Q2 2024 US Housing Market Update

In Q2 2024, the US housing market continued to face challenges due to high mortgage rates, rising prices, reduced affordability, rising but low supply, and depressed sales and construction activity.

- New home sales saw a slight quarterly uptick but were down year-over-year, while existing home sales declined on both a quarterly and annual basis.

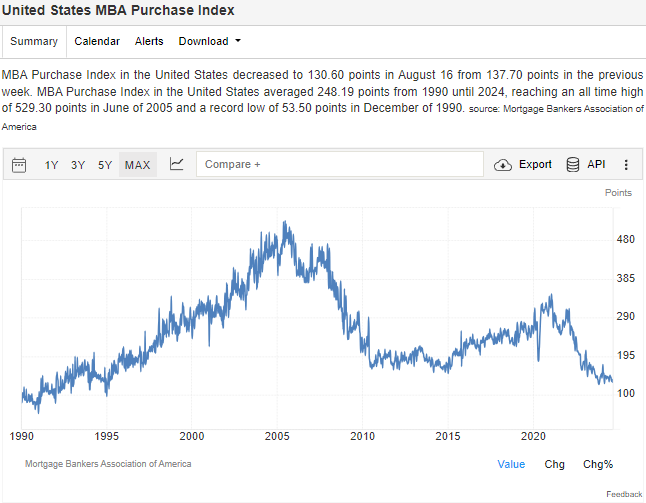

- Mortgage demand remains at historically low levels

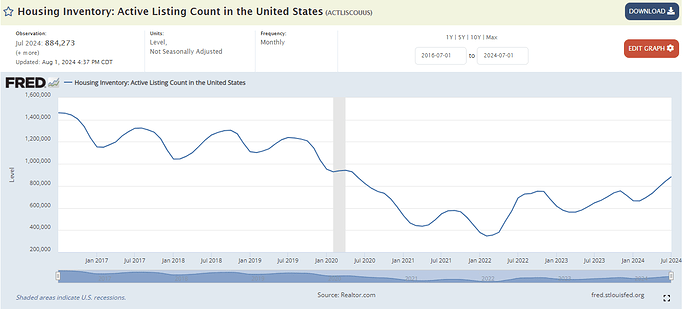

- Inventory increased year-over-year but is still below pre-pandemic levels, with both new and existing homes experiencing longer selling times…

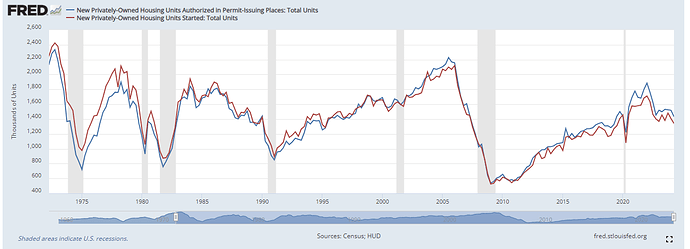

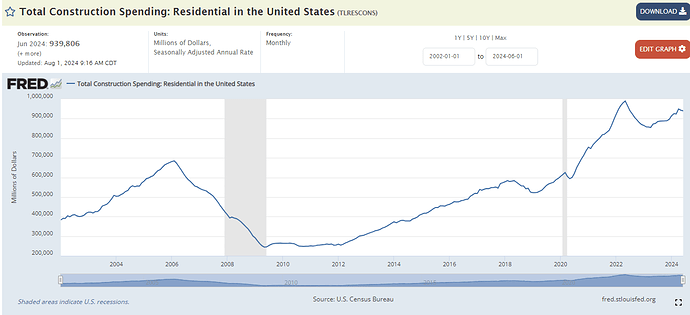

- Construction activity is down, with decreases in building permits and housing starts, although construction spending rose.

- Overall, home prices continue to rise, with existing home prices up due to limited supply, while new home prices face downward pressure from higher inventory levels

Sales and Mortgage Demand

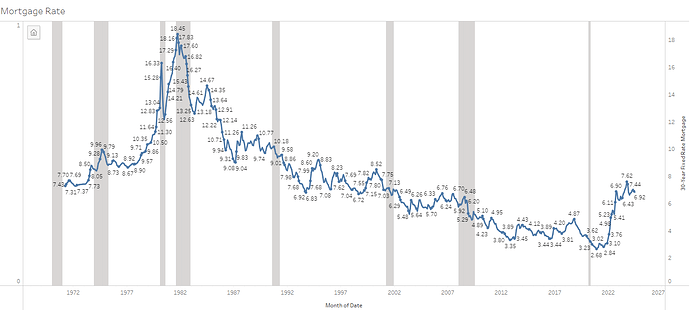

- Mortgage Rates ended Q2 2024 at 6.92% vs 6.71% in Q2 2023.

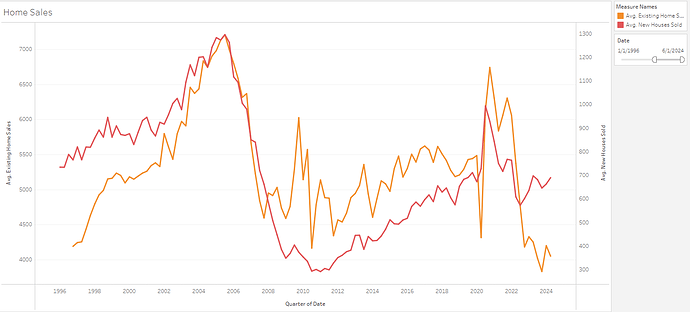

- New home sales increased 4% Q/Q to 690 SAAR, but continued to be -1.1% Y/Y.

- Existing home sales decreased -3.5 Q/Q to 4,050 SAAR, a -4.7 Y/Y reduction.

- The mortgage purchase index ended at 142.9, still at very low levels not experienced since the '90s. Index has continued to decline into Q3 2024.

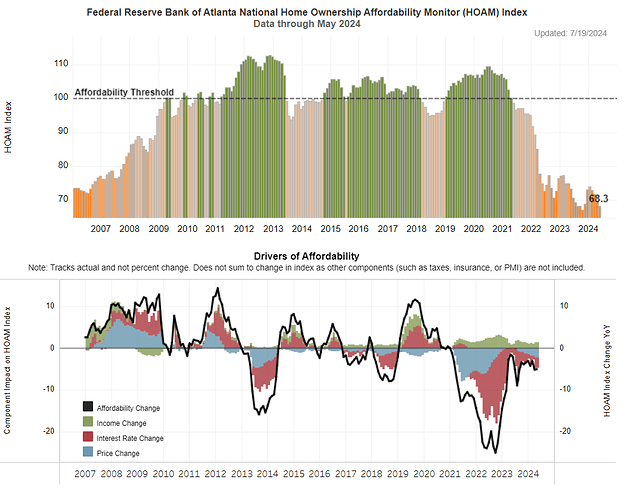

- Housing affordability continued to be very low, on par with 2008 levels.

Inventory and Construction activity

- Total Active listing count is currently at 884K, a 36.6% increased y/y. Still below 2019 levels.

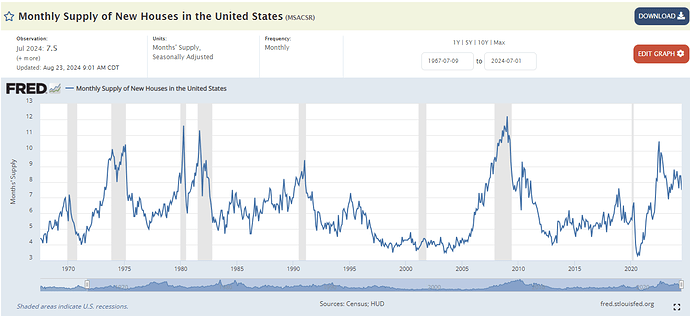

- Months supply of existing homes ended Q2 2024 at 4.1 (vs 3.2 in Q1 2024). The monthly supply of new homes ended at 8.4 (vs 8.2 in Q1 2024)

- Building permits down -5.8 Q/Q and -4.5% Y/Y to 1,431 SAAR

- Housing Starts down -4.7% Q/Q and -7.9% Y/Y to 1,340 SAAR

- Residential Construction spending up 2.4% Q/Q and 8.8% Y/Y.

Prices

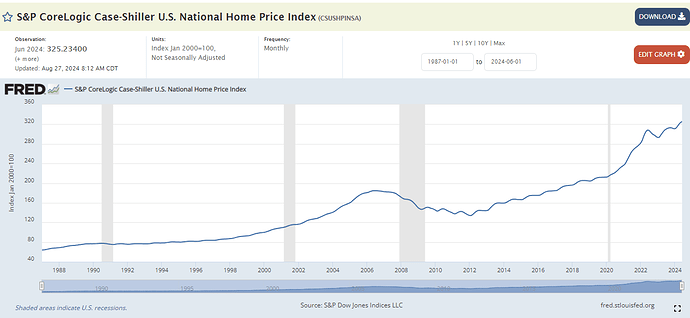

- Shiller U.S. National Home Price Index increased 2.6% Q/Q, and is up 5.4% Y/Y. It is up 4.6% YTD.

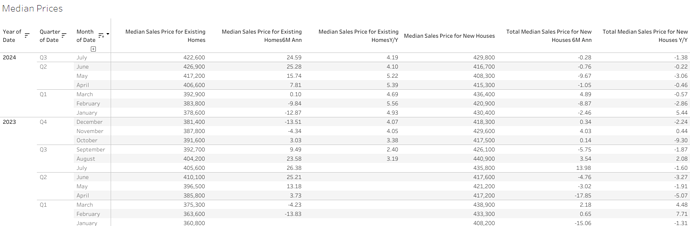

- Given the contrasting supply dynamics between new and existing home sales, prices for existing homes have continued to rise (4.1% Y/Y), while prices for new homes have faced downward pressure (-1.38% Y/Y). This has led to an unusual situation where the median prices for both new and existing homes are now quite similar.