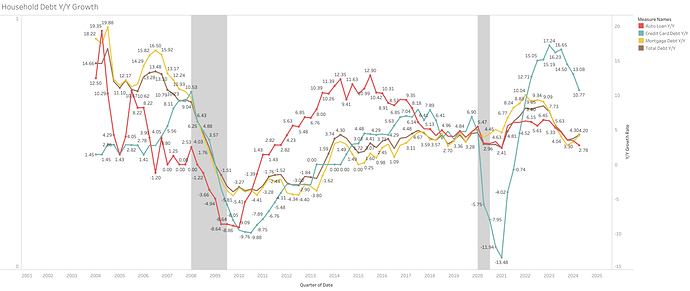

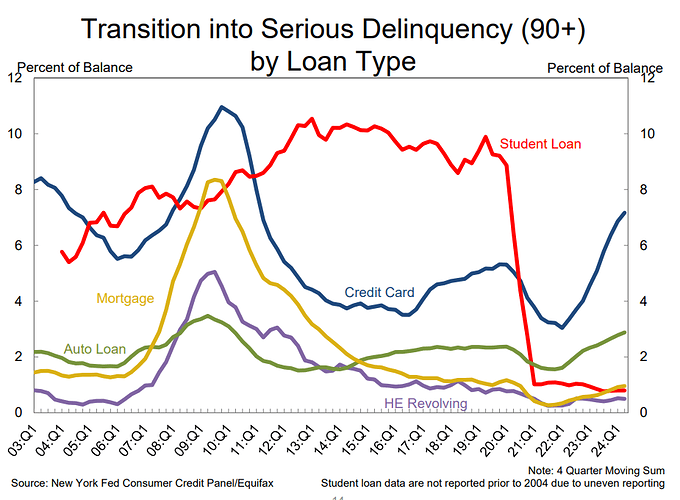

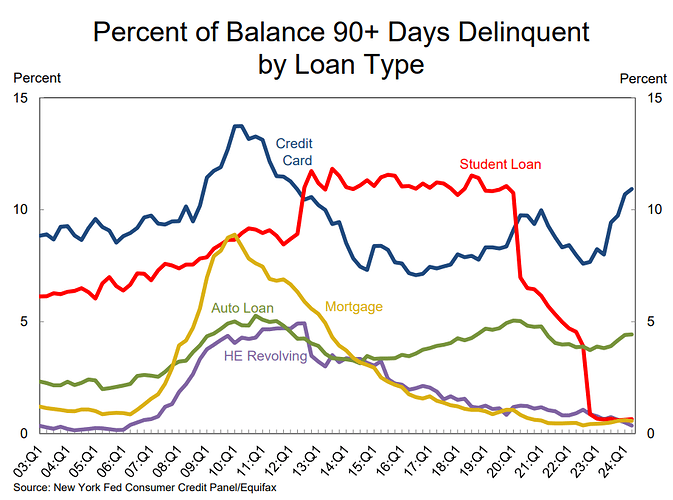

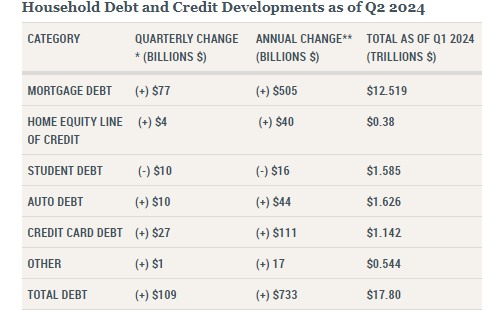

Q2 2024 Household debt increased by $109 billion (0.6%) in Q2 2024, to $17.80 trillion. Flows into delinquencies continue to rise.

- Y/Y growth rates moderating, but credit cards are still significantly high. However, 1H2024 credit card credit grew only by $13 billion (vs $ 45 billion 1H2023).

- Debt excluding mortgages up $32m billion in Q2 2024 vs -$6 billion in Q1 2024.

As reference disposable income grew 0.9% Q/Q (4.43% Y/Y) or $186 B SAAR (seasonally adjusted annual rate)

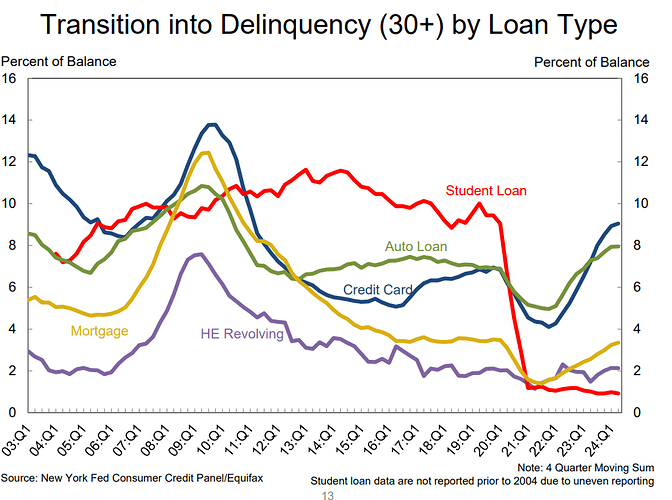

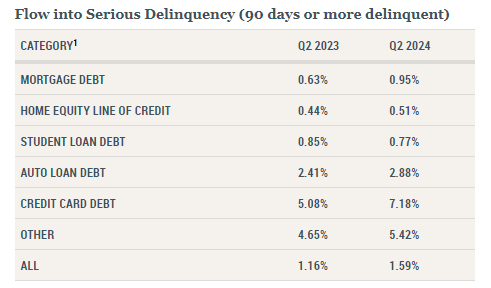

Flows into delinquency still increasing, especially high for credit cards and to a lesser extent for auto loans.

https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2024Q2

https://www.newyorkfed.org/newsevents/news/research/2024/20240806