The economy is currently growing above potential and the long term avg, this performance is due to some of these reasons still present in my opinion:

- Real Wage Growth: With inflation easing in 2024 and wage growth holding steady around 4%, real wage gains are increasing again, boosting consumers’ purchasing power and, consequently, supporting consumer spending.

- Productivity Gains: Productivity growth is currently also slightly higher than previous period averages

- Wealth Effect: Rising equity and housing prices have likely bolstered consumer optimism in spending through the wealth effect, as households feel more financially secure and willing to spend

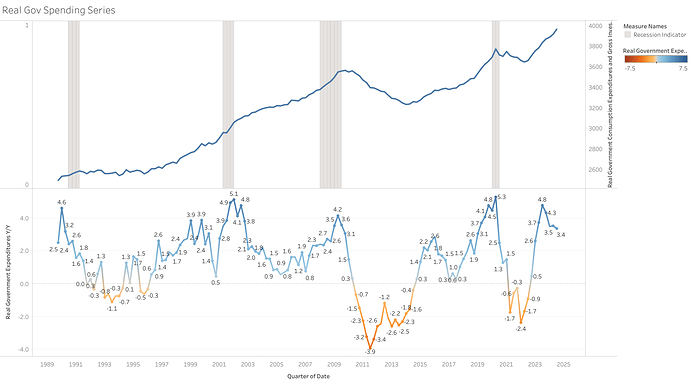

- Government Spending: Government expenditures continue to grow faster than GDP

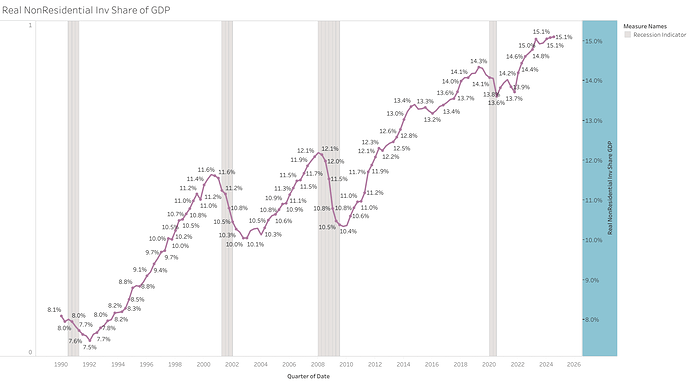

- Sectoral Investment: Significant investments in sectors like AI and semiconductors

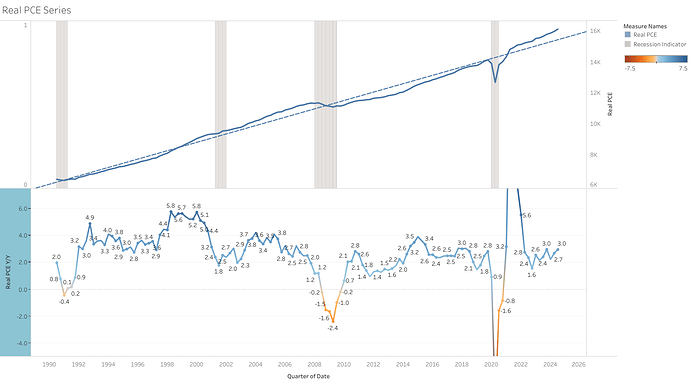

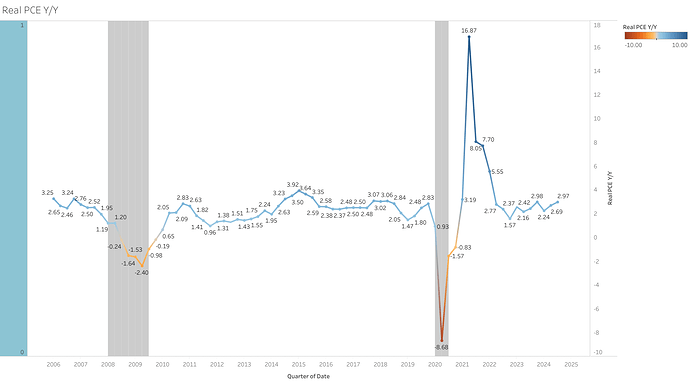

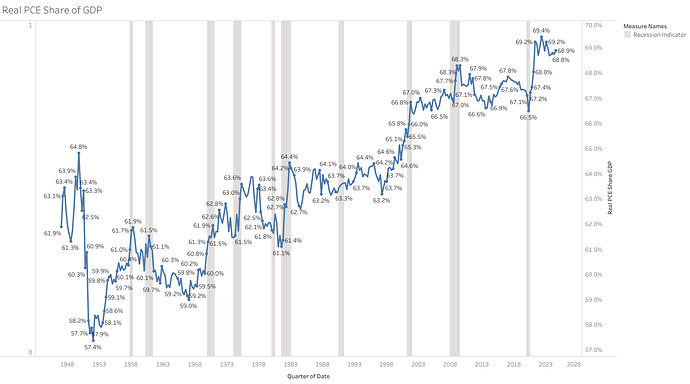

The economy is primarily driven by income growth imo (which has been decelerating), particularly through sustained wage gains, which continue to support spending (spending is almost 70% of GDP). As highlighted in my previous assessment, any significant economic downturn would likely require a more pronounced weakening in the labor market than we’ve seen to date. I expect this gradual softening in labor to continue due to current trends in the data, which underscores the importance of closely monitoring labor market dynamics in the coming months.

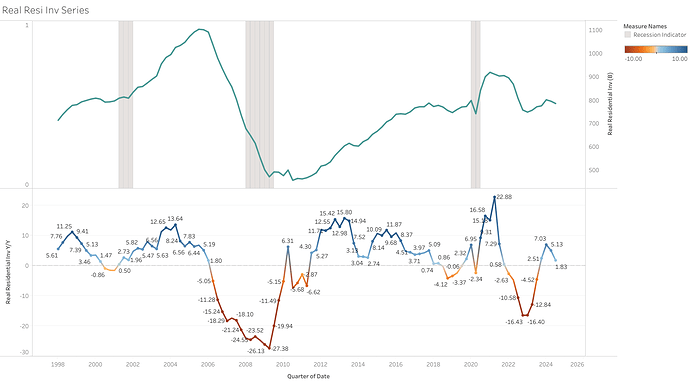

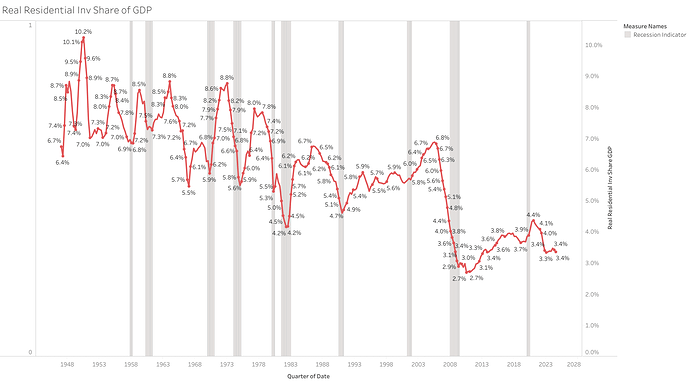

One area of concern already evident currently is the housing market, with residential investment showing signs of weakness. Although housing comprises a smaller share of GDP, it has historically been a leading indicator for economic cycles. Monitoring this sector closely is crucial, as further weakness on this sector could eventually have spillover effects on broader economic activity.

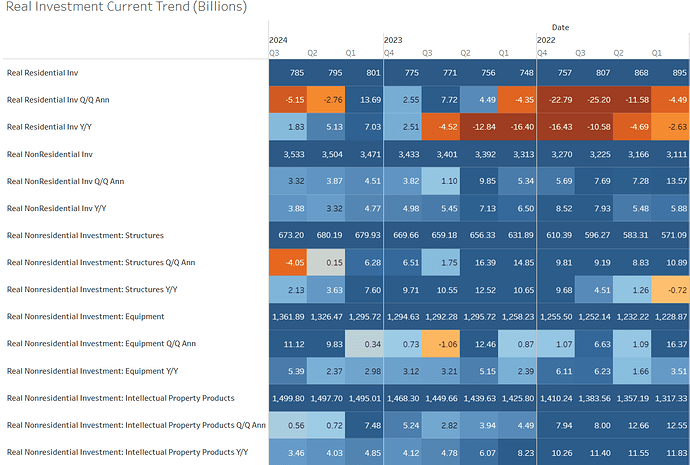

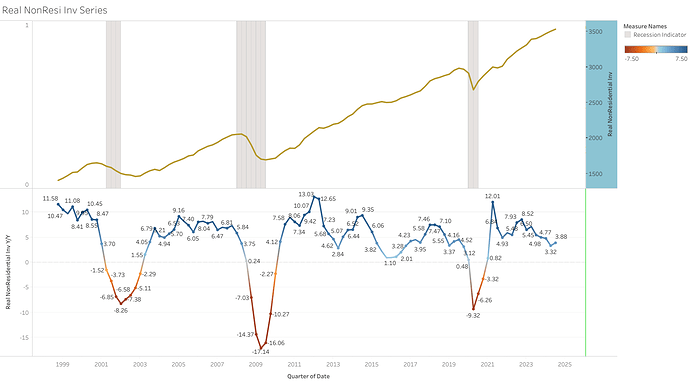

Meanwhile, other cyclical components, such as durable goods and equipment investment, are still performing reasonably well, though their growth rates are slowing and are below averages since 2010. Despite this deceleration, these cyclical segments of the economy are not indicating an imminent contraction.

- Notably, aircraft investment has contributed significantly to recent growth in equipment investment, driven by accelerated demand ahead of anticipated strikes on Boeing. This tailwind may dissipate in upcoming quarters, is unlikely to solely drive a downturn in investment, but the growth rate is most likely to decline.

As I always mention GDP is only a coincident indicator, reporting only on what happened in the last quarter, and it does not provide that much signal for the future economy.

I am also very skeptical lately of making definite assessments based on these first initial government data releases, so we have to keep an open mind always that the economy could be performing much better or worse than initial numbers indicate.

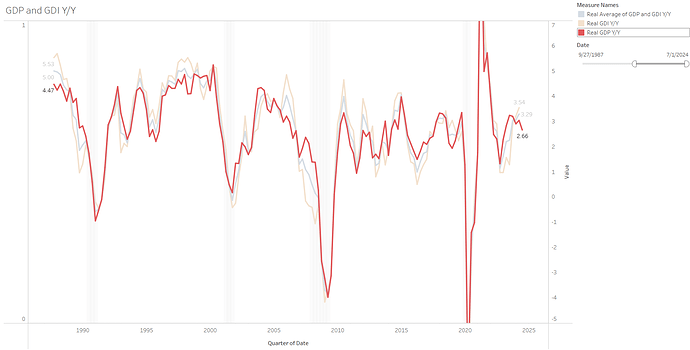

The y/y growth rate of GDP continues to decelerate but at a very slow pace, still in line with the average growth experienced before the pandemic.

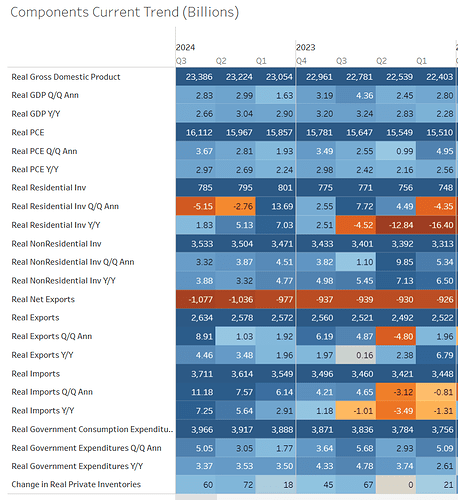

- All GDP components continued to perform relatively strongly and healthy in Q3 2024, with the exception of residential investment

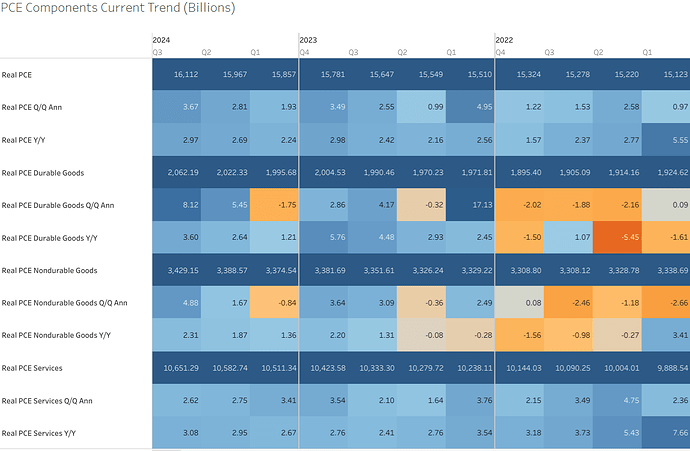

Consumer spending was the main driver of growth, with particularly strong contributions from the goods sector in q3 2024

- Real Durable goods grew 8,12% q/q ann, 3.6% y/y

- Real Nondurable goods grew 4.98% q/q ann, 2.31% y/y

- Real Services spending grew 2.62% q/q ann, 3.08% y/y

Investment experienced a softer quarter, primarily driven by ongoing weakness in the residential sector, which continues to weigh on the overall performance

- Overall real fixed investment grew 1.3% q/q ann, 3.42% y/y.

- Real Residential investment declined -5.15% q/q ann, 1.8%% y/y

- Real Non-Residential Investment grew 3.32% q/q ann, 3.88% y/y

- Within non-residential investment, equipment investment was the primary growth driver in Q3 2024, posting an annualized quarterly growth rate of 11.12%, the other two components were relatively weak.

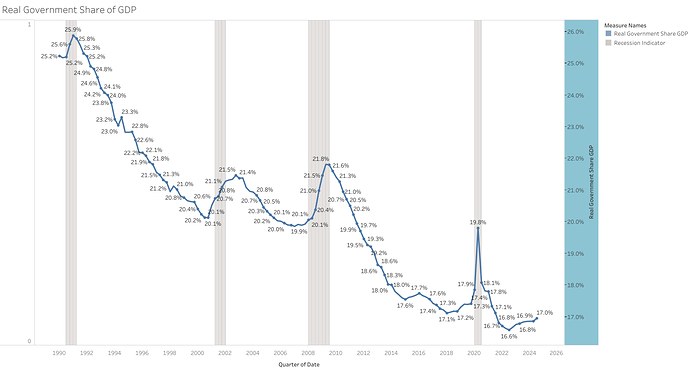

Real Government Spending and Investment had strong growth in q3 2024 at 5.5% q/q ann, outperforming the overall GDP growth.

- Despite the significant increase in fiscal spending lately, the share of GDP remains low compared to history.

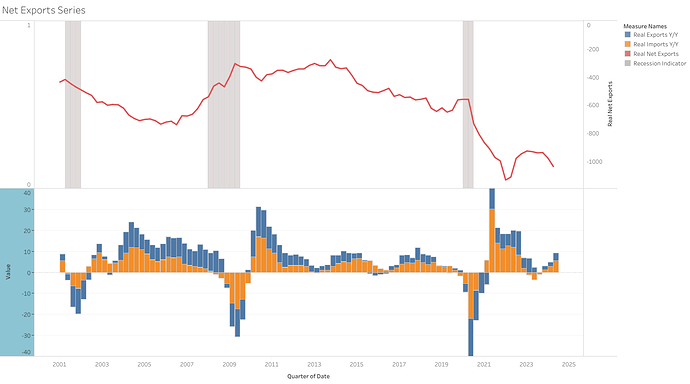

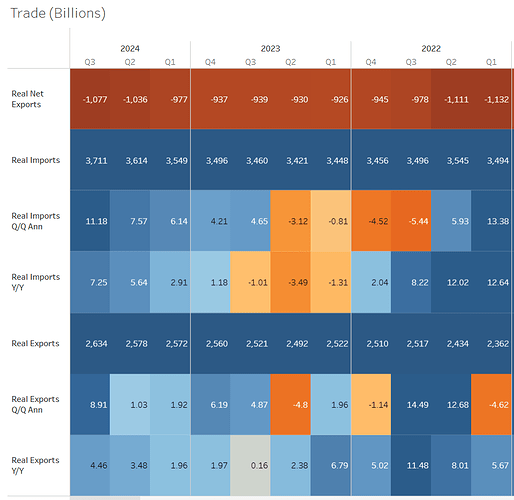

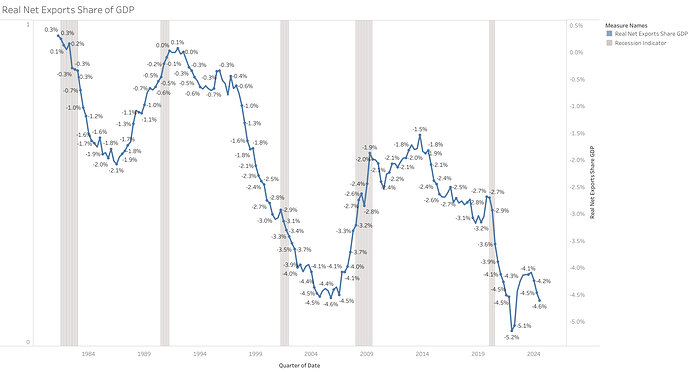

The trade balance continued to drag on growth, as imports outpaced exports growth again, though both showed robust expansion in Q3 2024

Sources:

GDP Model

Tableau

Google Sheets Data