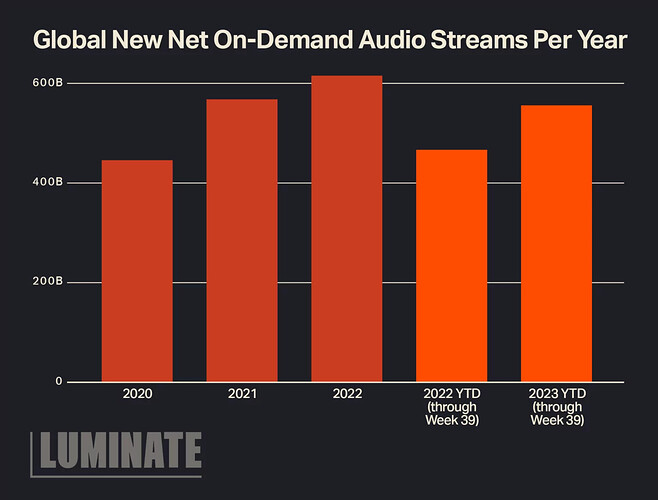

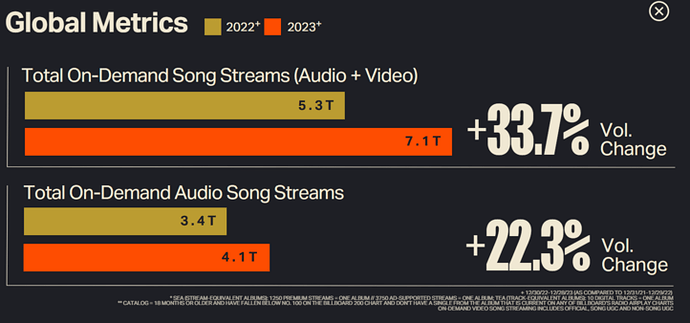

@Magalys research shows that Goldman Sachs expects paid streaming revenue to almost double by 2023 and total streaming revenue which includes ad funded streaming to more than double.

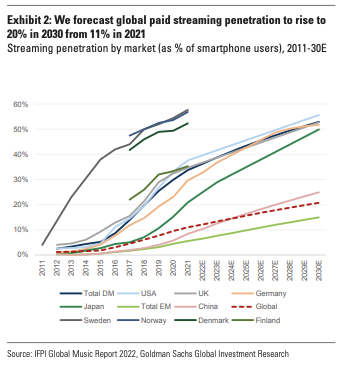

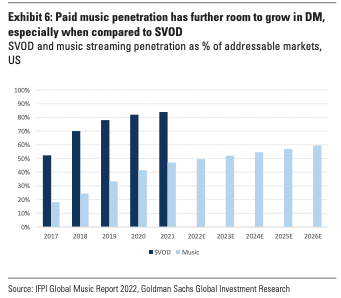

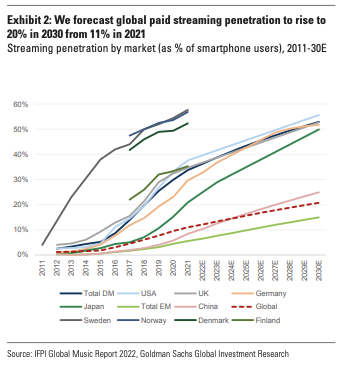

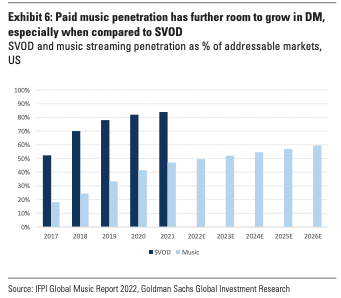

This is partiatially explained by expected price increases, increased advertising efficiency and importantly with the fact that the streaming industry is still very young and offers a lot of growth as paid music streaming penetration of smartphone users stand at only 11% worldwide and penetration is below 50% of adressable developed markets.

Reconsiliation of Goldman Insights with numbers

Comparing Goldmans insights with actual Spotify subscriber numbers in most important regions we are seeing 61.6million Spotify premium subscribers out of a population of 370million in North America (16.6%), 85.8 million out of 610 million (14%) in Europe (ex. Russia) and 46.2 million out of 660 million (6%) in Latin America.

If we think about the size of the addressable market for paid music subscriptions i think it might be 2 out of 3 people as of now in the United States, as a certain portion of users is too young or too old. Over the long run it will grow as older and younger people will be increasingly smartphone users as well.

For Europe i am assuming a slightly smaller adressable market of 60% as it is more diverse and for Latin America i am assuming that only 1 out of 3 people fits into the current addressable market with a strong tendency to grow. (Do you think this is correct @Magaly?)

This means Spotify currently owns 25.1% of the total adressable paid music streaming market in North America, 23.3% in Europe and 18.8% in Latin America.

Data from RIAA data shows us that there are currently 92 million paid streaming subscribers in the U.S.

If we compare this data to 61.6million Spotify premium subscribers in North America (which includes Canada) it appears like that Spotfy has more than 50% market share in the United States.

The same is likely true in Europe based on annecdotal evidence and might be true in Latin America as well.

Let’s assume that Spotify’s market share is 50% in all those regions for now for simplicity reasons. This means if Spotify owns 25.1% of the total adressable market in the United States and other paid music streaming players own the other 25.1% in total 50.2% of the total adressable market are owned by paid music streaming players. Following the same logic 46.6% of the total adressable market are owned in Europe and 37.6 % in Latin America.

Those numbers match Goldmans Insights of the total adressable market (pictured above) being at 50% and leaves us with a growth potential of 100% for the entirety of paid music streaming providers over the long run in developed markets. Therefore every provider could double paid subscriber numbers in those markets given that market shares stay exactly equal.

Interestingly Spotify does not only own paid subscribers but a signficantly higher number of MAUs.

They currently stand at 110.2 million in North America, 159.79 in Europe and 115.71 in Latin America.

Follwing the same total adressable market logic and ratios from above they already own 45% of the total adressable market in North America, 43.6% in Europe and 53% in Latin America.

(If we want to be precise we have to adjust total adressable market ratios among regions and paid vs. free offerings as certain regions are more willing and able to pay than others)

In my opinion those MAU numbers are both encouraging and concerning. They offer a clear path towards premium sub growth and sustained profitability for Spotify but also show that further growth potential in developed markets is limited and MAU growth needs to slow down at one point. (Depending how much market share competitors are holding and how many users are using more than one App)

Overall i am staying bullish on Spotify due to persistent but slowing premium subscriber growth opportunities in developed markets, pricing & advertising opportunites, strong international growth potential and my believe that Spotify is in a sufficiently strong competitive situation.