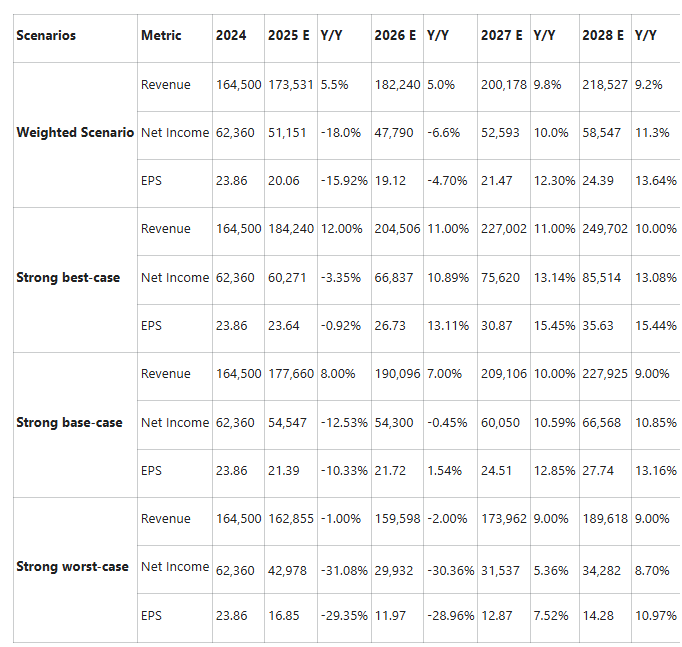

Scenario-model under Trump’s tariffs

The above scenario model is based on the following assumptions:

- Meta is somehow immune to economic slowdown, due to its dominant position in performance-based advertising. Some analysts and advertising industry leaders have pointed out that during uncertain times, businesses tend to switch ad spend from brand marketing to digital advertising. This behavior was evident during the 2008–2009 recession, when US ad spending declined 18%, yet digital ad spend only fell 3.4%.

- Mild revisions to the 2025 digital ad spending projection. Magna lowered their 2025 social media ad spend projections by only 0.8%. Similarly, MoffettNathanson reduced their 2025 estimate for online advertising spend by only 1.1%. These mild downgrades signal that Tariffs are not expected to be a major headwind to online advertising in 2025.

- Only around 220,980 SMBs in U.S. are importers. This is only a tiny fraction of the over 8 million SMBs that advertise in Meta Platforms. However, even SMBs that don’t import are likely to be hit by the tariffs as well.

- Consumers are unwilling to tolerate another wave of inflation, though their balance sheets remain healthy. As such, SMBs may be limited in how much of the tariff cost they can pass on to consumers.

- The risk of a recession in 2025 is low. The tariffs will affect $1.4 trillion of imports, hence reducing GDP by 0.4-0.7%. However, my worst-case scenario gives recession a 35% probability.

- The model assumes that Trump’s policies won’t affect the current corporate tax rate.

Recommendation

Based on the scenario-weighted analysis, Meta Platforms appears well-positioned to withstand potential turbulence from tariffs and broader macroeconomic uncertainty in 2025. I do not expect the share price to be significantly impacted by trade policy, as Meta’s performance-driven ad model provides meaningful downside protection. Instead, I believe investor sentiment will be more heavily influenced by the company’s execution in AI- particularly the commercial performance of Meta AI and its progress on agent-based solutions.

Recent developments raise concerns: early reports suggest that Meta’s business agents are underdelivering, and the resignation of Meta’s head of AI research this week adds uncertainty at a critical time. Unless Meta demonstrates meaningful progress on its AI roadmap in the coming quarters, particularly relative to peers, its valuation may face pressure independent of macro factors. Therefore, I wouldn’t recommend increasing the position until there is clarity on its AI performance.