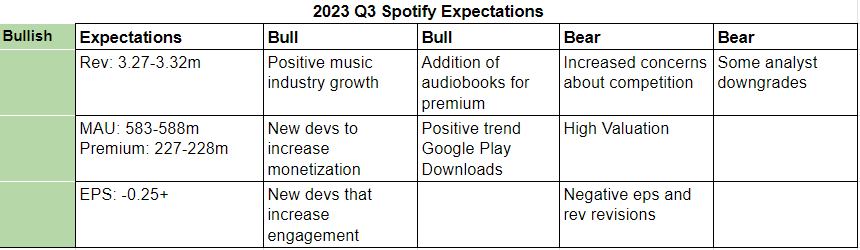

These are my Spotify expectations, which are mostly for a positive quarter.

I think the stock is still in a good position long term, but currently, I would just hold it, due to high valuations.

I don’t have any level of high confidence in my expectations and are just guesses based on Spotify usually underestimating its users’ growth in last quarters, but missing revenues a bit, and downloads data from Google Play.

Summary bullish arguments:

- Global music streams volume growing 22.7% YTD, and 13% in the US.

- The recent inclusion of merch and event tabs, and the potential for a superpremium plan could be a good catalyst for additional monetization.

- Spotify continues to innovate and developments like AI DJ is already showing good results, and other product developments during the quarter are expected to continue driving better engagement and increase the moat.

- 150,000 audiobooks are now available for premium subscribers, with 15 hours per month, which continue to add more value to the offering.

- Data from Google Play Downlowds show there were 93m Spotify downloads during Q3 (Data for Apple store is apparently not available), the highest in the latest 4 quarters.

Some negatives or risks we see:

- There are increased concerns among analysts about competition, especially from YT, Apple and Amazon, due to this and some pricing and margin concerns there have been some downgrades during the quarter. However, most still hold a buy rating.

- Revisions for estimates, especially for revenue, have been mostly negative during the quarter.

- Currently, the stock seems to have already priced in a level of high growth, if growth were to disappoint there are more risks to the downside.